Secret takeaways:

-

Ether exchange-traded funds saw $71 million in inflows, signifying strong institutional hunger.

-

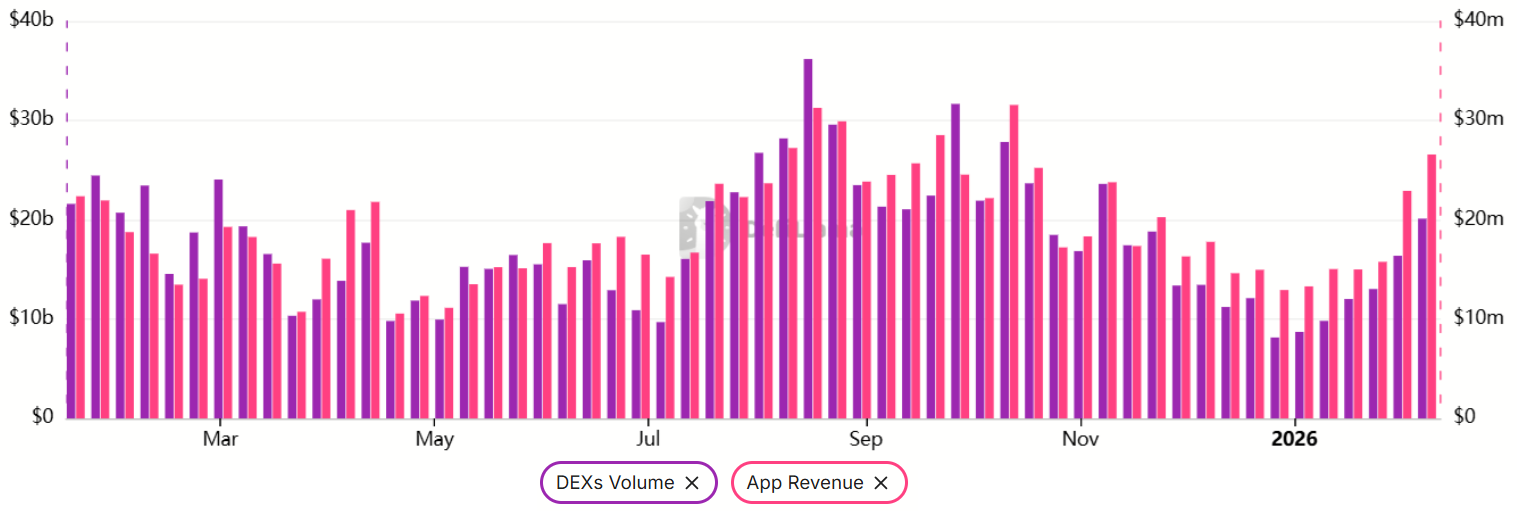

Weekly decentralized exchange volume doubled to $20 billion, narrowing the earnings space with Solana.

Ether (ETH) cost stopped working to sustain levels above $2,000 on Thursday, leaving traders to weigh the possible drivers for a market turn-around. While optimism has actually subsided considering that the crash to $1,745 on Friday, both exchange-traded fund (ETF) streams and ETH derivatives metrics are revealing early indications of a turnaround.

Traders now question if there suffices momentum for a get better towards $2,400.

US-listed Ether ETFs just recently broke a three-day streak of outflows, drawing in $71 million in fresh capital in between Monday and Tuesday. Most importantly, properties under management have actually supported at $13 billion, which suffices to preserve institutional interest. Ether ETFs presently balance over $1.65 billion in everyday trading volume, a level of liquidity that allows involvement by the world’s biggest hedge funds.

To put Ether ETFs in viewpoint, the State Street Energy Select Sector SPDR ETF (XLE United States)– the biggest in the United States energy sector– trades approximately $1.5 billion daily. That instrument tracks a combined $2 trillion market capitalization throughout business such as Exxon (XOM United States), Chevron (CVX United States), ConocoPhillips (POLICE United States), The Williams Business (WMB), and Kinder Morgan (KMI United States).

ETH metrics and ETF inflows signify possible market healing

While institutional hunger for Ether ETF trading is a favorable indication, it does not ensure that need for ETH derivatives is naturally bullish.

On Wednesday, the annualized premium (basis rate) of ETH futures stayed listed below the 5% neutral limit. This absence of need for bullish take advantage of has actually been a consistent style for the previous 3 months. Nevertheless, the indication has actually supported at 3%, even as the ETH cost struck its least expensive level in 9 months. These derivatives markets are showing moderate strength, which stays a motivating indication for Ether financiers.

Related: Denmark’s Danske Bank enables customers to purchase Bitcoin and Ether ETPs

Ether’s cost weak point has actually driven Ethereum’s Overall Worth Locked (TVL) to $54.2 billion, below $71.2 billion one month prior, according to DefiLlama information. Lowered deposits in the network’s wise agreements represent a significant threat, as lower chain costs lessen the native staking yield. Furthermore, Ethereum’s supply burn system stays depending on extreme need for blockchain processing.

Regardless of these aggravating conditions, need for Ethereum decentralized applications (DApps) has actually been slowly enhancing throughout 2026.

Weekly decentralized exchange (DEX) volumes on the Ethereum network rose to $20 billion, up from $9.8 billion one month prior. This increased activity triggered DApps earnings to reach $26.6 million in the 7 days ending Feb. 8, supplying a healthy indication of ETH need. While Solana stayed the clear leader with $31.1 million in weekly DApps earnings, the space in between the 2 networks is narrowing.

Those keeping track of Ether cost efficiency specifically stop working to see that ETH onchain metrics and derivatives have actually shown strength, particularly as inflows into Ether ETFs resumed. While it may take a number of weeks for financiers to completely gain back self-confidence, there are strong indications that a near-term rally towards $2,400 is possible.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding. While we make every effort to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage developing from your dependence on this info.