Secret takeaways:

-

Low BTC and ETH utilize hunger contrasts with strong stock exchange, highlighting delicate belief regardless of enhancing liquidity expectations.

-

While financial unpredictability continues, prepared for financial relieving minimizes disadvantage danger for cryptocurrencies, preferring a possible bullish momentum.

Bitcoin (BTC) and Ether (ETH) acquired momentum on Wednesday, increasing to their greatest levels in 2 weeks as financiers wait for a more expansionist financial policy. Weak financial signs improved expectations of fresh stimulus steps, increasing need for limited possessions.

The S&P 500 index and gold likewise responded favorably as financiers prepared for greater liquidity going into the marketplaces. Still, with the cryptocurrency market capitalization sitting 29% listed below its all-time high of $4 trillion, Bitcoin and Ether traders stay alert to the possibility of a correction driven by wider financial unpredictability.

Need for limited possessions enhanced on Wednesday, revealed by the dive in United States 5-year Treasurys costs and gold approaching $4,240, up 3% in 2 weeks. Bitcoin held near $93,000, the same from 2 weeks previously. Ether, nevertheless, stays 37% listed below its all-time high of $4,956, triggering traders to reassess the outlook for the altcoin market.

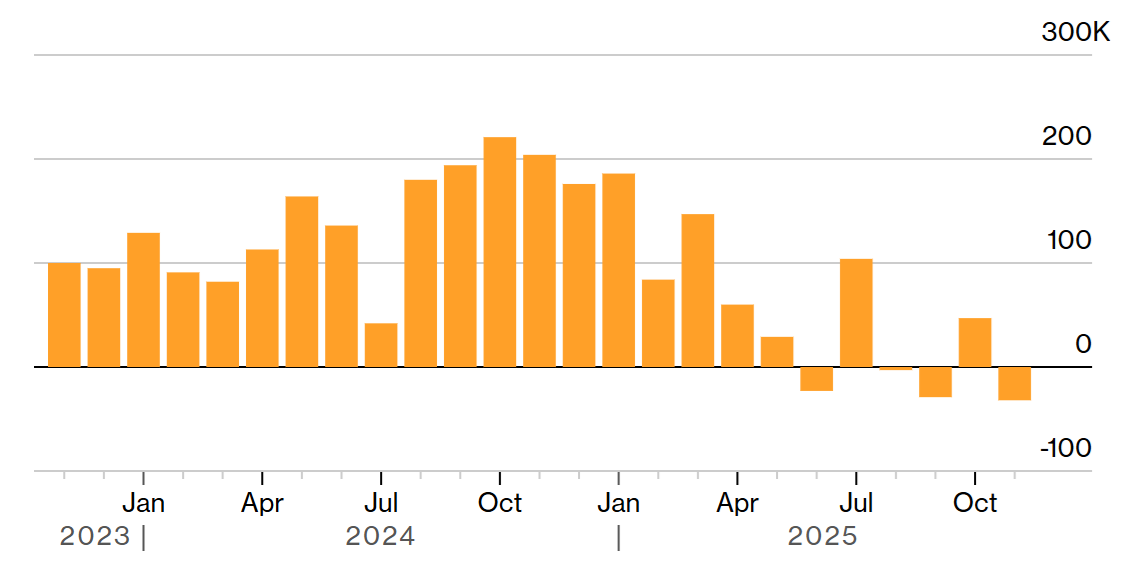

The United States labor market revealed indications of slowing in November as personal business cut 32,000 tasks, with small companies dealing with the most difficult conditions. The ADP payroll report kept in mind that employees saw a 0.1% pay decrease from October, which minimized inflation issues. Traders now wait for the Fed’s rates of interest choice on Dec. 10, anticipating clearer assistance on policy instructions.

Crypto must gain from the extra inbound liquidity

Fed policymakers have actually signified diverging views, partially due to the absence of main United States federal government information throughout the federal government financing shutdown that ended on Nov. 12. Some argue rate cuts are required to avoid much deeper labor market weak point, while others caution extra decreases might intensify inflation, which stays well above the Fed’s 2% target.

Growing reliance on expert system financial investments by a few of the world’s biggest business includes another layer of unpredictability. Jean Boivin, head of the BlackRock Financial investment Institute, supposedly stated: “There is a lot discuss the capacity of the bubble … individuals understand the danger.” According to Yahoo Financing, BlackRock likewise highlighted the physical constraints of massive AI information center growth.

The United States outlet store operator Macy’s stated Wednesday that its outlook shows continuous pressure from careful customer costs and greater tariffs, which are anticipated to weigh on lead to the last months of 2025. In an interview with CNBC, CEO Tony Spring stated Macy’s has actually been required to make “selective” cost boosts throughout many classifications.

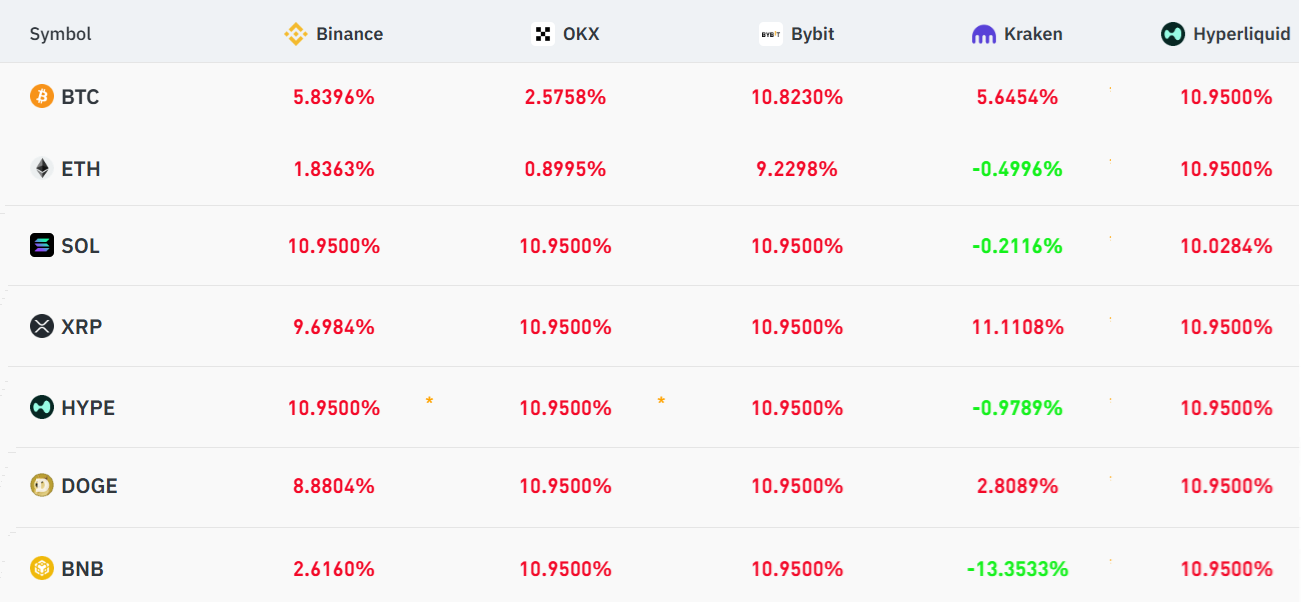

Need for bullish utilize positions on Bitcoin and Ether stays uncommonly low. Under neutral conditions, the annualized financing rate on continuous agreements need to fall in between 6% and 12% to cover the expense of capital. This absence of conviction is noteworthy considered that the United States Russell 2000 Little Cap Index sits simply 2.3% listed below its all-time high.

Related: Ethereum treasury trade relaxes 80% as handful of whales control buys

The stock exchange is anticipated to benefit straight from expansionist financial policies through lower capital expenses and federal government rewards connected to AI and atomic energy facilities. Without a shift in belief, cryptocurrencies might continue to lag as task market conditions deteriorate and unpredictability constructs.

Regardless of the soft labor and customer information, cryptocurrencies are not at impending danger of collapse. The anticipated liquidity increase need to assist reduce financial pressure and sustain hunger for limited possessions. As long as financial conditions continue to loosen up, Bitcoin and Ether are most likely to recuperate modest ground than deal with a sharp turnaround.

This post is for basic details functions and is not meant to be and need to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we aim to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might consist of positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage emerging from your dependence on this details.