Bottom line:

-

Bitcoin chops around $114,000 as a whale anticipates more BTC rate losses next.

-

Rate pressures short-term holders, who have their expense basis simply listed below the $114,000 mark.

-

Secret moving averages remain in deem assistance bases.

Bitcoin (BTC) had a hard time to hold its rebound at Monday’s Wall Street open as a questionable whale contributed to their BTC rate drawback bet.

Bitcoin whale doubles down on BTC rate dip

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD pulling back from everyday highs of $116,000.

The set rapidly closed an advantage “space” in CME Group’s Bitcoin futures market, and after that dipped under the everyday open.

$BTC CME Space has actually now been closed ✅ https://t.co/Cd6fq3Na1A pic.twitter.com/OWy2aa1bb6

— Daan Crypto Trades (@DaanCrypto) October 13, 2025

Markets were unmoved by words from the United States federal government over a prospective US-China trade relocation that might prevent a significant tariff escalation.

Treasury Secretary Scott Bessent revealed “working level” talks with China later on in the week.

” Our company believe this is a tactical escalation (by Beijing) to form pre-summit bargaining, not a tactical decoupling,” Morgan Stanley experts composed in a note on the day, estimated by sources consisting of Reuters.

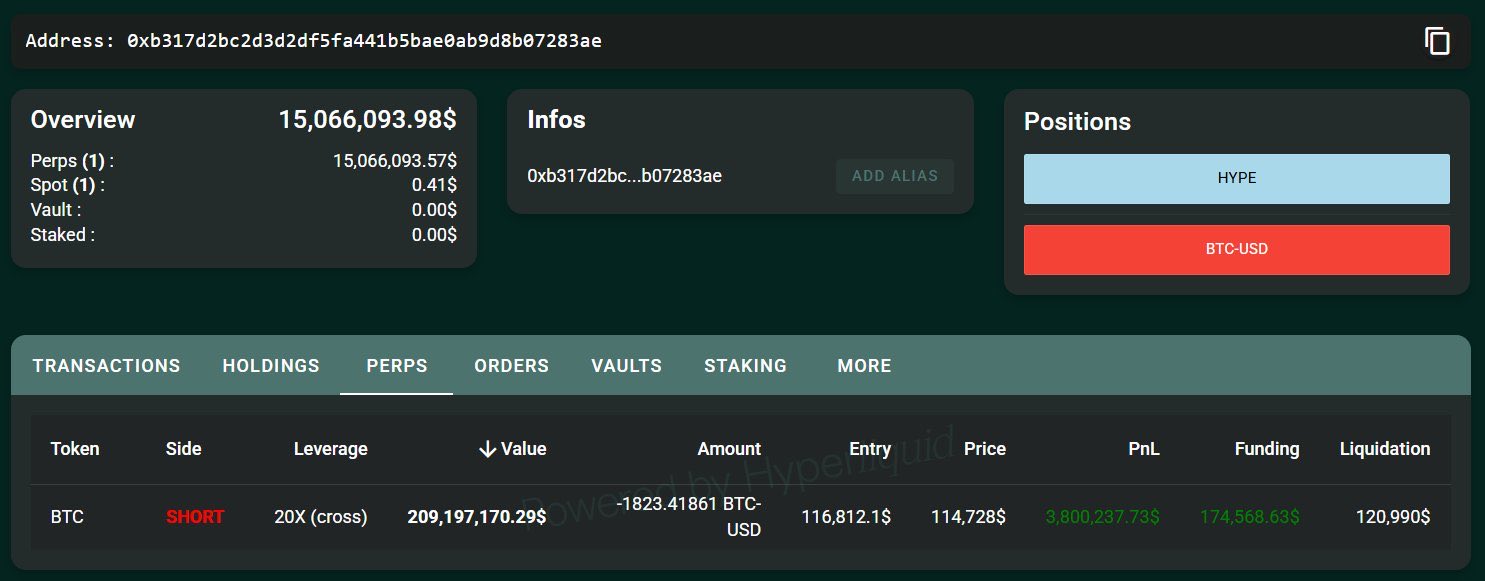

As traders waited on hints, attention concentrated on an unidentified Bitcoin whale who had actually taken advantage of Friday’s $20 billion liquidation occasion by shorting prior to the China news hit.

On Monday, the entity contributed to its brief position, which at the time of writing deserved 3,500 BTC with a liquidation rate of around $120,000.

” As I stated the other day, he perhaps wishes to lose cash or get liquidated so individuals will not believe he had expert details,” crypto expert and business owner Ted Pillows responded in a post on X.

Analyst Max Keiser recommended that nasty play was included, declaring that “banks are providing (ie printing) billions to money naked Bitcoin-shorts.”

” It will not work,” he included.

Bitcoin speculators turn in between earnings and loss

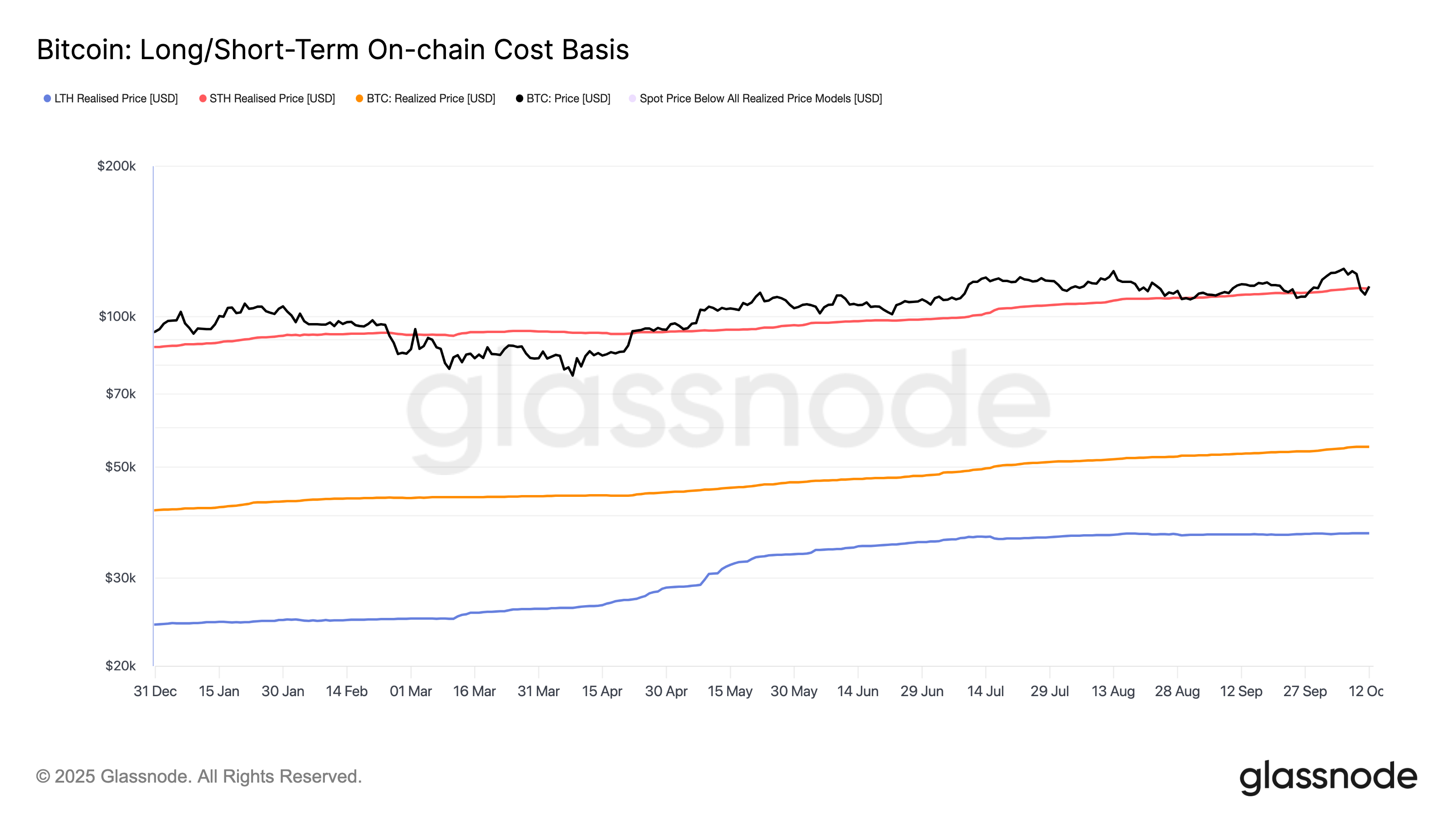

BTC rate action hence circled around an essential assistance line, represented by the aggregate expense basis of short-term holders (STHs).

Related: $ 120K or end of booming market? 5 things to understand in Bitcoin today

As Cointelegraph reported, STH wallets, connected to entities hodling for as much as 6 months, function as a safeguard throughout booming market drawdowns.

Information from onchain analytics platform Glassnode puts the STH expense basis at $113,861 since Sunday.

Continuing, onchain analytics platform CryptoQuant flagged 3 pattern lines as essential to view next: the 30-day, 90-day and 200-day basic moving averages (SMAs).

In among its “Quicktake” article on the day, factor Arab Chain composed:

” This structure recommends that the long-lasting structural uptrend stays undamaged (as the rate is still above the 200-DMA), however brief- to medium-term tactical momentum has actually compromised, with the rate now listed below the 30- and 90-DMA, which have actually assembled into a vibrant resistance zone.”

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.