Bottom line:

-

Bitcoin quits pre-Wall Street gains as range-bound BTC rate action remains in location.

-

A possibly record-breaking TradFi choices expiration occasion threatens curveball volatility throughout danger possessions.

-

Bitcoin continues to hold crucial assistance required for a perform at $135,000.

Bitcoin (BTC) reversed earlier gains after the June 20 Wall Street open as a significant expiration occasion brought a “wedding day” for United States equities.

Bitcoin bulls battle at crucial moving averages

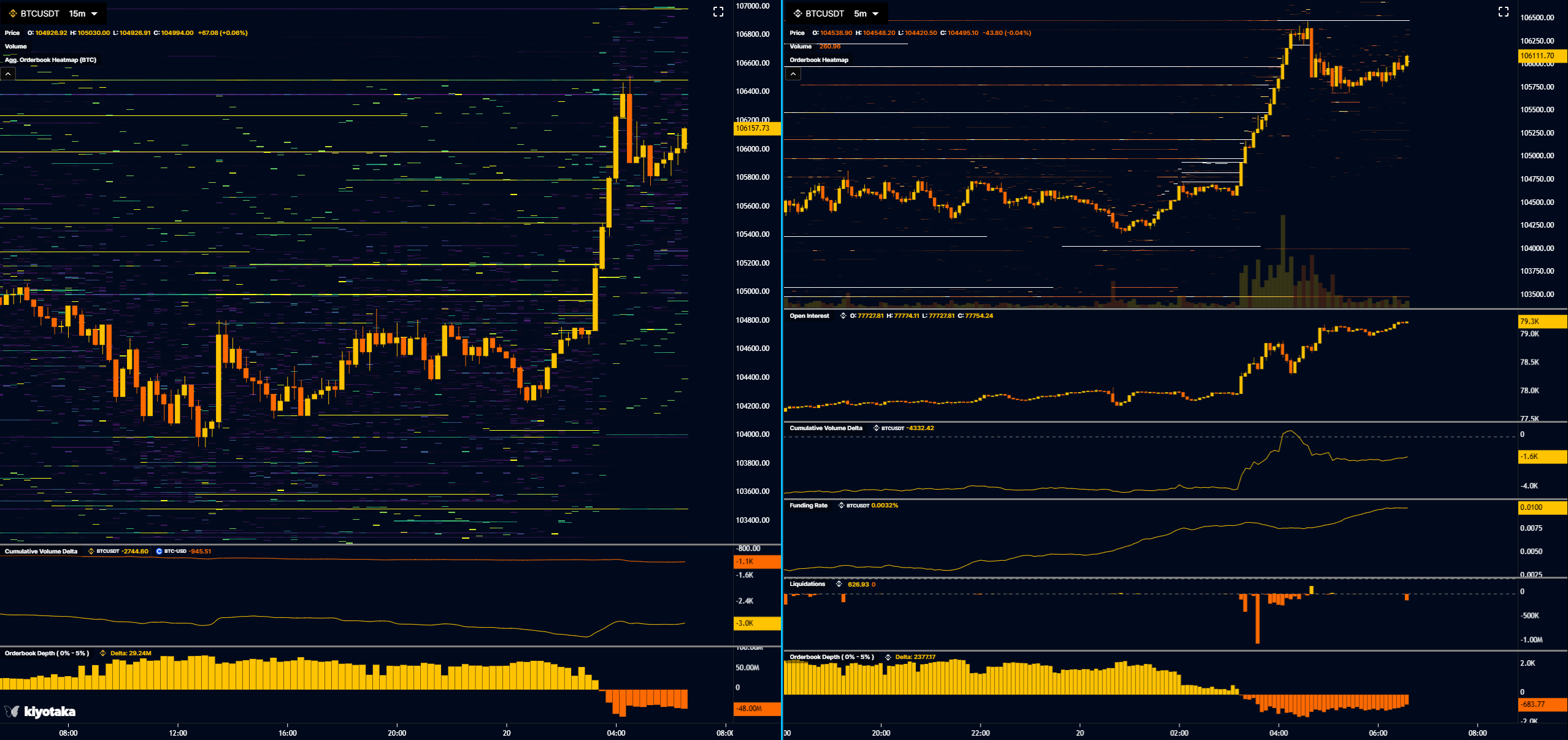

Information from Cointelegraph Markets Pro and TradingView revealed BTC rate momentum stalling after a journey to $106,500.

BTC/USD therefore changed around its 21-day basic moving average (SMA) at 105,800, a level highlighted by Keith Alan, co-founder of trading resource Product Indicators.

That level accompanied the 10-day SMA, another recover effort in development, as flagged by popular trader Matthew Hyland.

” Market is still located brief consisting of more shorts packing up here,” fellow trader Alter continued throughout the journey past $106,000.

” Noteworthy ask depth here on orderbooks so this indicates area circulation is quite dominant & & crucial today.”

With Bitcoin still stuck in a narrow intraday variety, a prospective volatility driver can be found in the type of an abnormally big TradFi expiration occasion.

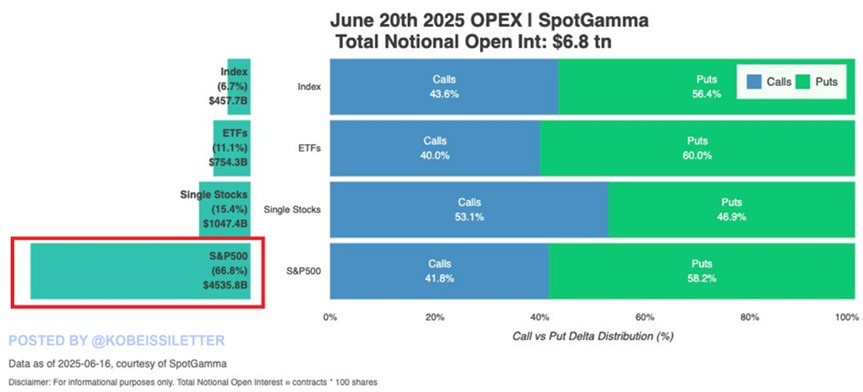

” Brace for increased market volatility today: $6.8 trillion worth of choices on stock indexes, ETFs, equity index futures, and private stocks are set to end throughout today’s trading session,” trading resource The Kobeissi Letter informed X fans ahead of what it called a “wedding day.”

” This is possibly the most significant ‘triple witching’ OpEx on record, according to SpotGamma price quotes. It will likewise be the very first regular monthly post-holiday OpEx in a minimum of 25 years.”

$ 135,000 BTC rate target still “on the table”

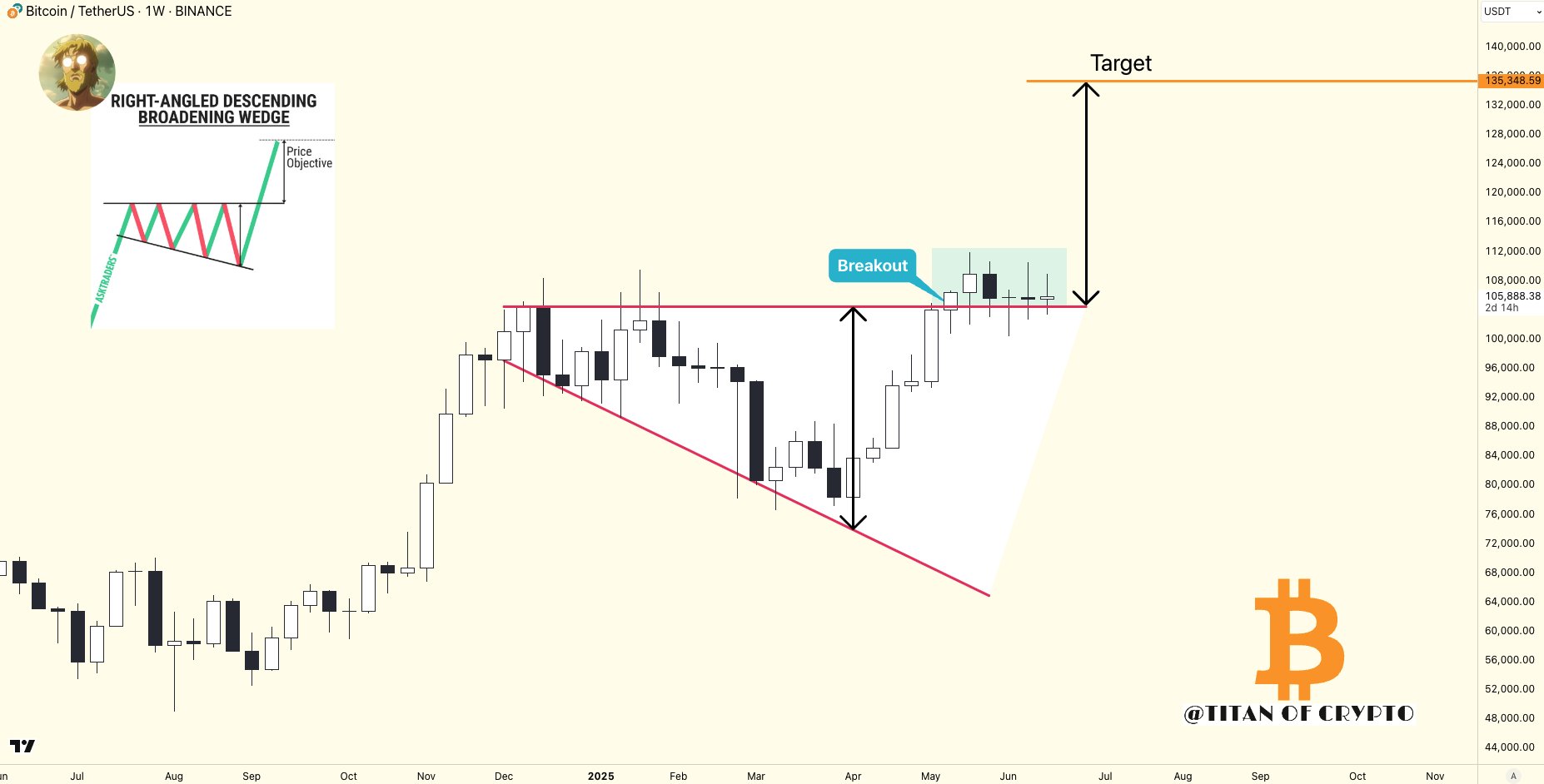

Embracing a longer-term view, trading and analytics account Titan of Crypto saw factor for optimism based upon weeks of assistance retention.

Related: Here’s when Bitcoin experts anticipate brand-new BTC rate volatility

Submitting the weekly chart to X, Titan of Crypto argued that a $135,000 BTC rate target stayed “on the table.”

” BTC broke out of a right-angled coming down expanding wedge, and the structure stays legitimate,” part of the accompanying commentary summed up.

Cointelegraph just recently reported on numerous bullish rate projections, consisting of $140,000 and greater.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.