Secret takeaway:

-

ETH deals with offering pressure as $480 million in liquidations and falling network charges effect financier self-confidence.

-

ETH’s unfavorable financing rate might contribute in a possible rebound rally.

Ether (ETH) cost dealt with a three-day 13.8% correction, retesting the $2,900 assistance on Wednesday for the very first time in 4 weeks. The motion followed a sharp decrease throughout the cryptocurrency market as traders turned risk-averse amidst an intensifying socio-economic environment.

ETH recovered the $3,000 level after United States President Donald Trump cancelled import tariff walkings on different European Union nations. Nevertheless, traders fear more disadvantage after $480 million in bullish leveraged positions were liquidated in 2 days.

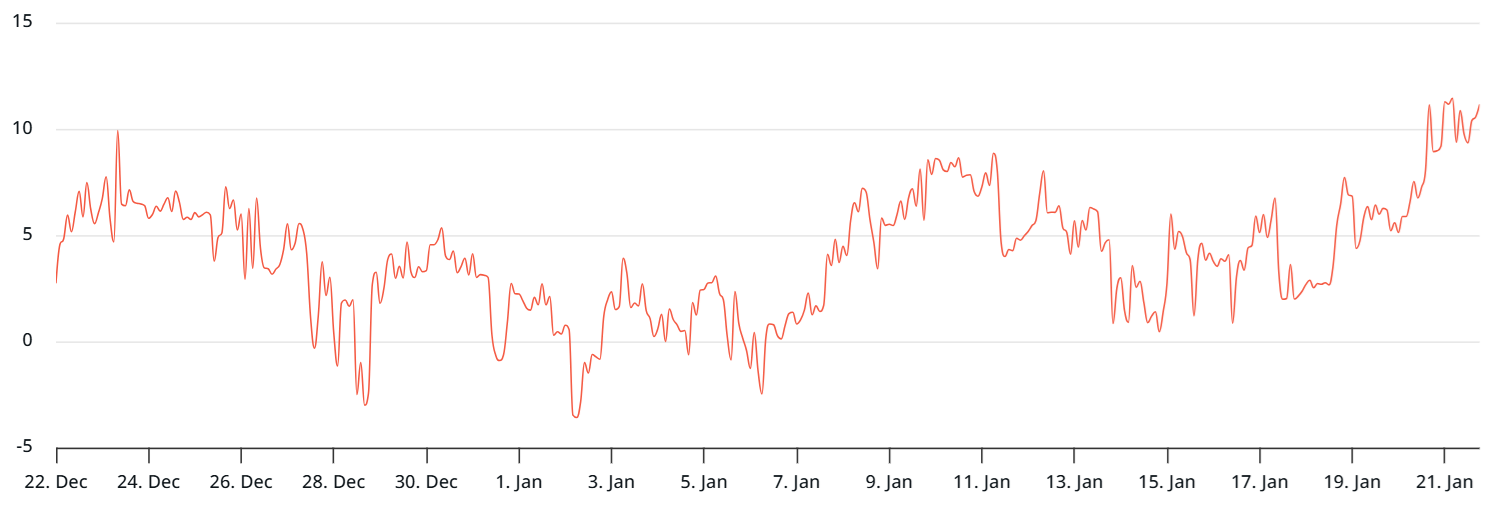

The financing rate on ETH continuous futures briefly turned unfavorable on Wednesday, implying shorts (sellers) needed to pay to keep their positions open. Under neutral situations, this indication must vary in between 6% and 12%, with longs (purchasers) spending for take advantage of. Still, an uncertainty is not always an indication of bearishness.

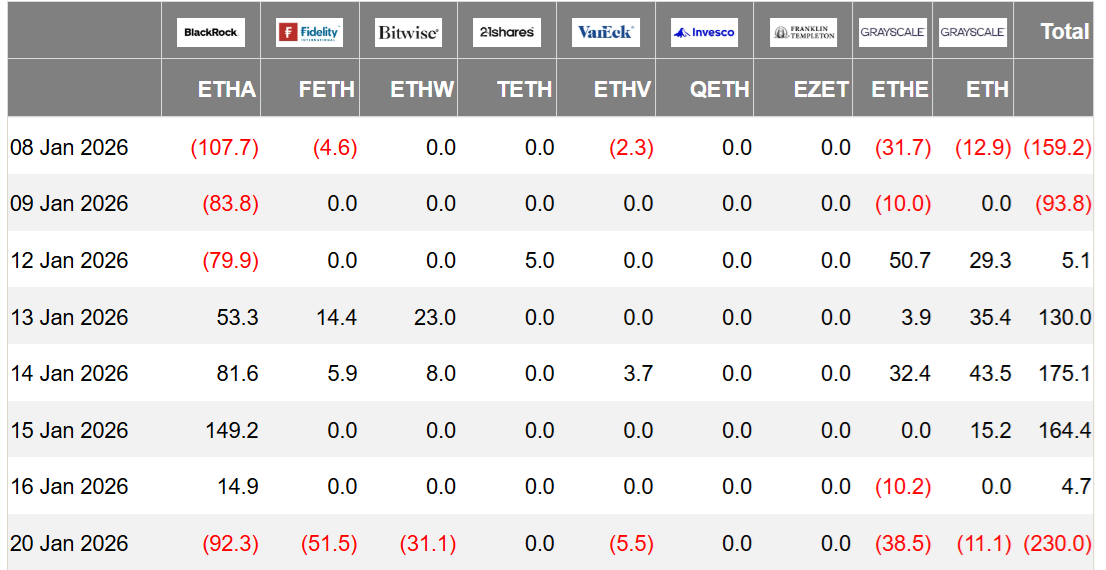

Traders fear that institutional interest in Ethereum has actually faded following current outflows from Ether area exchange-traded funds (ETFs). These financial investment instruments presently hold over $17 billion worth of ETH, representing a substantial market overhang.

The US-listed Ether ETFs saw $230 million in net outflows on Friday, reversing the previous week’s pattern of $96 million in typical net inflows. More concerningly, business that concentrated on building up ETH as a reserve method face heavy accounting losses, consisting of Bitmine Immersion (BMNR United States) and Sharplink (SBET United States).

ETH traders pay more for disadvantage cost security: Are bears in charge?

To verify if expert traders have actually turned bearish, one need to evaluate the need for ETH alternatives. When whales and market makers fear more disadvantage, the alter metric relocations above 8% as put (sell) alternatives trade at a premium relative to comparable call (buy) instruments. On the other hand, bullish markets are typically followed by an alter indication listed below -8%.

According to the ETH alternatives alter, traders are presently requiring an 11% premium to hold disadvantage direct exposure, the greatest level in 7 weeks. Far from being a sign of bearish bets, the indication shows traders’ pain following several ETH cost rejections at $3,400 over the previous 10 weeks amidst decreasing Ethereum network onchain metrics.

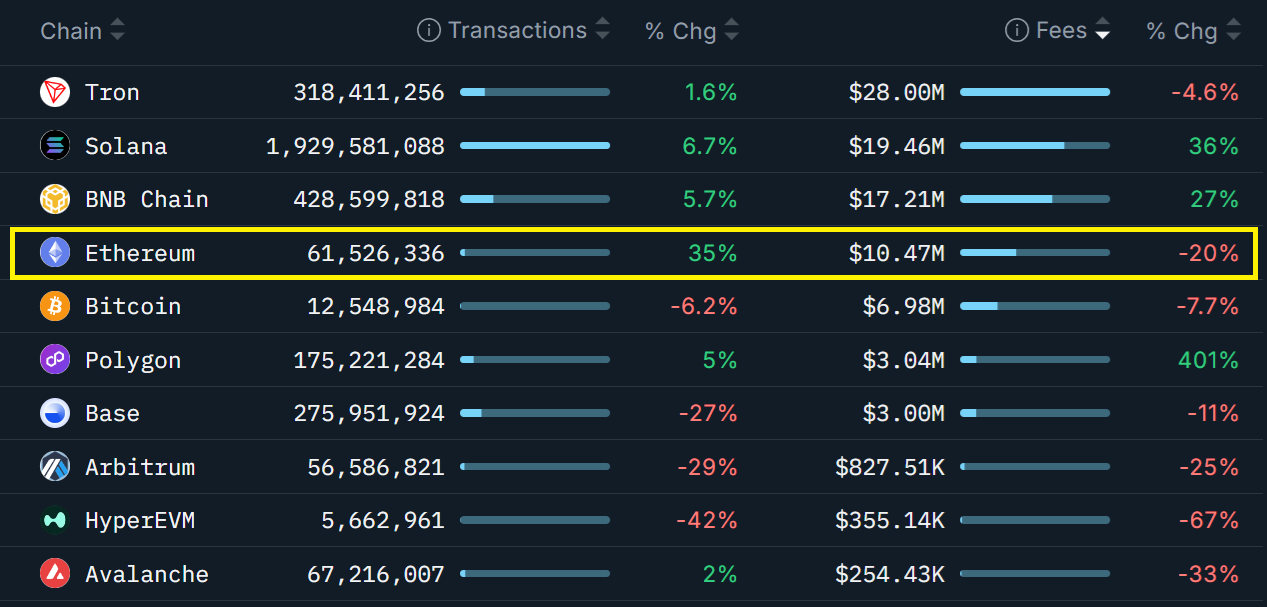

Ethereum network charges decreased 20% from their standard over the previous week, according to Nansen. On the other hand, rival Solana experienced 36% greater charges, and BNB Chain collected 27% greater charges. More significantly, Solana’s management in deal volume stays undeniable, as the amount of the Ethereum base layer and scaling options stood listed below 570 million over 7 days.

Related: ETH whales purchased the dip, however will accumulators avoid a drop to $2.7 K?

Ether’s course to recover $3,400 depends greatly on financial exposure, that includes the returns on the expert system facilities and the resolution of financial and geopolitical dispute.

Offered the absence of need for leveraged bullish ETH positions and increased competitors in decentralized applications information processing, the chances of a sustainable Ether cost rally in the near term stay slim.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we make every effort to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might include positive declarations that go through threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage emerging from your dependence on this info.