Secret takeaways:

-

Ethereum’s base layer activity has actually cooled, with costs and TVL dropping, revealing slower need regardless of the current rate healing.

-

Layer-2 networks are proliferating, assisting to support Ethereum even as base layer use damages and traders stay mindful.

Ether (ETH) rallied to a three-week high near $3,400 on Tuesday after weak United States task market information strengthened expectations that United States financial policy might end up being less limiting earlier than formerly believed.

Even with the 11.2% weekly gains, traders still stress that slow Ethereum network activity and restricted need for bullish utilize might suppress the short-term advantage.

Nansen information reveals that Ethereum’s 30-day network costs stopped by 62%, a far much deeper pullback than the approximately 22% decrease observed on Tron, Solana and HyperEVM throughout the exact same window.

Some activity, nevertheless, stuck out: deals on Base increased 108%, while Polygon taped an 81% boost, recommending ongoing momentum throughout Ethereum’s broadening layer-2 community.

The Ethereum Fusaka upgrade on Dec. 3 presented modifications developed to enhance rollup effectiveness, which might have added to the lower network costs kept in mind throughout the month.

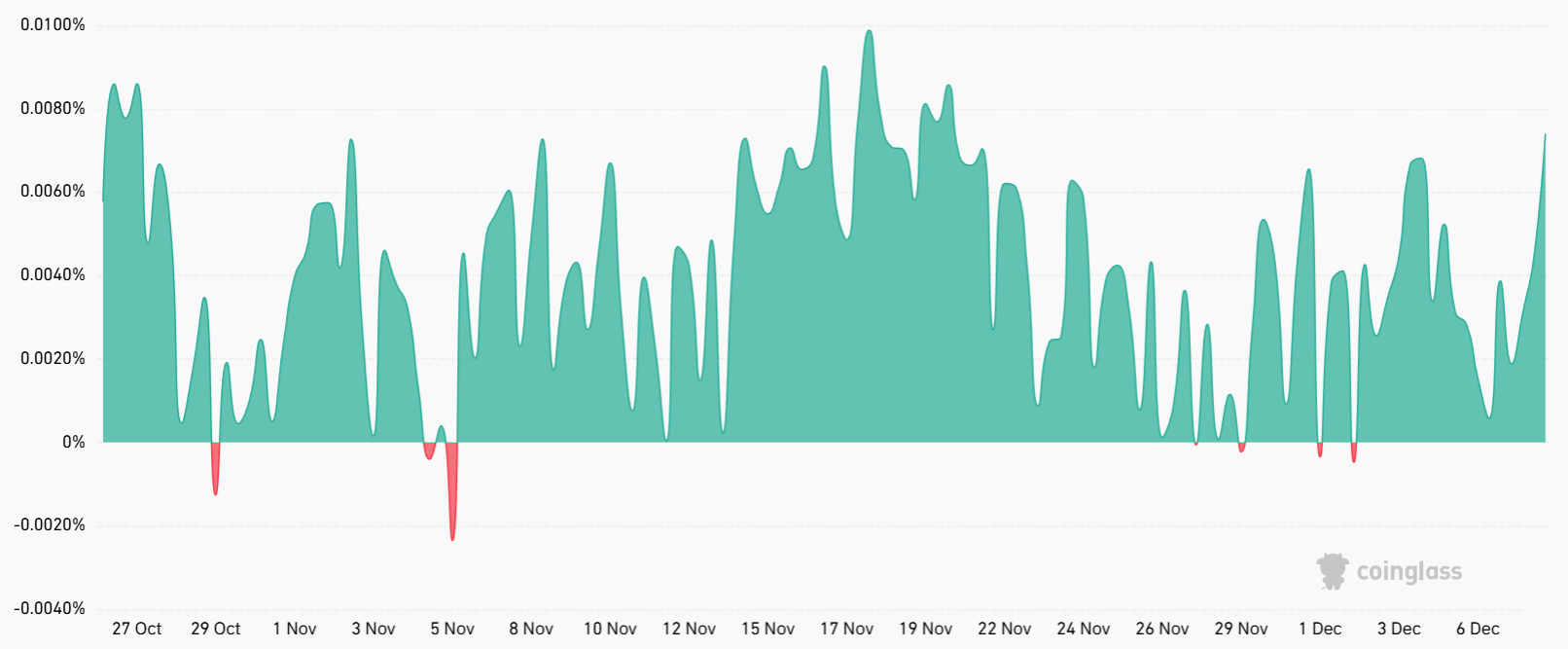

On Tuesday, the annualized financing rate for ETH continuous futures held near 9%, showing a relatively even circulation of leveraged positions in between purchasers (longs) and sellers (shorts). Under typical market conditions, this indication tends to oscillate in between 6% and 12% to represent capital expenses; levels above that variety generally signify more powerful bullish positioning.

Traders turned more protective after the United States Bureau of Labor Stats reported 1.85 million layoffs in October, the greatest figure considering that 2023. Markets are now pricing in a 0.25% rates of interest cut by the United States Federal Reserve on Wednesday, while attention shifts to Fed Chair Jerome Powell’s remarks following the Committee conference.

Ethereum’s layer-2 development offsets base layer cost decreases

Regardless of the current bullish momentum, Ether still trades 32% listed below its all-time high of $4,597 from August. To evaluate whether need for the Ethereum network is truly decreasing, it works to take a look at the influence on decentralized applications (DApps).

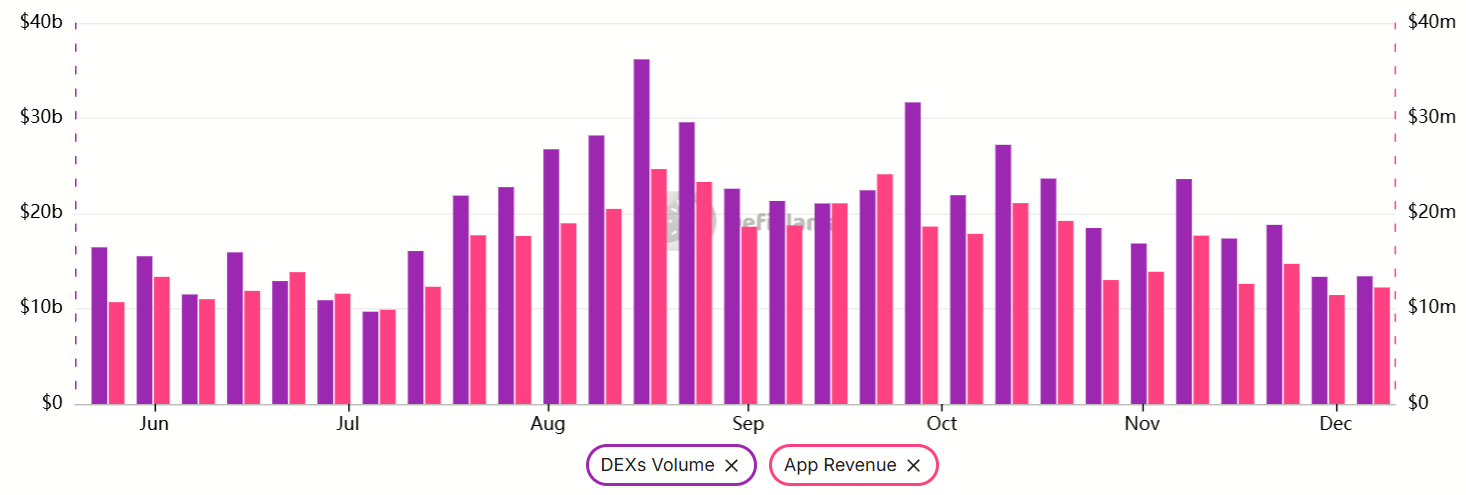

Volumes on Ethereum-based decentralized exchanges was up to $13.4 billion over 7 days, below $23.6 billion 4 weeks previously. Also, decentralized application incomes reached a five-month low of $12.3 million throughout the exact same duration. In general, need for Ethereum’s base layer processing has actually been slipping considering that it peaked in late August.

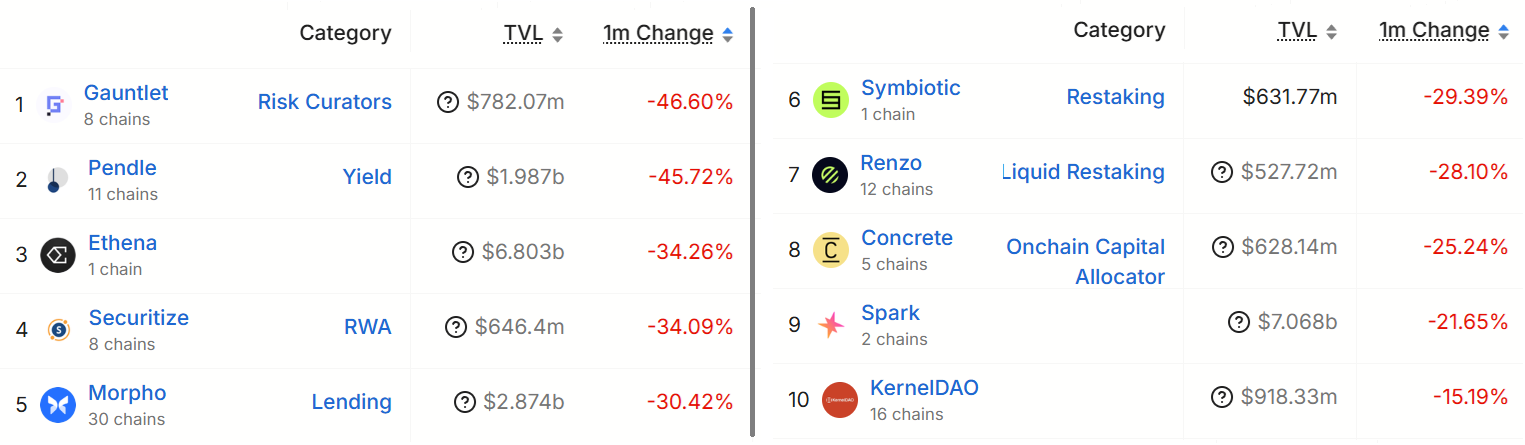

A few of Ethereum’s leading DApps saw a sharp drop in overall worth locked (TVL), consisting of Pendle, Athena, Morpho and Glow. Aggregate TVL on the Ethereum base layer was up to $76 billion from $100 billion 2 months previously. Nevertheless, Ethereum’s supremacy stays undamaged with a 68% market share, while runner-up Solana holds under 10%.

Ether bulls argue that the network’s strong rewards for layer-2 scalability provide a more sustainable design compared to the much heavier load and centralized coordination needed by completing blockchains. Ethereum is placed to record a considerable share of future development in decentralized financing (DeFi).

Related: United States Treasurys lead tokenization wave as CoinShares forecasts 2026 development

United States Securities and Exchange Commission Paul Atkins supposedly stated in a FOX Company interview that tokenization of the United States market might happen in “a number of years,” including that blockchain uses “substantial advantages” such as predictability and openness. Atkins stated the United States must “welcome this brand-new innovation, bring it onshore where it can work under American guidelines.”

While Ethereum’s base layer costs have actually seen a sharp decrease, together with the drop in TVL, activity throughout the layer-2 community continues to broaden. Presently, neither onchain nor derivatives information suggest a significant weak point in ETH rate characteristics.

This post is for basic details functions and is not planned to be and ought to not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding. While we make every effort to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this details.