Secret takeaways:

-

Dogecoin has actually broken out of a multimonth in proportion triangle.

-

Trading volumes tripled throughout the breakout, indicating strong bullish momentum.

Dogecoin (DOGE) cost has actually rallied by almost 40% in the previous 7 days, beating the wider crypto market, which has actually acquired almost 8% in the exact same duration.

The leading memecoin now means additional cost development in the coming weeks, due to a mix of technical and onchain elements.

DOGE cost breakout mean 95% gains ahead

The weekly DOGE cost chart reveals a breakout from a multimonth in proportion triangle, a bullish extension pattern.

Since Saturday, it is trading at around $0.296. However more significantly, its trading volumes throughout the breakout more than tripled, symbolizing strong upside momentum.

DOGE cost can now increase as high as the triangle’s optimum height, putting its breakout target at around $0.60, up around 95% from the present cost levels, by October.

Some chartists, consisting of CryptoKing and CryptoGoos, have actually put their in proportion triangle targets a little lower at $0.45. That lines up with the upper trendline of another multiyear and much wider triangle pattern, as revealed listed below.

Dogecoin’s relative strength index (RSI) enhances the bullish setup after treading listed below its overbought limit of 70.

Nevertheless, DOGE bulls should safeguard assistance at its 50-week rapid moving average (50-week EMA; the red wave) near $0.227 to verify the setup. A definitive close listed below the flooring might press Dogecoin lower towards the 200-week EMA at around $0.215.

Can DOGE repeat last November’s 230% gains?

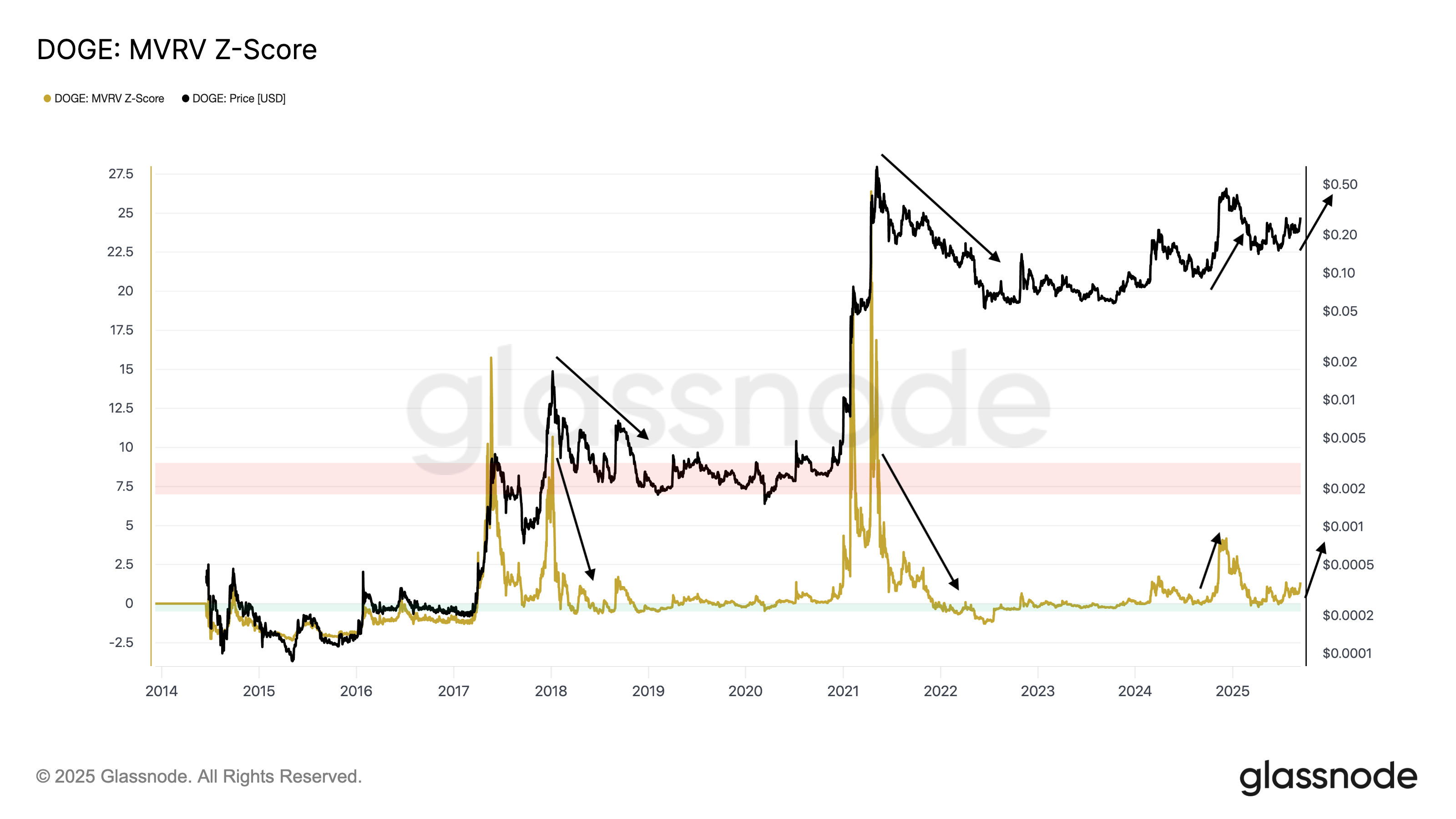

Dogecoin’s MVRV Z-Score sits near 1.35 since Saturday, a level that in past cycles has actually frequently appeared prior to significant rallies, consisting of last November’s 230% gains.

The MVRV Z-Score steps whether DOGE is overpriced or underpriced compared to what many holders initially paid.

An extremely high rating (especially above the red location) suggests the marketplace is overheated due to the fact that financiers are resting on huge latent earnings. An extremely low rating (listed below the green location) recommends undervaluation, where most holders are at or listed below their expense basis.

In 2021, for instance, the Z-Score rose above 20 when DOGE struck its $0.70 peak, flashing clear indications of market excess.

Related: Dogecoin cost increases regardless of most current hold-up of United States DOGE ETF launch

Today’s modest 1.35 reading signals the reverse: holders aren’t resting on severe gains, leaving lots of space for cost to climb up before overbought conditions emerge.

This additional suggests DOGE still has considerable space to grow in the coming weeks.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.