Secret takeaways:

-

ADA cost is up over 70% given that June 22, indicating completion of the drop.

-

Several bullish chart signals recommend ADA cost can climb up over 200% towards $3.

ADA (ADA), the native token of the Cardano network, published an excellent 75% gain in between June 22 and July 18, most likely marking completion of a multimonth drop that bottomed out at $0.50 in June.

ADA cost has actually rallied as much as 9% over the last 24 hr to strike a 20-week high of $0.89 on Friday.

ADA Bollinger Bands might fire up explosive relocation

ADA has the fuel to introduce to all-time highs if volatility signals play out like in the past. The existing state of the Bollinger Bands (BB) volatility sign needs that the ADA/USD set rockets greater.

Throughout the current rally, the ADA/USD weekly candlestick touched the upper band of the band. When this takes place, it can indicate an impending increase above the sign, showing the start of benefit volatility.

Related: Cost forecasts 7/14: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, ADA, BUZZ

ADA breaking the upper band has actually traditionally resulted in enormous rallies in cost as seen in 2021 (1,500%), 2022 (117%) and 2024 (300%).

The chart listed below likewise reveals that the Bollinger Bands have actually started squeezing, and the cost touching the upper band includes weight to hopes that a comparable circumstance might now play out.

Cardano cost flashes numerous buy signals

Regardless of the outstanding run over the last couple of weeks, ADA’s cost is still almost 4x far from its $3.10 all-time high from 2021.

Nevertheless, the cost has actually sent out numerous bullish signals on various amount of time, recommending that the rally is getting momentum

ADA broke out of a bull flag on the weekly chart, turning the upper border of the flag, the 50-day easy moving average (SMA) and the 200-day SMA into assistance, as displayed in the chart below.

The determined target of the bull flag is $2.70, or a 216% boost from the existing cost.

Furthermore, a golden cross, formed when the 50-day SMA crossed above its 200-day equivalent recently, strengthens the case for an extension of the uptrend.

The moving typical merging divergence sign (MACD), which determines pattern strength, produced a bullish cross as the ADA/USD trading set confirmed a bull flag on the weekly chart. The metric started constructing favorable bars after a “red” duration, which started in early 2025.

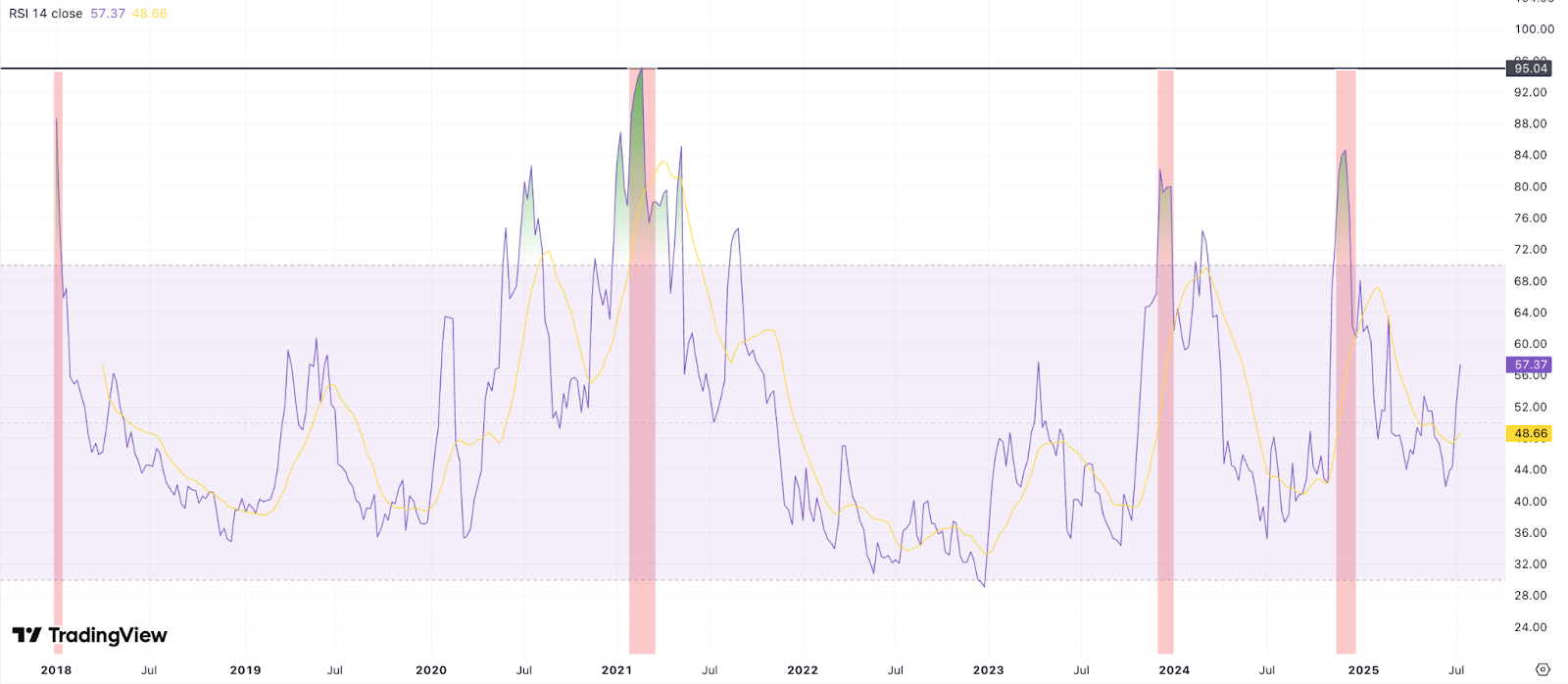

The weekly relative strength index (RSI), on the other hand, reveals that XRP has more space to run before reaching overheated levels, such as in the 2018, 2021, and December 2024 cycle tops.

Even with the everyday RSI at 80, history reveals that ADA might still rally 130% more to $1.80, according to pseudonymous expert Deezy.

Last time the RSI (relative strength index) on Cardano’s everyday candle lights struck 80, ADA would go on to pump ANOTHER 130%!

130% pump from here is $1.82 ADA

Send it pic.twitter.com/dOmasaZjXG

— Deezy (@deezy_BTC) July 17, 2025

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.