Secret takeaways:

-

The Bitcoin Coinbase Premium turned red as BTC cost dropped listed below $104,000.

-

Bitcoin’s RSI struck its floor because April, meaning a prospective bottom zone.

-

The 200-day EMA assistance stayed essential as BTC dangers short-term capitulation.

Bitcoin (BTC) extended its current decrease on Friday, slipping to $103,500 and setting off a significant shift in onchain market belief. The Bitcoin Coinbase Premium Index, which tracks the cost distinction in between BTC on Coinbase and other exchanges, turned red on the per hour chart for the very first time in weeks.

Previously today, BTC tried to discover assistance around $110,000, buoyed by consistent area need from United States financiers. The Coinbase premium even increased to 0.18, its greatest reading because March 2024.

Nevertheless, as the cost stopped working to hold above $110,000 on Thursday, that short-term self-confidence faded. While the per hour premium has actually turned unfavorable, the everyday reading stayed somewhat favorable, showing that long-lasting United States purchasing assistance hasn’t completely vanished, however it is presently under pressure.

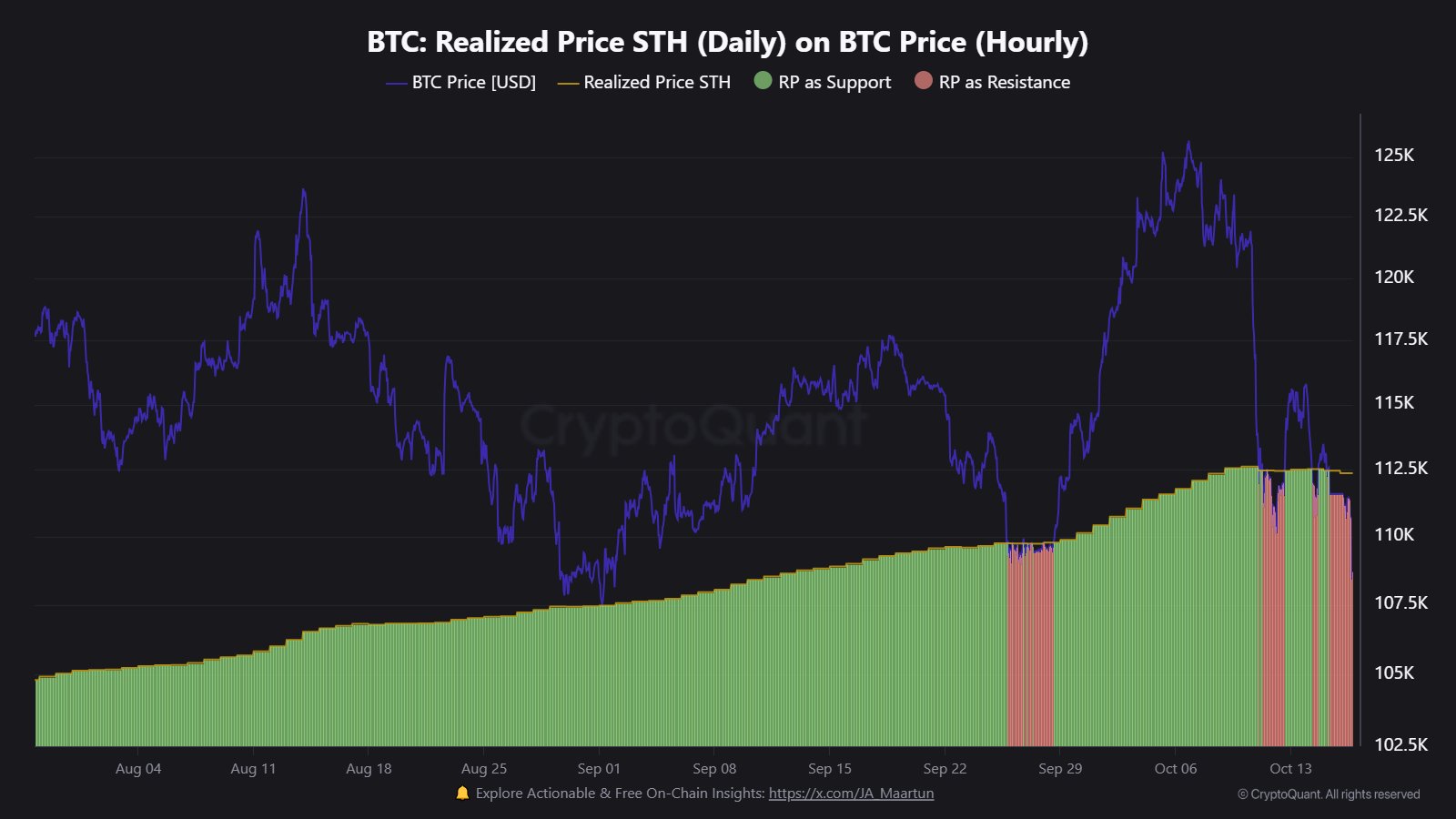

Contributing to the bearish pressure, Bitcoin’s taker sell volume rose above $4 billion, signifying a wave of market sell orders. The relocation accompanied BTC’s rejection near the short-term holder (STH) recognized cost at $112,370, a crucial level that now served as resistance.

Historically, this level marked the typical expense basis for current purchasers, indicating that continual rejection listed below it might speed up short-term capitulation towards $100,000.

Related: Bitcoin holds $105K as United States bank stocks recuperate, Trump truce raises belief

Bitcoin mirrors its March– April bottom structure

BTC’s existing cost action carefully looks like the March– April bottom variety, when sharp intra-day wicks cleaned out liquidity developed over thirty days before a progressive healing started. The pattern recommended that BTC might retest the $100,000 variety without always breaking the wider bullish structure, unless it falls decisively listed below that level.

The relative strength index or RSI likewise dropped to its most affordable level, matching April’s low worth of 34, following which BTC began to recuperate in the charts.

An essential technical signal to view is the 200-day rapid moving average (EMAs), which BTC has actually held for almost 6 months. In the previous cycle, it kept this pattern from October 2024 to March 2024 before briefly losing it throughout debt consolidation. This time, the trendline has actually held from April to October 2025, with the cost potentially losing the trendline in the coming days.

If BTC continues to follow its previous fractal, the marketplace might go into a debt consolidation stage lasting a number of weeks. In Q1, the healing stage extended almost 45– 55 days, forming a real bottom just in late April. Using the very same timeline recommends that a progressive healing might not emerge till late November or early December.

Crypto trader Dentoshi echoed this view and stated,

“$ BTC has actually regularly bottomed around the 3-day 100 EMA this bull run– however it’s taken 45– 96 days to do so.”

Related: Bitcoin ‘bull run is over,’ traders state, with 50% BTC cost crash caution

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.