Secret takeaways:

-

ETH derivatives placing programs big traders increasing long direct exposure as belief supports in spite of continuous weak point in more comprehensive threat markets.

-

Public business holding large ETH reserves continue to trade at discount rates, signifying financiers still do not have conviction in a near-term healing.

Ether (ETH) dealt with a sharp 15% drop Wednesday to Friday, being up to $2,625, its most affordable level because July. The relocation erased $460 countless leveraged ETH bullish positions in 2 days and extended the decrease to 47% from the Aug. 24 all-time high.

Need from ETH bulls is still mainly missing in derivatives markets, although belief is gradually favoring a prospective relief bounce to $3,200.

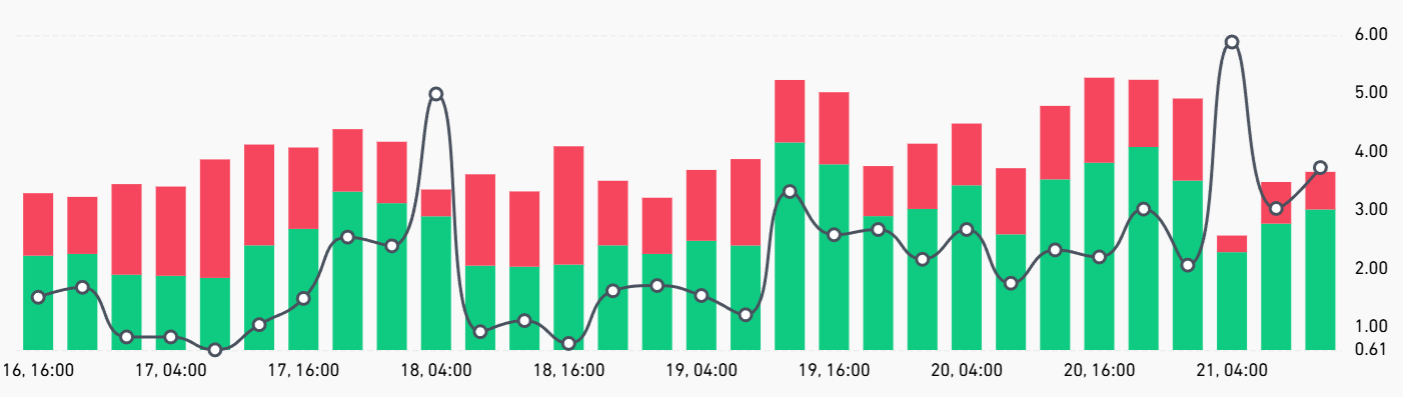

The annualized financing rate on ETH continuous futures settled near 6% on Friday, increasing from 4% the previous week. Under well balanced conditions, the sign usually varies 6% to 12% to cover the expense of capital. While still far from a bullish setup, ETH futures revealed some strength even as macroeconomic unpredictability increased.

United States customer and real estate information signal increasing financial tension

A University of Michigan study reveals that 69% of customers now anticipate joblessness to increase in the year ahead, more than two times the level from a year earlier. Joanne Hsu, the director of the customer study, supposedly stated: “Cost-of-living issues and earnings concerns control customer views of the economy throughout the nation.”

Throughout a revenues get in touch with Tuesday, Home Depot CEO Ted Decker stated the business continues “to see softer engagement in bigger discretionary tasks,” primarily due to continuous weak point in the real estate market. Decker stated that real estate turnover as a share of overall readily available supply has actually approached a 40-year low, while home costs have actually started to change, according to Yahoo Financing.

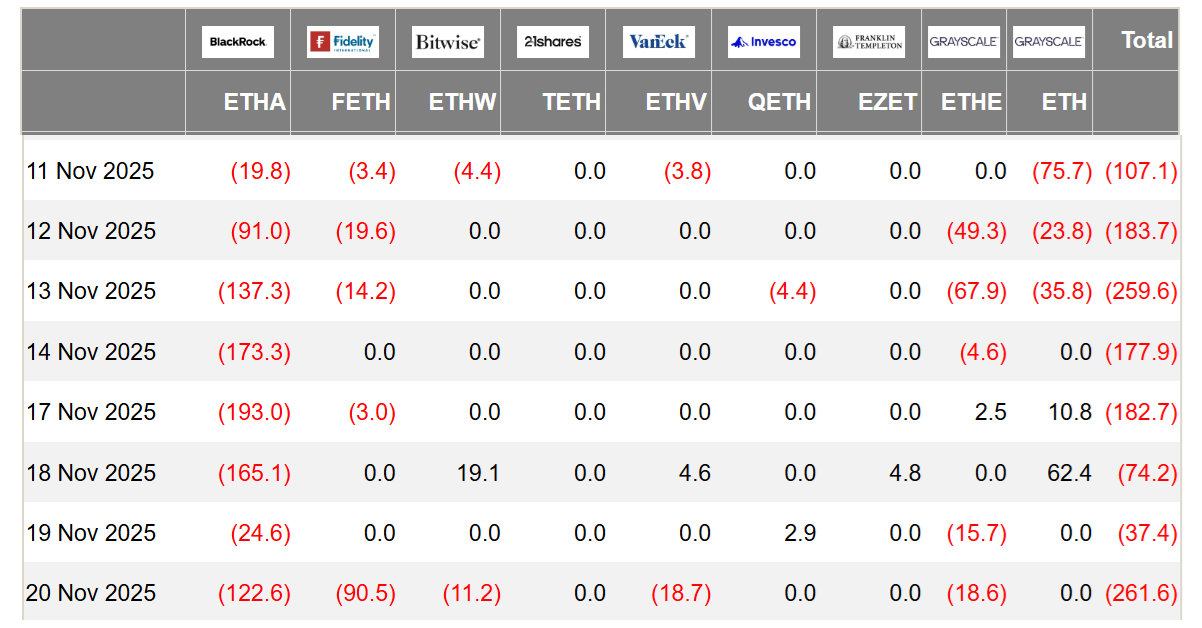

Part of Ether traders’ fading self-confidence comes from 9 straight sessions of net outflows in area Ether exchange-traded funds (ETFs). Approximately $1.33 billion has actually left those items throughout that stretch, driven in part by institutional financiers decreasing direct exposure to run the risk of properties. The United States dollar reinforced versus significant foreign currencies as issues around the expert system sector grew.

The United States Dollar Index (DXY) reached its greatest level in 6 months as financiers looked for the security of money holdings. It may appear counterproductive, provided the United States economy’s heavy ties to the tech sector, however traders are just holding reserves till there is clearer presence on work information and whether customer need will recuperate after the prolonged United States federal government shutdown.

Leading traders at OKX increased their long positions even as Ether was up to $2,700 from $3,200 on Sunday. Self-confidence is slowly enhancing following strong quarterly revenues and year-end assistance from Nvidia (NVDA United States), and after Federal Reserve Bank of New York City President John Williams stated he sees space for rates of interest cuts in the near term as the labor market deteriorates.

Related: BitMine reveals 2026 ETH staking strategies as market melts down

The cryptocurrency bearishness has actually been particularly hard for business that constructed big ETH reserves through financial obligation and equity issuance, such as BitMine Immersion (BMNR United States) and ShapeLink Video Gaming (SBET United States). Those stocks presently trade at discount rates of 16% or more relative to their ETH holdings, highlighting financiers’ absence of convenience.

From a derivatives viewpoint, whales and market makers are progressively persuaded that $2,650 marked the bottom. Still, bullish conviction most likely depend upon restored area Ether ETF inflows and clearer signals of a less limiting financial policy, indicating Ether’s prospective go back to $3,200 might take a couple of weeks.

This post is for basic info functions and is not meant to be and need to not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.