Bottom line:

-

Bitcoin RSI information forms a bearish divergence, getting traders in position for lower levels next.

-

The May month-to-month candle light close seals 11% gains, however the weekly close is the occasion on the radar for market individuals.

-

Locations of interest consist of $97,000 along with the mentally considerable $100,000 mark.

Bitcoin (BTC) looked for to maintain 2024 all-time highs on June 1 after the month-to-month candle light close provided 11% gains.

Bitcoin RSI divergence primes traders for brand-new lows

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD trying to recover $105,000 into the weekly close.

Continual drawback throughout the week brought Bitcoin back into contact with considerable assistance levels from earlier in the booming market.

Chief amongst these was the regional top from Dec. 17, 2024 at around $104,450.

Commenting, popular trader Matthew Hyland explained the weekly close level as “essential.”

#BTC Weekly close now essential pic.twitter.com/QFvhnVRuba

— Matthew Hyland (@MatthewHyland_) May 30, 2025

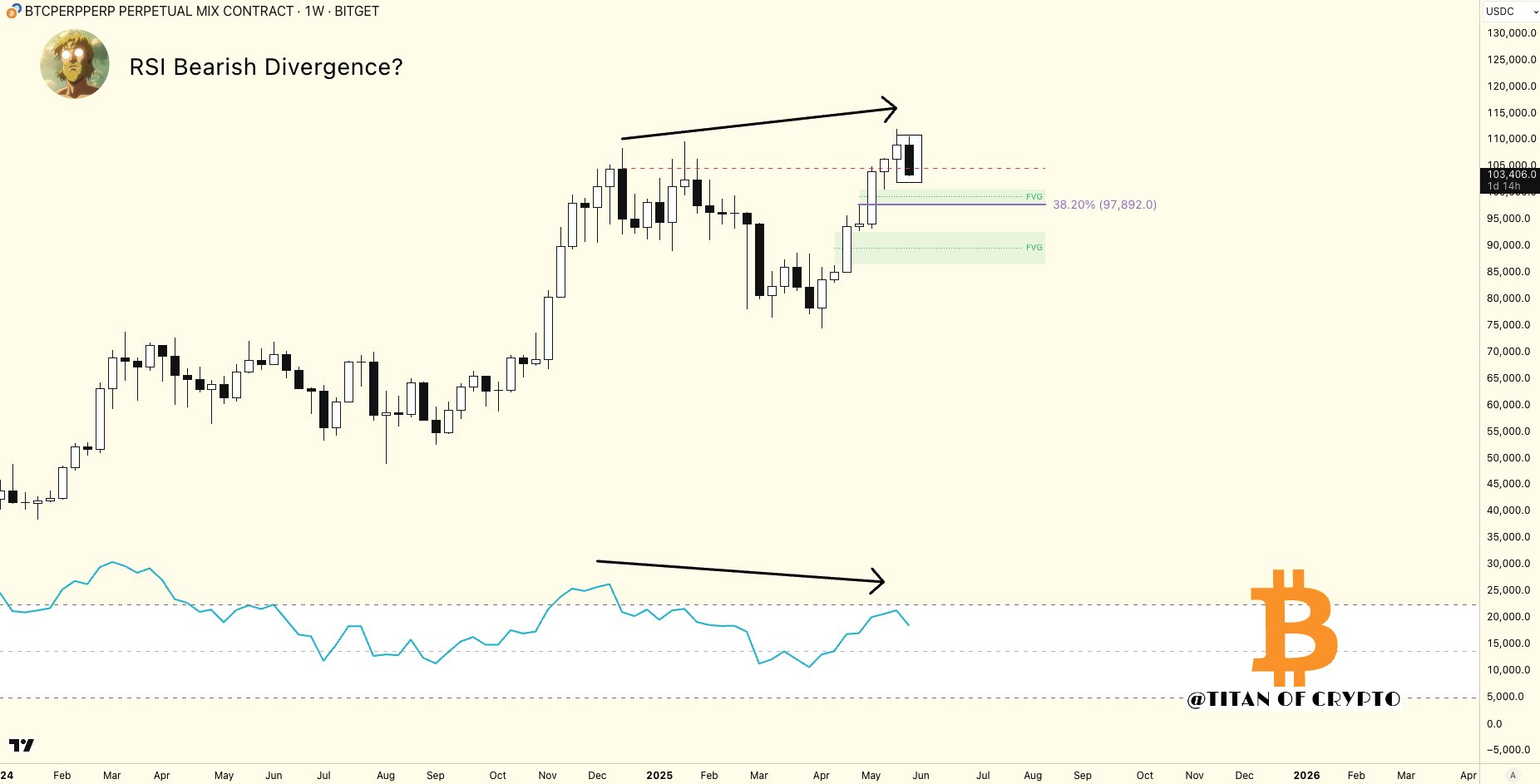

Hyland published a chart revealing a bearish divergence in between rate and the relative strength index (RSI) on weekly timeframes.

RSI is a timeless pattern strength indication, which determines momentum at provided rate points.

Continuing, fellow trader Titan of Crypto alerted that the divergence might have broader ramifications for bulls.

” A prospective RSI bearish divergence is forming on the weekly chart. Still unofficial however worth enjoying,” he informed X fans on Might 31.

An accompanying chart referenced so-called reasonable worth spaces (FVGs) as determined by Fibonacci retracement levels, these revealing imbalances in between purchasers and sellers as rate rose to its present location.

2 FVG zones of interest were at $97,000 and $90,000.

” After a +50% run, a cooldown would not be a bad thing. Healthy market structure matters,” Titan of Crypto acknowledged.

BTC rate uptrend “undamaged”

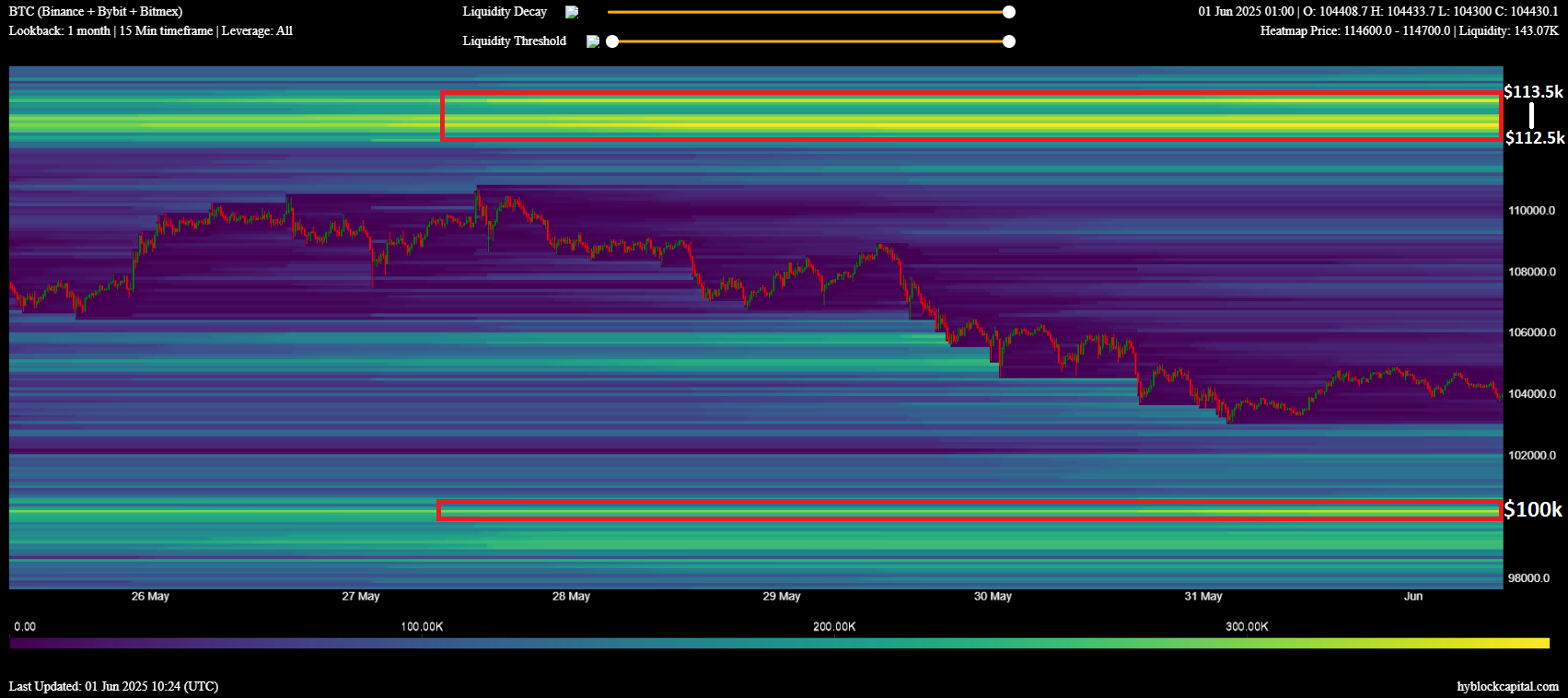

Based upon order book liquidity information, trader CrypNuevo recommended the $100,000 might operate as a cost magnet ought to the marketplace fall even more.

Related: How low can the Bitcoin rate go?

” It’s a strong mental level and liquidity tends to stack in these levels. Prospective retest of this level initially,” part of an X thread continued reading the day.

CrypNuevo preserved faith in the total bullish market structure regardless of BTC/USD dropping 8% over the previous week.

” So I believe we’ll most likely drop to $100k and mess around there for some days – even a minor momentary drop listed below it to shake the marketplace would make sense.,” he concluded.

” However in the huge image, we have the booming market assistance at $84k reaching rate; uptrend is undamaged; liquidity is above.”

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.