Secret takeaways:

-

ETH’s continuous agreement distortions are fading, with regular monthly futures signaling neutral conditions and decreased short-term market worry.

-

Options markets reveal well balanced need in between bullish and bearish techniques, showing a healthy derivatives market.

-

ETH surpassed most altcoins throughout the crash and the following 2 days, enhancing its relative strength and bullish momentum.

Ether (ETH) rate recovered the $4,100 level on Sunday, alleviating a few of the discomfort from Friday’s sharp 20.7% flash crash. The $3.82 billion in leveraged long liquidations left a long lasting mark on ETH derivatives markets, however 4 elements recommend that Ether’s rebound from the $3,750 assistance might have ended this short-term correction.

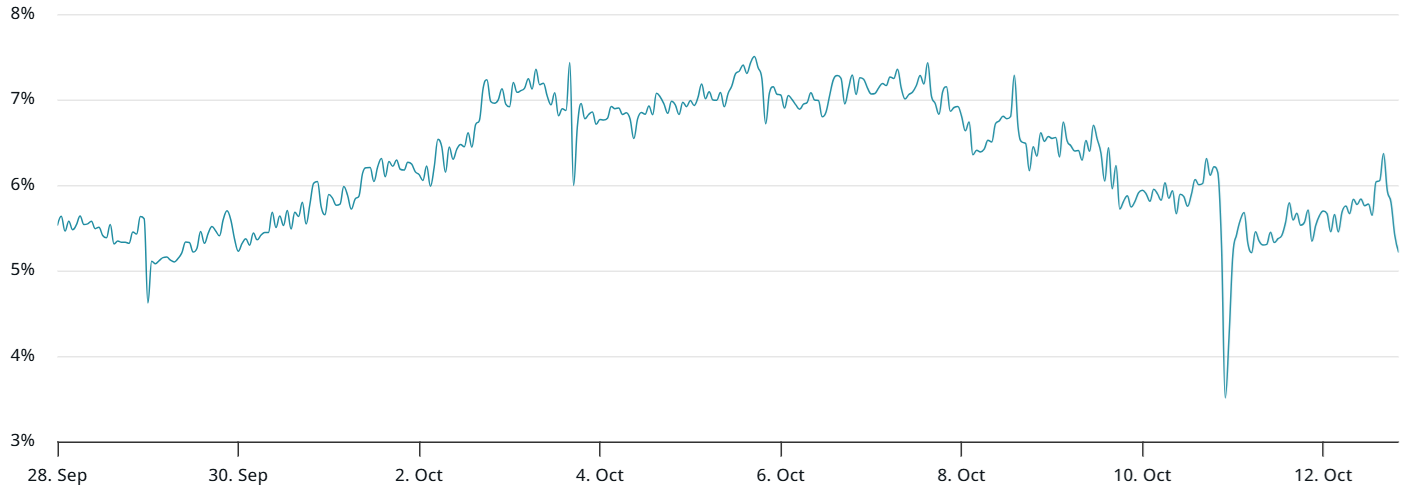

The financing rate on ETH continuous futures plunged to -14%, indicating brief (bearish) traders are paying to keep their positions open, an unsustainable condition over extended durations. This uncommon setup most likely shows growing worries that particular market makers or perhaps exchanges might be dealing with solvency problems. Whether those issues have benefit or not, traders usually show higher care up until self-confidence is completely brought back.

ETH derivatives signal go back to normalcy in spite of marketwide unpredictability

Unpredictability continues over whether exchanges will repay customers for mismanagement connected to cross-collateral margin and oracle prices. Binance has actually up until now revealed $283 million in payment and suggested that other cases stay under evaluation.

Traders are most likely to stay mindful up until a comprehensive post-mortem has actually been provided. Covered tokens and artificial stablecoins experienced the steepest parity losses, triggering traders’ margins to fall approximately 50% within minutes.

ETH regular monthly futures taken in the shock in less than 2 hours, rapidly gaining back the minimum 5% premium needed for a neutral market. For that reason, the absence of need for leveraged long positions in continuous agreements most likely shows weak item style instead of strong bearish belief.

This distortion in the derivatives market might continue up until market makers gain back self-confidence, a procedure that might take weeks or perhaps months, and must not be considered as a bearish signal for ETH’s momentum.

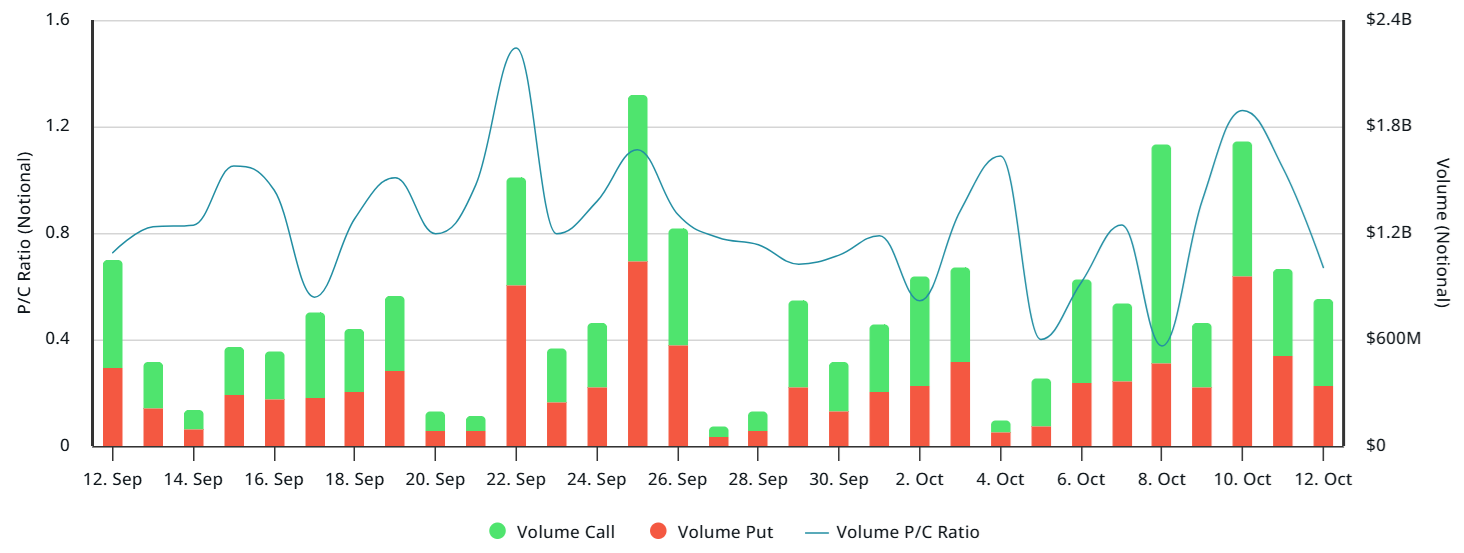

Ether choices markets on Deribit revealed no indications of tension or uncommon need for bearish techniques. Trading volumes over the weekend stayed typical, and activity in put (sell) choices was somewhat lower than in call (buy) choices, signifying a well balanced and healthy market.

This information assists alleviate issues about a collaborated cryptocurrency market crash. A sharp increase in choices volume would likely have actually taken place if traders had actually been preparing for a significant rate drop. For that reason, whatever set off the cascading liquidations and instability in ETH derivatives markets has actually captured traders completely off guard.

ETH historic efficiency, area ETFs and derivatives distance themselves from rivals

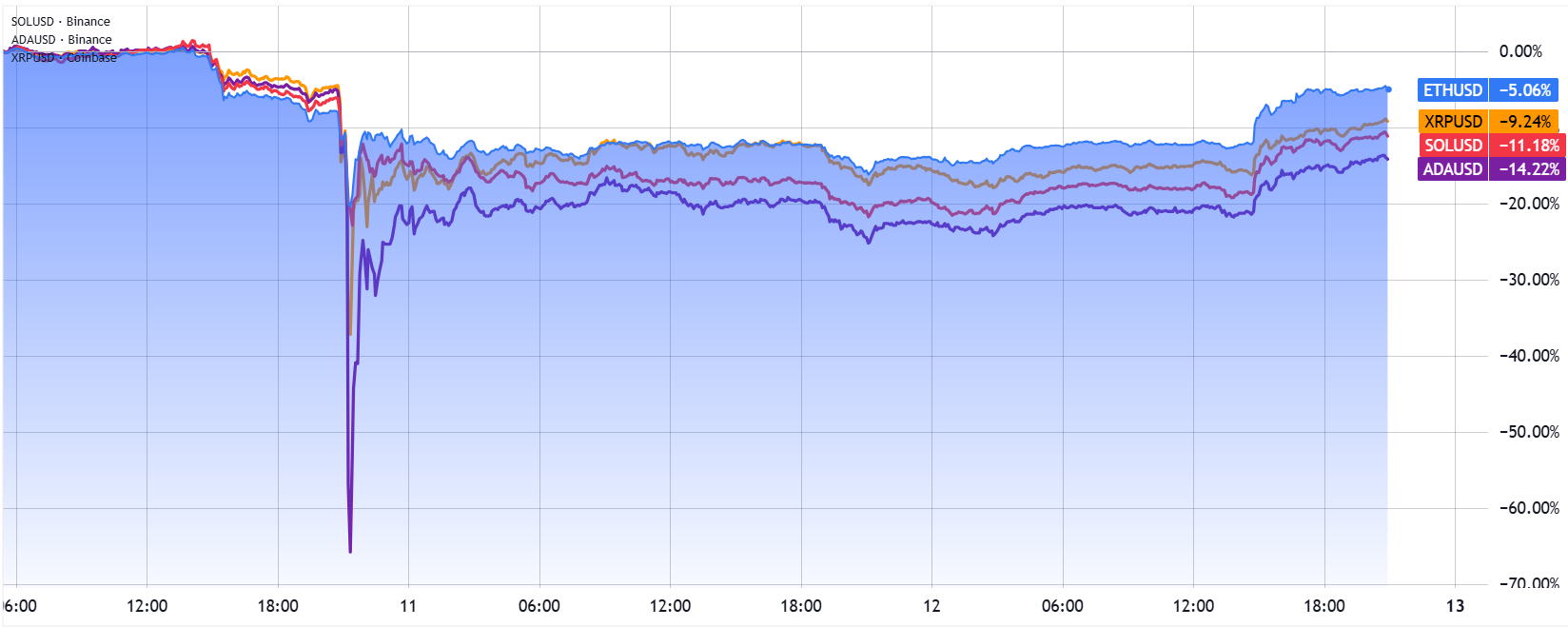

More significantly, a handful of significant altcoins knowledgeable intraday corrections far much deeper than Ether’s 20.7%, consisting of the severe cases of SUI (SUI) at 84%, Avalanche (AVAX) at 70%, and Cardano (ADA) down 66%. Ether has actually fallen 5% in the previous 2 days, while the majority of rivals stay approximately 10% listed below their pre-crash levels.

Related: Descriptions of USDe ‘depeg’ on Binance concentrate on collaborated attack, oracles

Ether’s decoupling from the more comprehensive altcoin market highlights the strength supplied by its $23.5 billion in area exchange-traded funds and $15.5 billion in open interest on choices markets. Even if Solana (SOL) and other competitors get in the area ETF race, Ether’s recognized network results and strength throughout unstable durations continue to make it the leading altcoin option for institutional capital.

Ether’s outlook stays strong as self-confidence in derivatives structures slowly returns, supporting a possible healing towards the $4,500 resistance level.

This post is for basic details functions and is not meant to be and must not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.