Ethereum’s native token, Ether (ETH), dropped to a year-to-date low of $1,927 on Thursday, and is presently down more than 60% from its all-time high of $4,950.

Experts stated the decrease is stress-testing holders’ conviction, and onchain and crypto exchange inflow information indicate the start of a bearish market. Regardless of the selling strength, one group of Ether holders has actually been purchasing, however whether this will assist ETH recover $2,000 is to be figured out.

Secret takeaways:

-

Mid-sized holders (100– 10,000 ETH) decreased their holdings, indicating a capitulation stage.

-

Big holders (10,000-plus ETH) have actually increased direct exposure throughout the last quarter, soaking up sell pressure for the altcoin.

-

ETH is trading listed below the understood rate for all financier accomplices, and the increasing exchange inflows keep disadvantage threat raised.

Onchain information programs who’s holding, including and capitulating

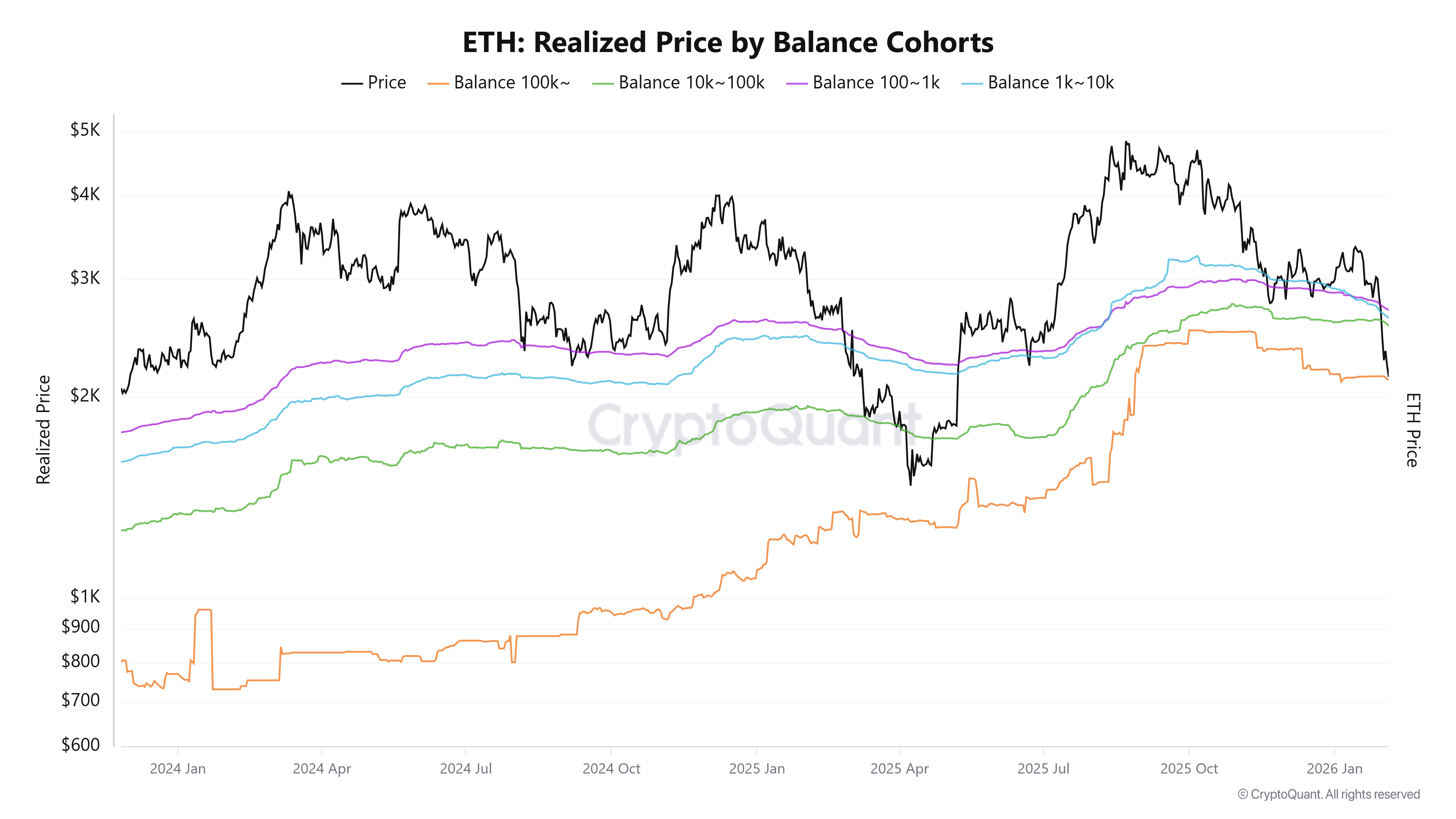

Over the previous 5 months, the Ether balance-by-holder-value information reveals a clear modification in habits throughout various wallet sizes.

The metric clarifies which financiers are soaking up disadvantage pressure and which are leaving as costs go back to Might 2025 levels.

Information from CryptoQuant kept in mind that on August 18, 2025, wallets holding 100– 1,000 ETH managed 9.79 million ETH, 1,000– 10,000 held 14.51 million ETH, 10,000– 100,000 held 17.18 million ETH, and 100,000-plus wallets held 2.75 million ETH.

On Wednesday, the balances of the 100– 1,000 and 1,000– 10,000 accomplices was up to 8.32 million ETH and 12.26 million ETH, respectively.

On the other hand, 10,000– 100,000 wallets increased holdings to 19.77 million ETH, while 100,000-plus wallets broadened to 3.68 million ETH.

The information indicated build-up by whales and big entities, while smaller sized and mid-sized holders seem dispersing into the existing rate weak point.

Ether is likewise trading listed below the understood rate of every associate, which shows the typical expense basis at which each group last moved its ETH. Recognized costs cluster in between $2,120 for 100,000-plus holders and $2,690 for 100– 1,000 holders, with ETH briefly closing listed below the aggregate understood rate of $2,630 on Saturday, a level related to stress-driven selling.

Related: Ethereum rate: Timeless chart pattern puts sub-$ 2K ETH in focus

Exchange inflows and taker information keep pressure on ETH’s rate

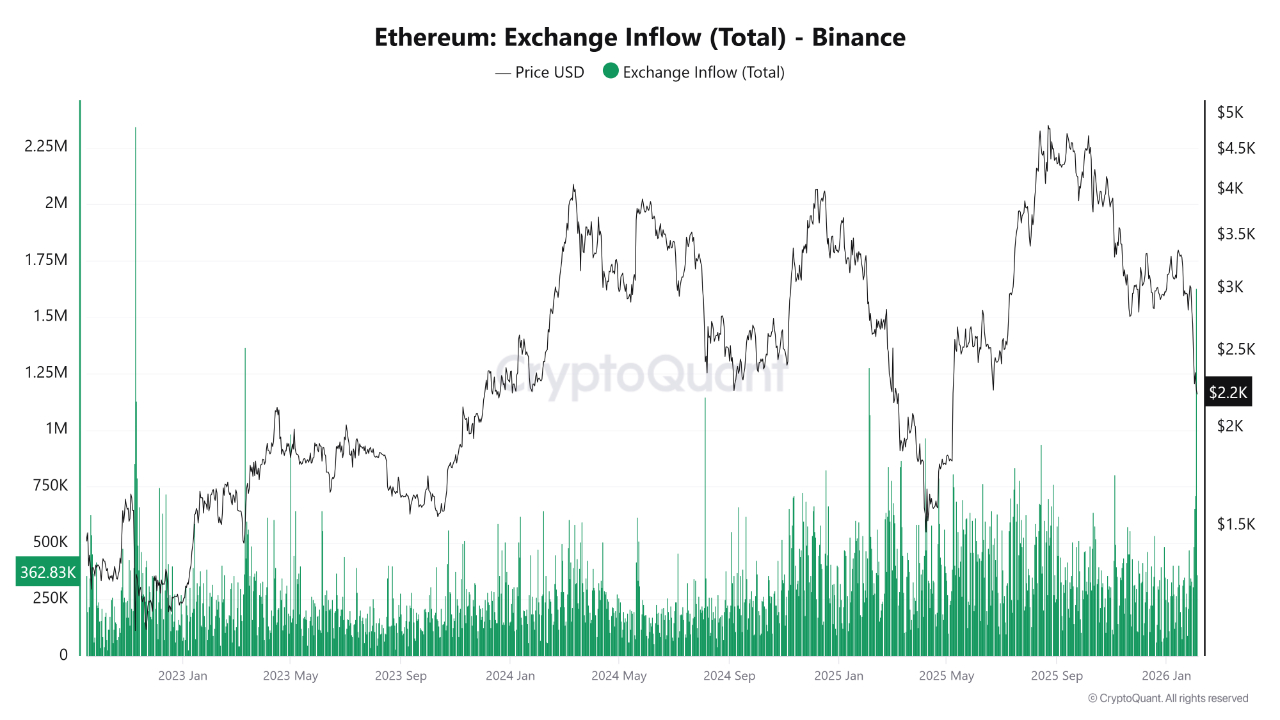

Ether exchange inflows on Binance rose to about 1.63 million ETH on Wednesday, the greatest day-to-day reading given that 2022. Big inflows might show preparation to offer or rebalance, and an inflows surge throughout a weak rate action stage enhances the issue.

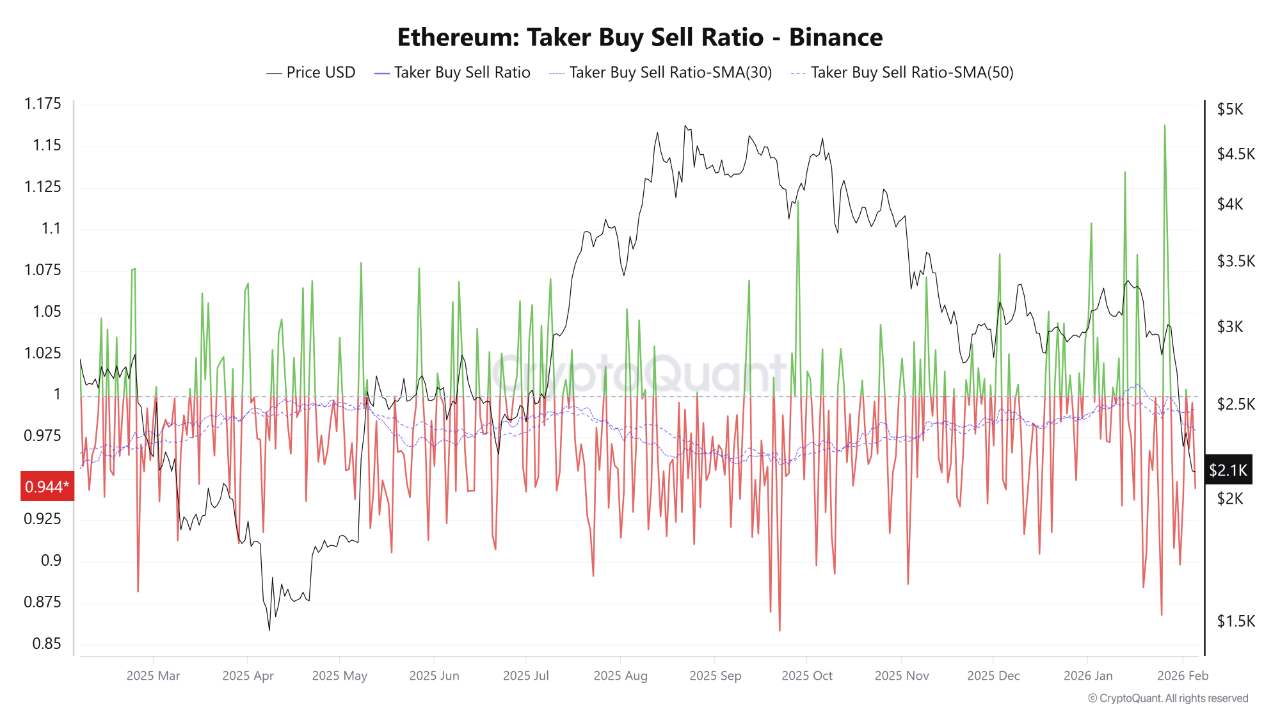

Market execution information contributes to that image. Crypto expert PelinayPA kept in mind that Ether’s Binance taker buy/sell ratio sits “around 0.94,” listed below the neutral level of 1. Both the 30 and 50-day averages stay under 1, recommending selling pressure is the dominant pattern instead of a momentary stage.

PelinayPA included that this might likewise mark the start of a “real bear season” for the altcoin, anticipating tough rate conditions to continue for a while longer.”

Related: Vitalik Buterin offers $6.6 M in ETH after flagging organized withdrawals

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we make every effort to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might consist of positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this info.