Bitcoin’s next considerable cost driver might arrive this Friday as the United States financial obligation suspension duration pertains to an end, possibly injecting fresh liquidity into markets and driving a rate rebound.

The United States Treasury struck its $36 trillion financial obligation ceiling a day after President-elect Donald Trump’s inauguration on Jan. 20. Treasury Secretary Janet Yellen revealed a “financial obligation issuance suspension duration” starting Jan. 21, which is set to last up until March 14, according to a letter released on Jan. 17.

Bitcoin (BTC) has actually dropped 22% throughout the two-month financial obligation suspension strategy, from over $106,000 on Jan. 21 to $82,535 at the time of composing on March 12, TradingView information programs.

BTC/USD, 1-day chart because Financial obligation suspension strategy. Source: Cointelegraph/TradingView

The resumption of federal government costs will bring a liquidity increase that might catalyze Bitcoin’s next rally, according to Ryan Lee, primary expert at Bitget Research study.

” With in-hand money, the need for monetary properties such as stocks and crypto can increase, and there might be a remedy for continuous volatility,” the expert informed Cointelegraph. “In such durations, we can anticipate an increase in the total momentum, although lots of other elements are necessary to keep in mind.”

Beyond worldwide tariff unpredictability, “issues such as inflation, rate of interest and geopolitical problems stay unsolved,” Lee included.

Thinking about that the financial obligation suspension ends simply 2 weeks after the White Home Crypto Top, a part of the brand-new liquidity might stream into cryptocurrencies, according to Aleksei Ponomarev, co-founder and CEO of crypto index investing company J’JO.

” Rises in liquidity have actually usually benefited Bitcoin and run the risk of properties, and completion of the United States financial obligation suspension will be no various,” he informed Cointelegraph, including:

” While the liquidity rise will certainly drive market value motion, it is restricted to short-term effect. The long-lasting trajectory of Bitcoin is, and stays, connected to institutional financial investments, ETF development and regulative clearness and execution.”

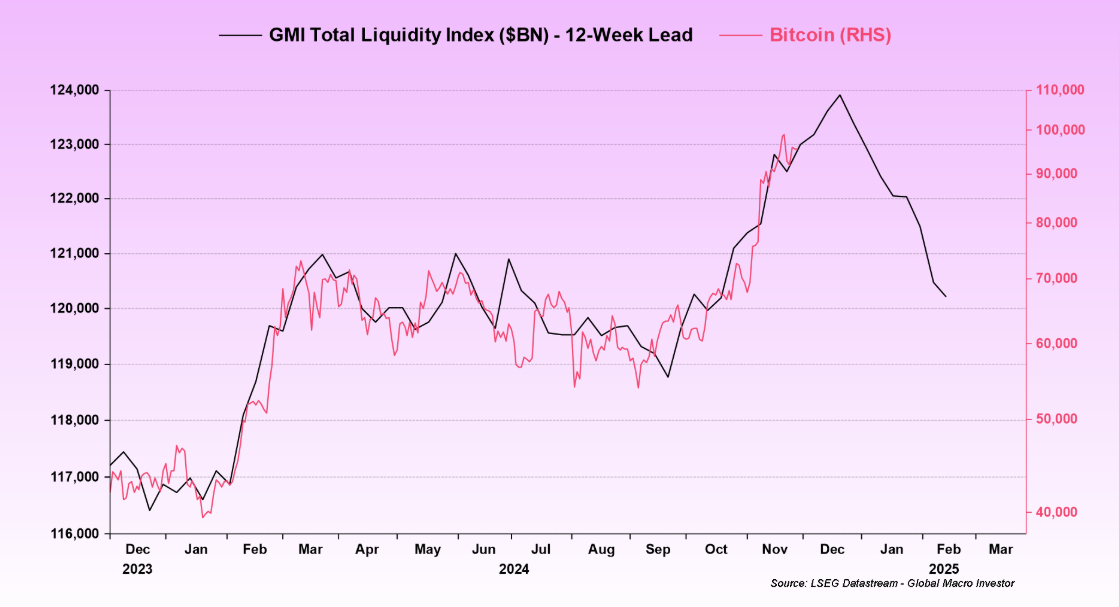

GMI Overall Liquidity Index, Bitcoin (RHS). Source: Raoul Friend

Nevertheless, Bitcoin’s right-hand side (RHS), which marks the most affordable quote cost somebody wants to offer the currency for, might still deal with a possible correction to near $70,000 up until completion of the financial obligation suspension duration on Friday, based upon its connection with the worldwide liquidity index.

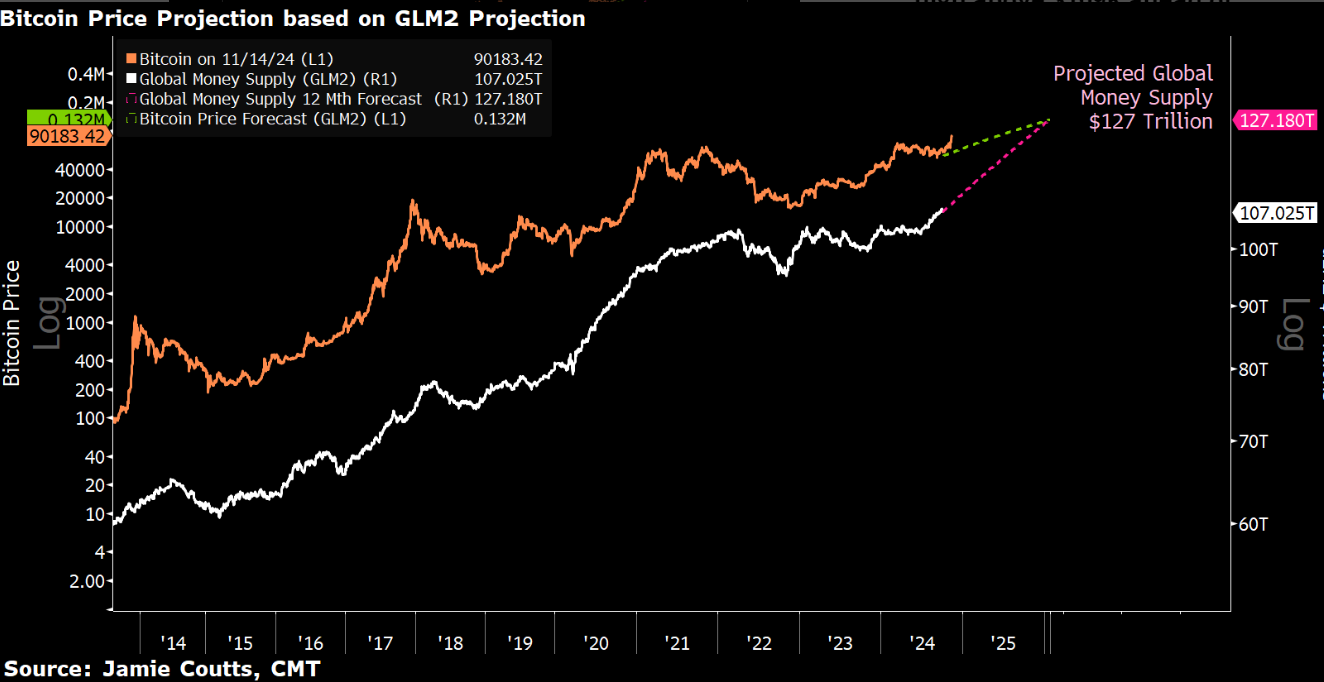

Still, the growing cash supply might press Bitcoin cost above $132,000 before completion of 2025, according to price quotes from Jamie Coutts, primary crypto expert at Genuine Vision.

BTC forecast to $132,000 on M2 cash supply development. Source: Jamie Coutts

Related: Bitcoin might gain from United States stablecoin supremacy push

Bitcoin cost still restricted by worldwide trade war issues

While more worldwide liquidity is a positive indication for Bitcoin, the world’s very first cryptocurrency stays restricted by worldwide trade tariff issues, according to James Wo, the creator and CEO of equity capital company DFG:

” While some might argue that vindictive procedures from tariff-imposed nations were currently priced in, tariffs have actually a postponed financial effect beyond their preliminary statement.”

” Greater import expenses and minimized business margins are most likely to press inflation greater, requiring reserve banks to keep rate of interest raised for longer under a limiting financial policy,” he included.

This might likewise tighten up liquidity conditions, making threat properties such as Bitcoin “less appealing in the brief to medium term,” Wo stated.

Related: Bitcoin reserve reaction signals impractical market expectations

The European Union presented vindictive tariffs on March 12, threatening a Bitcoin correction listed below $75,000 in the short-term. This might happen momentarily due to Europe accounting for over $1.5 trillion of yearly United States exports.

Regardless of the short-term correction issues, many experts stayed positive about Bitcoin’s cost trajectory for late 2025, with cost forecasts varying from $160,000 to above $180,000.

Publication: SCB pointers $500K BTC, SEC hold-ups Ether ETF alternatives, and more: Hodler’s Digest, Feb. 23– March 1