Secret takeaways:

-

Ether continuous futures volume has actually gone beyond Bitcoin, indicating a significant shift in market interest.

-

A bearish RSI divergence indicate short-term fatigue.

Ether (ETH) has actually traded simply listed below the $4,000 resistance because December, 2025 and traders doubt whether it will be crossed whenever quickly. In spite of the problem in conquering $4,000, one crucial target for bulls lies at the +1 σ active recognized cost band, presently hovering near $4,500. The metric tracks the typical ETH expense, actively altering hands on the network.

Information from Glassnode showed that this level functioned as a ceiling throughout the March 2024 high and the 2020– 21 cycle. A continual breakout above this line has actually formerly set off quick up momentum, however likewise brings the danger of getting too hot and structural volatility.

The momentum is likewise shown in ETH’s future markets. Cointelegraph reported that Ether continuous futures have actually gone beyond Bitcoin in volume supremacy for the very first time because 2022, marking the “biggest” shift in trading focus towards ETH ever taped. Similarly, pseudonymous trader Byzantine General just recently modified his short-term outlook, specifying,

” I believe I’m incorrect about ETH getting some short-term drawback. It’s too strong, declines to print any considerable correction … It’s appearing like a simply f *** ing send it minute.”

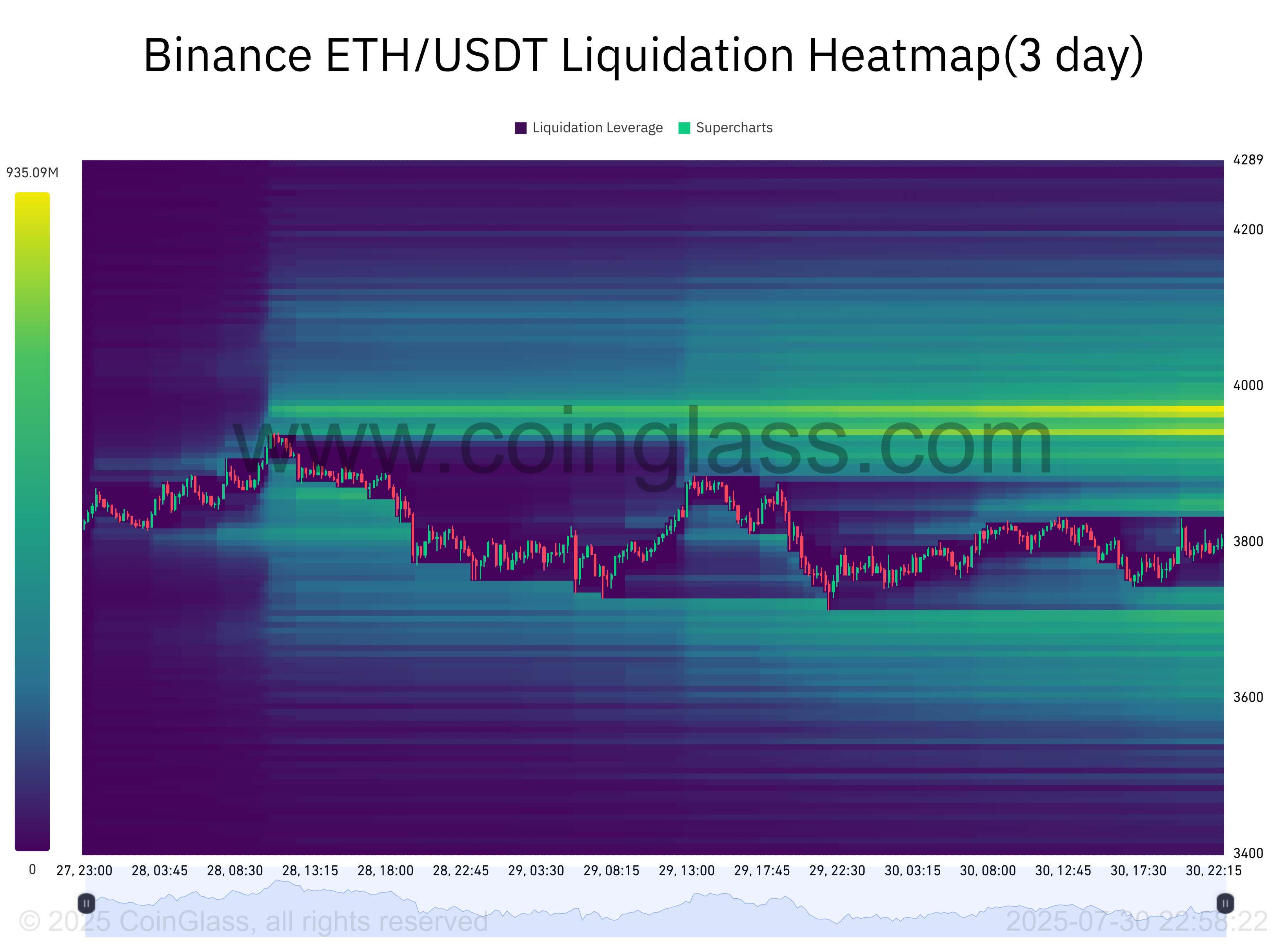

Supporting this story, Ether’s liquidation maps expose a thick cluster of brief liquidations stacked simply above $4,000. A tidy relocation above this limit might liquidate as much as $930 million in positions, possibly sustaining a vertical approach $4,500.

Related: Here’s why some Ethereum traders anticipate ETH cost to strike $16K this cycle

Bearish divergences raise short-term care for ETH

While bullish momentum controls the story, a crucial technical signal might hinder the existing rally. On both the four-hour and one-day timeframes, Ether’s cost has actually printed brand-new regional highs, however the relative strength index (RSI) has actually stopped working to verify the relocation, resulting in bearish divergences.

Bearish divergences might be an early indication of purchaser fatigue, looking like patterns in previous regional tops. Zooming out, the everyday chart exposes a consistent bearish divergence that hasn’t totally fixed because ETH crossed above $3,500. A short-term pullback towards crucial assistance zones can’t be eliminated if cost stops working to follow through beyond $4,000 with persuading volume.

If a bearish correction works out, the instant assistance variety on the lower timespan stays simply listed below $3,700, where a narrow reasonable worth space (FVG) is observed.

Nevertheless, consistent bearish pressure might result in Ether screening its long-lasting FVG in between $3,200 and $3,300, resulting in a bearish break of structure.

Related: ‘Biggest’ volume alter for ETH verifies pivot to altcoins: Glassnode

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.