Secret takeaways:

-

Bitcoin’s Bollinger Bands indication now sees the capacity for BTC rate breakout above $110,000.

-

Bitcoin eyes brand-new all-time highs in July due to numerous tailwinds.

Bitcoin (BTC) might see additional benefit volatility as BTC’s rate holds crucial levels, according to a timeless technical analysis metric.

Bollinger Bands: BTC rate nears breakout

In a Sunday post on X, crypto YouTuber Crypto Rover stated that Bitcoin was placed for an upward breakout based upon Bollinger Bands analysis.

Bollinger Bands, a Bitcoin indication utilized by traders to examine momentum and volatility within a particular variety, had actually reached its tightest point in 12 months, signifying that a considerable rate relocation might be underway or impending.

Crypto Rover shared a chart revealing that Bitcoin Bollinger Bands were “tighter than they have actually been” given that February 2024 throughout three-day timeframes.

Related: ‘ Incorrect relocation’ to $105K? 5 Things to understand in Bitcoin today

Bitcoin rose about 75% in between February and March of 2024 to its previous all-time highs of $74,000, after breaking above the upper border of the Bollinger Bands.

If history repeats, Bitcoin’s present rate of $108,900 might rapidly develop into a brand-new all-time high of $190,000, according to information from Cointelegraph Markets Pro and TradingView.

In an accompanying remark, Crypto Rover stated:

” Huge pump inbound!”

He wasn’t the only trader to identify the emerging pattern.

” Bollinger band tighter than it’s been for over a year,” stated crypto expert Cantonese Feline, including, “Larger relocation coming.”

” The $BTC Bollinger Bands are quite compressed– presently around annual lows at a 9.4% rate variety,” composed Crypto markets analyst Frank Fetter in an X post.

The $BTC Bollinger Bands are quite compressed– presently around annual lows at a 9.4% rate variety. When vol? pic.twitter.com/H69SWOZD9x

— Frank (@FrankAFetter) June 30, 2025

John Bollinger, the developer of the Bollinger Bands volatility indication, had actually formerly stated that Bitcoin’s numerous rejections from the upper border of the indication around $110,000 might mark a regional top.

However the indication’s developer is now bullish when again. In a Sunday post on X, Bollinger stated:

” Bitcoin seems establishing for a benefit breakout.”

Several metrics: Bitcoin “bull pattern is undamaged”

As Cointelegraph continues to report, numerous elements are putting Bitcoin in an excellent position for more upside regardless of striking resistance at $110,000.

In addition to consistent institutional need through area Bitcoin ETFs and treasury business, BTC’s huge cup-and-handle pattern in greater timeframes tasks a breakout to as high as $230,000.

Looming United States tariff due dates in addition to an upcoming “Crypto Week” in Washington D.C. might open danger cravings amongst the bulls.

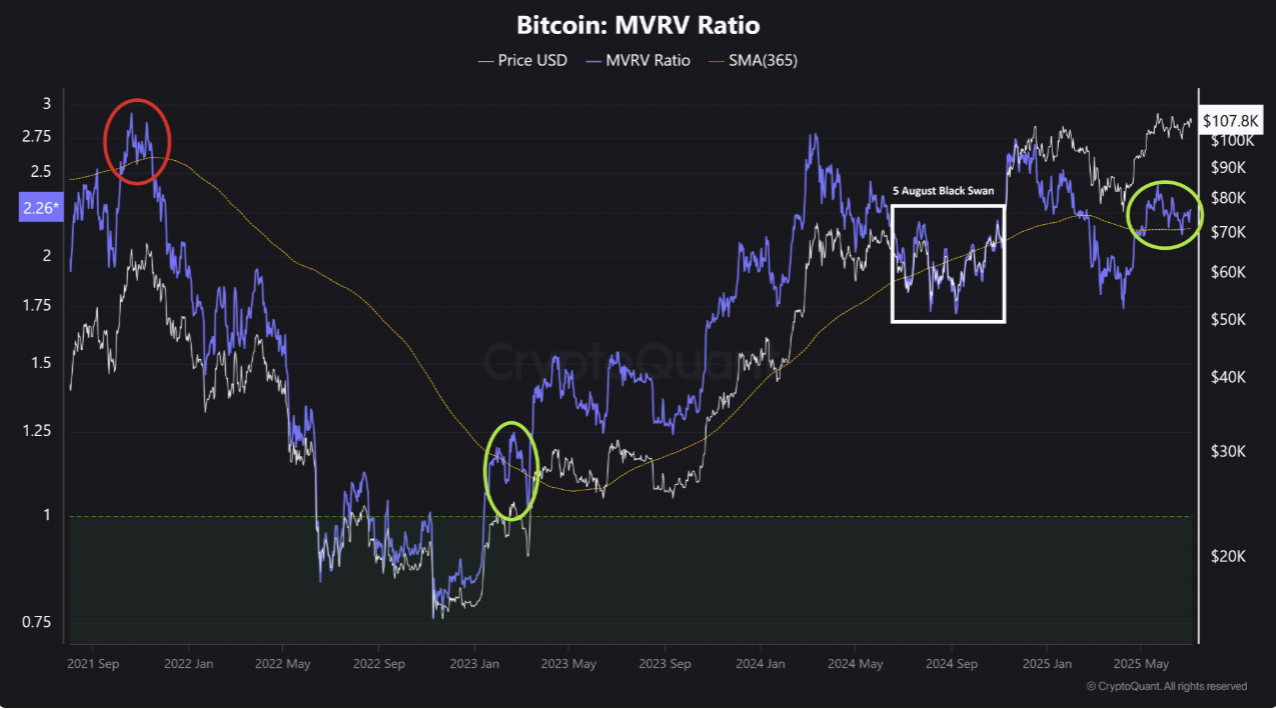

On The Other Hand, the Bitcoin market price understood worth “MVRV” ratio, an onchain metric utilized to examine whether Bitcoin’s rate is miscalculated or underestimated, is at 2.23, above its 365-day easy moving average (SMA365) at 2.15, per information from CryptoQuant.

” Historically, as long as MVRV stays above its SMA365, the uptrend tends to continue,” discussed CryptoQuant expert Burakkesmeci in a QuickTake analysis, including:

” The bull pattern is undamaged.”

As Cointelegraph reported, continued growth of worldwide cash supply (M2) functions as another prospective driver for Bitcoin to reach $170,000 in the coming months.

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.