Secret takeaways:

-

ETH derivatives flash care as professional traders stay neutral-to-bearish, and weak DApps need and falling charges pressure Ether’s cost.

-

Business ETH purchasing and area ETF inflows have actually not brought back financier self-confidence, as lower staking yields and soft network activity continue.

Ether (ETH) cost experienced a two-day 4% correction after briefly reaching $3,400 on Wednesday. The relocation captured bulls by surprise, activating $65 million in liquidations of leveraged long ETH futures. More significantly, expert traders have actually preserved a neutral-to-bearish position, according to derivatives markets, in spite of ETH reaching its greatest level in 2 months.

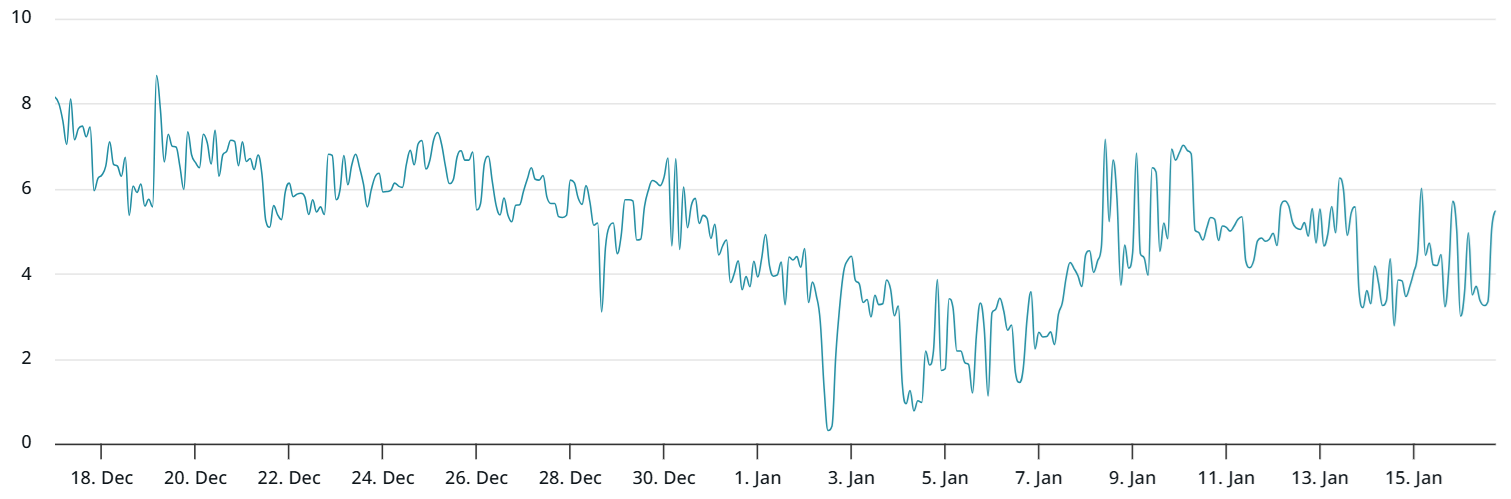

ETH regular monthly futures traded at a 4% annualized premium (basis rate) relative to find markets on Friday. Levels listed below 5% are considered bearish, as sellers normally require a premium to make up for the longer settlement duration. This uncertainty can be partly described by a sharp sag in the wider cryptocurrency market, while gold and the S&P 500 index leapt to all-time highs in 2026.

Ether’s drop to $3,280 carefully matches the 28% decrease in overall cryptocurrency market capitalization because Oct. 6, 2025. Lower interest in decentralized applications (DApps) has actually weighed on rates, specifically after need for memecoin launches and trading activity faded. New entrants are vital to promote blockchain activity, charges and need for native tokens.

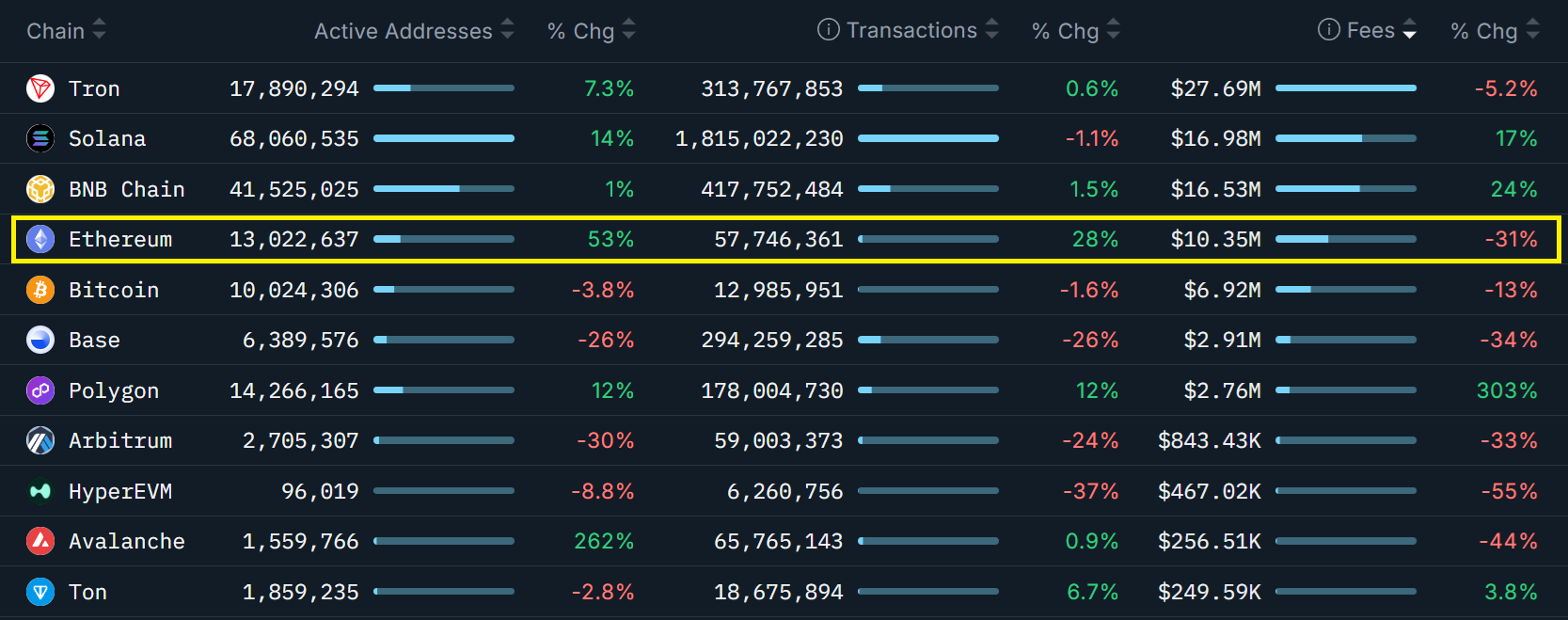

Ethereum base layer deals grew by 28% over thirty days, however network charges fell by 31% versus the standardized average. By contrast, deals on rivals Solana and BNB Chain stayed reasonably steady, while charges leapt by 20% usually. More worrying, Ethereum’s biggest scaling service, Base, saw a 26% decrease in deals over the exact same duration.

ETH momentum weak amidst low charges, DApps need, and staking threats

Whales and market makers are extremely conscious general network use, as Ethereum has an integrated system that burns ETH throughout durations of extreme need for blockchain information processing. Lower network activity lowers ETH staking returns, leaving financiers less incentivized to hold positions. Presently, 30% of the overall ETH supply stays secured staking.

Despite whether Ether’s absence of bullish momentum just shows weaker DApps need, traders are not likely to restore self-confidence while institutional circulations stay neutral. Ethereum area exchange-traded funds (ETFs) in the United States taped a modest net inflow of $123 million because Jan. 7, while openly noted business that bought ETH stay mainly undersea.

Bitmine Immersion (BMNR United States) market capitalization stood 13% listed below the $13.7 billion worth of ETH kept in its business reserves. Likewise, Sharplink (SBET United States) holds $2.84 billion worth of ETH, while the business’s market capitalization amounted to $2.05 billion. Even as these business continue to get ETH at present levels, financier self-confidence in the cryptocurrency continues to deteriorate.

ETH put (sell) choices traded at a 6% premium relative to call (buy) instruments on Friday, a level thought about the limit of a neutral-to-bearish market. Ether expert traders appear less comfy holding disadvantage cost direct exposure, signaling low expectations for a bullish breakout to $4,100 in the near term.

Related: Crypto belief drops amidst worry over United States market structure costs

The decrease in network charges even more lowers the possibility of a continual bullish momentum. Eventually, ETH cost appears greatly based on external elements instead of advancements within the Ethereum environment itself. Expert traders’ suspicion shows weak need for DApps and issues over possible outflows from the ETH native staking program.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we aim to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might include positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage developing from your dependence on this info.