Secret takeaways:

-

Ether’s bullish structure stays undamaged even as the wider crypto market reveals weak point.

-

Over 540,000 ETH have actually been collected by brand-new whale wallets given that July 9.

-

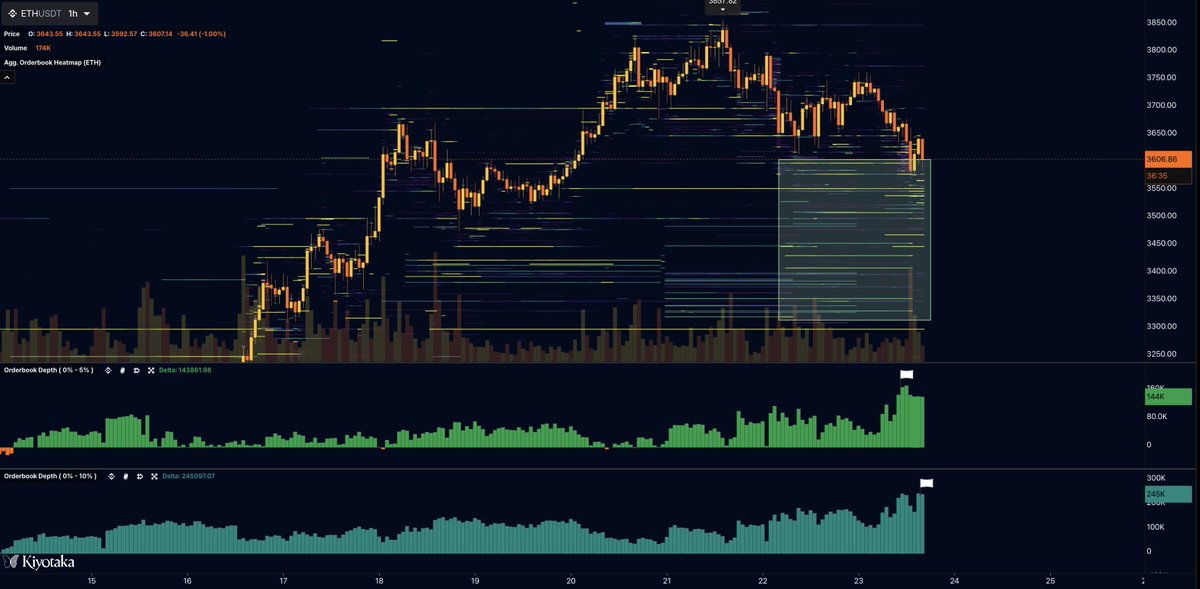

A concentration of buy orders in between $3,000 to $3,400 raises the danger of a liquidity sweep before a rally to brand-new highs.

After striking an annual high of $3,850 on Binance, Ether (ETH) has actually revealed more powerful durability than Bitcoin (BTC) throughout the current pullback. While BTC has actually slipped to brand-new variety lows at $115,000, ETH continues to trade above the $3,500 assistance level, keeping its bullish structure undamaged and possibly considering an approach $4,000.

On the four-hour chart, ETH is holding above the 50-day rapid moving average (EMA). On the one-hour chart, it stays above the 200-day EMA, signaling continued strength throughout essential lower amount of time.

A possible inverted head-and-shoulders pattern is forming on the one-hour chart. A verified breakout above $3,750, a crucial resistance and coming down trendline, might send out the cost to $4,000.

Crypto expert Byzantine General likewise sees possible for ETH to review current highs, mentioning the possession might be getting ready for “another stab at the highs.”

Nevertheless, if ETH loses the $3,500 level, the bullish setup would likely be revoked. Because case, cost might review the reasonable worth space in between $3,150 and $3,300 before a healing.

Related: Eric Trump ‘concurs’ Ether should be over $8K as Worldwide M2 cash skyrockets

Will Ether retest $3,100?

Ether (ETH) has actually displayed noteworthy strength versus wider market weak point, mostly due to aggressive whale and institutional build-up.

Considering That July 9, 8 freshly developed whale wallets have actually generated 540,460 ETH, worth almost $2 billion. 3 wallets scooped up another 74,207 ETH ($ 273 million) on Thursday, indicating strong self-confidence amongst big financiers.

MARKET UPDATE: Fresh #Ethereum wallets are on an aggressive purchasing spree, with 74,207 $ETH worth $273M being scooped up in simply the last 10 hours.

Considering That July 9, 8 such wallets have actually included 540,460 ETH ($ 1.99 B) to their holdings.

( h/t: @lookonchain)

— Cointelegraph Markets & & Research Study (@CointelegraphMT) July 25, 2025

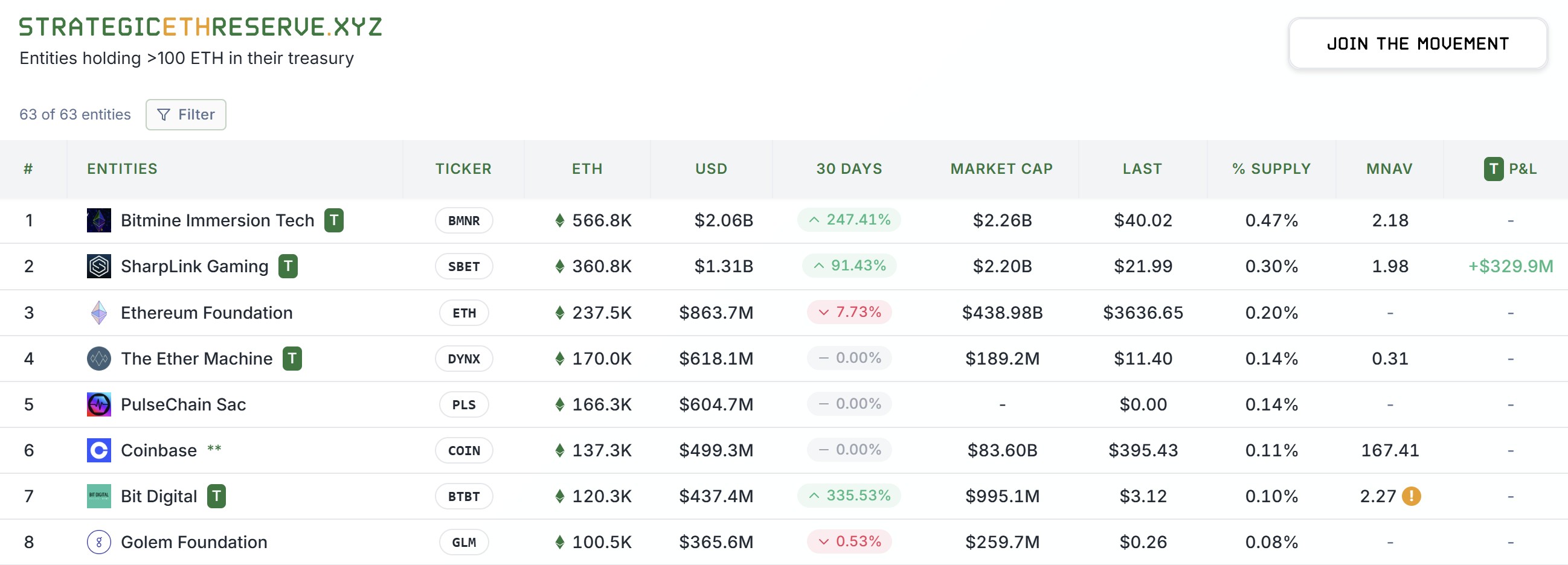

Strategic build-up of Ether has actually likewise risen in current weeks. Holdings amongst big corporations have actually almost doubled, increasing to 2.3 million from 1.2 million in 4 weeks. Tom Lee’s financial investment company, Bit Mine, which has actually obtained 266,119 ETH ($ 970 million) over the previous week, now holds 566,776 ETH, valued at $2.06 billion, making it the biggest Ether treasury amongst institutional entities.

Nevertheless, one technical signal provides a short-term issue. Information suggested that ETH presently has a record 245,000 ETH in buy orders stacked on the quote side of continuous futures books, primarily in between the $3,000 and $3,400 variety. This rise in need signals strong interest, however likewise highlights a liquidity space listed below existing levels.

With area and derivatives order books securely lined up, ETH might still sweep into this buy zone before resuming its uptrend. A short-term drop towards $3,400 and even $3,100 stays on the table.

Related: Ether will ‘knock on $4,000’ and quickly outperform Bitcoin: Novogratz

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.