Secret takeaways:

-

Bitcoin’s death cross, which formerly caused 64% -77% BTC rate decreases, has actually flashed once again.

-

Installing selling pressure is triggering lots of financiers to offer their BTC holdings at a loss.

Bitcoin (BTC) might have validated its entry into a bearish market after the rate dropped to $80,000 on Friday. This view is strengthened by a merging of technical signs that have actually traditionally preceded prolonged decreases.

Bitcoin’s macro uptrend was revoked

The BTC/USD set closed listed below its 50-week moving average on Sunday, a level crypto expert Rekt Capital has actually been carefully seeing, stating that the “rate will require to recover it immediately on a relief rally to secure the structure.”

It’s going to get made complex for Bitcoin to preserve bullish market structure if it carries out a Weekly Close listed below the 50-week EMA later on today

If the Weekly Close certainly takes place listed below the 50 EMA, rate will require to attempt recover it immediately on a relief rally to secure the … https://t.co/kxqpfUXC91 pic.twitter.com/SNp1Lxj0Dx

— Rekt Capital (@rektcapital) November 16, 2025

” Bitcoin wasn’t able to recover the 50-week EMA,” the expert composed in a Friday post on X, including:

” Bullish market structures are revoked when the macro pattern shifts.”

Rekt Capital was describing Bitcoin’s drop listed below essential assistance lines, even as the rate moved listed below the 100-week moving average to reach a six-month low of $80,500 on Friday.

Related: Bitcoin depression to $86K brings BTC closer to ‘max discomfort’ however terrific ‘discount rate’ zone

On the other hand, the rate validated a “death cross” on its day-to-day chart at the end of recently, a technical pattern that has actually formerly preceded considerable rate decreases.

On Sunday, Bitcoin’s 50-day basic moving average (SMA) crossed listed below its 200-day SMA for the very first time given that January 2024, forming a death cross.

” Every Bitcoin cycle has ended with a Death Cross,” stated expert Mister Crypto in an X analysis on Monday, asking:

” Why would this time be various?”

In January 2022, the death cross was followed by a 64% BTC rate drop, bottoming at $15,500, sustained by the FTX collapse.

March 2018 and September 2014 saw 67% and 71% decreases in BTC rate, respectively, after painting comparable SMA crossovers.

As Cointelegraph reported, Bitcoin’s SuperTrend indication likewise sent out a bearish signal on the weekly chart, an incident that has actually traditionally marked the start of a bearish market.

Bitcoin recognized losses exceeded $800 million

With offering pressure increasing by the hour, the volume of recognized losses has actually increased to levels not seen given that the 2022 FTX collapse.

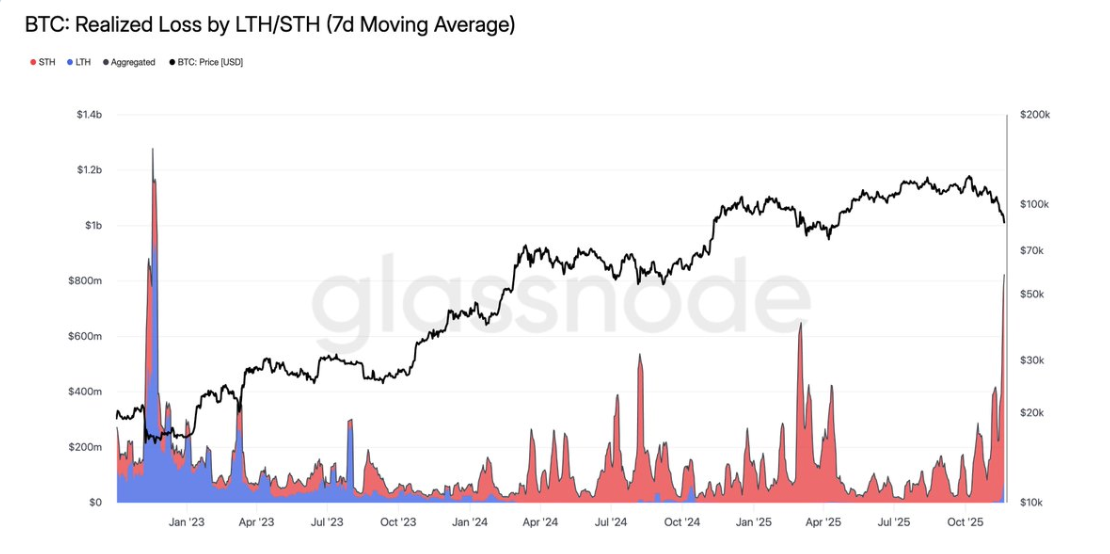

Onchain information service provider Glassnode shared a chart revealing that Bitcoin’s aggregate recognized losses by both short-term and long-lasting holders have actually risen to locations above $800 million on a seven-day rolling basis. The $800 million mark was last crossed in November 2022.

” Short-term holders are driving the bulk of the capitulation,” Glassnode stated, including:

” The scale and speed of these losses show a significant washout of minimal need as current purchasers relax into the drawdown.”

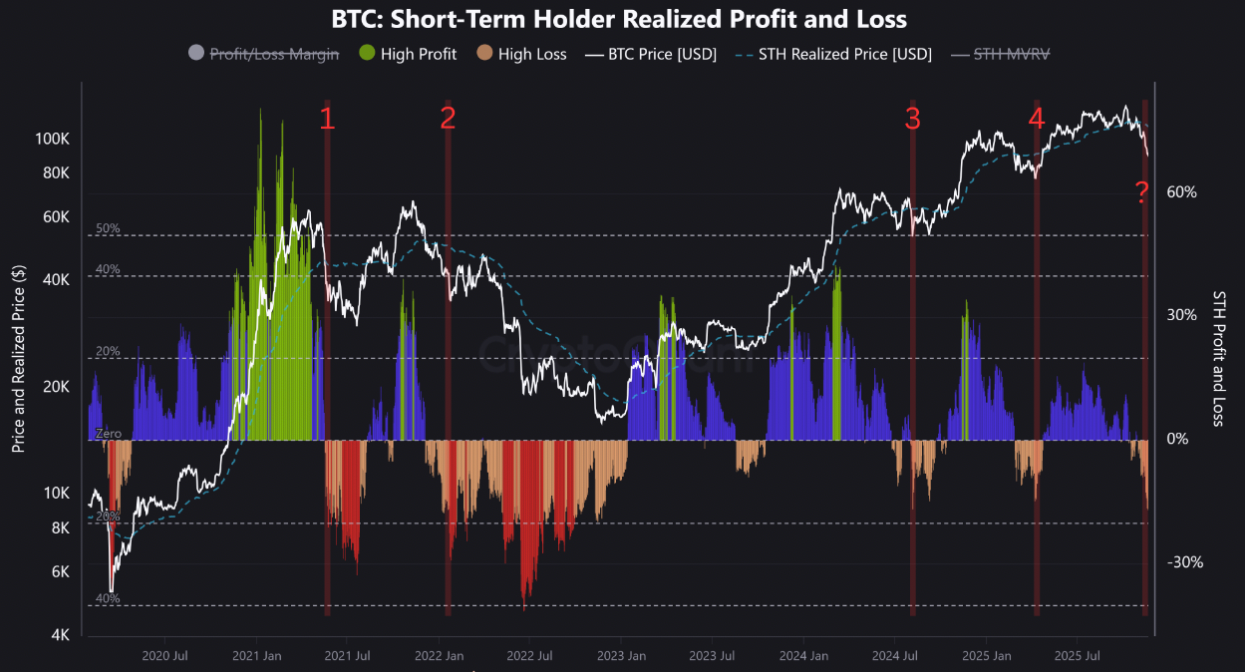

Sharing a comparable viewpoint, CryptoQuant expert IT Tech stated short-term selling “frequently marks a regional bottom if the rate rapidly recovers the expense basis,” including:

” Stopping working to do so traditionally shows a much deeper bearish pattern or verifies a bearish market.”

As Cointelegraph reported, short-term holders have actually been panic-selling their Bitcoin holdings at a loss, fanning to experts’ forecasts that the BTC rate will extend its drop towards its April bottom of $74,500.

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.