Secret takeaways:

-

ETH holds $2,400 in assistance regardless of a 15% rate drop and $277 million in liquidations.

-

Layer-2 network development and area ETH ETF inflows sustain financiers’ self-confidence in Ether.

Ether (ETH) stopped working to sustain the bullish momentum that peaked at $2,880 on Wednesday, though it likewise revealed durability near the $2,450 level. While financiers aren’t especially delighted with the existing rate, derivatives metrics indicate a growing sense of self-confidence.

On Friday, the Ether futures premium briefly turned bearish as ETH rate plunged 15% to $2,440, eliminating $277 million in leveraged long positions over 2 days. Nevertheless, by Sunday, the futures premium had actually recovered the neutral 5% limit, recommending that traders are gaining back self-confidence in the $2,400 assistance level.

Ethereum layer-2 environment rises

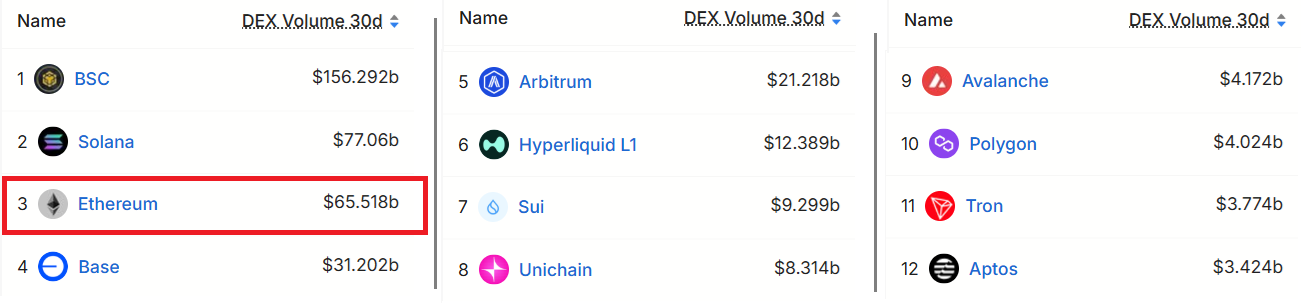

The current rise in Ethereum layer-2 scaling options most likely added to Ether’s rally in early Might. This accompanied Solana and BNB Chain surpassing Ethereum in decentralized exchange (DEX) trading volumes. Combined activity on Base, Arbitrum, Unichain, and Polygon has actually exceeded Ethereum’s $65.5 billion in month-to-month DEX volume.

Lots of Ether holders are annoyed by the constantly low costs on Ethereum’s base layer, an essential aspect behind the development in ETH supply. On the other hand, rollups have actually allowed scalable options, opening brand-new possibilities. For instance, Base’s biggest decentralized application, Morpho, supports custom-made facilities for usage cases like collateralized financing and yield generation.

On June 12, Shopify released a restricted rollout of USDC stablecoin payments on the Base blockchain. The item consists of a 1% cashback reward and is anticipated to completely release by the end of 2025. This cooperation with Coinbase highlights the low-priced, safe and secure nature of layer-2 blockchain Base.

Ether derivatives markets show durability amidst ETH rate weak point

ETH alternatives markets provide more insight into belief amongst expert traders following the drop listed below $2,500 on Tuesday. In a neutral environment, the 25% delta alter usually changes in between unfavorable 5% and +5%, showing well balanced prices in between put (sell) and call (buy) alternatives.

Presently, ETH put alternatives are trading at a 4% discount rate compared to comparable call alternatives, which keeps them within the neutral variety. This recommends that, regardless of ETH stopping working to preserve the $2,500 level, whales and market makers have not turned bearish. Part of that optimism might originate from the $830 million in net inflows to Ether US-listed area exchange-traded funds (ETFs).

Decreasing ETH balances on exchanges are usually deemed bullish, because deposits indicate a preparedness to offer, while withdrawals normally signify staking or long-lasting holding, minimizing instant supply pressure.

Since June 17, the overall Ether balance on exchanges dropped to 16.31 million ETH, below 16.71 million a month previously. This lines up with Ethereum’s overall worth locked (TVL), which increased 6% over the exact same duration to $67.2 billion, according to DefiLlama.

Related: BlackRock drives $412M Bitcoin ETF inflows amidst Israel-Iran dispute

Eventually, Ether’s trajectory is ending up being significantly affected by increasing geopolitical stress in the Middle East and the continuous trade disagreements in between the United States and its crucial financial partners.

While traders are not anticipating ETH to review $3,000 in the near term, the strength of derivatives markets recommends that the $2,400 assistance level might continue to hold.

This post is for basic details functions and is not meant to be and ought to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.