Secret takeaways:

-

ETH’s cost gains are driven by an uptick in network activity and robust area ETF inflows.

-

Information recommends $2,800 will stay a tough obstacle for ETH to get rid of.

Ether (ETH) has actually traded within a reasonably narrow variety in between $2,370 and $2,770 because May 10, yet a number of indications recommend possible for upward motion. Ethereum continues to lead the blockchain area in both deposits and activity when its layer-2 scaling services are consisted of in the analysis.

In spite of Ether’s failure to recover its all-time high throughout the 2024– 25 cycle, none of the so-called Ethereum killers have actually come close to matching its $66.6 billion in overall worth locked (TVL). Ethereum presently holds a dominant 61% share of the marketplace, while the 2 biggest rivals together represent just 14%.

The TVL of Ethereum’s base layer grew 6% over the previous one month, led by gains from Pendle, Ethena, and Glow. On the other hand, BNB Chain saw a 6% decrease, and Solana’s deposits came by 2%. More significantly, the rise in deposits throughout completing blockchains throughout the memecoin craze previously in 2025 has actually shown to be unsustainable.

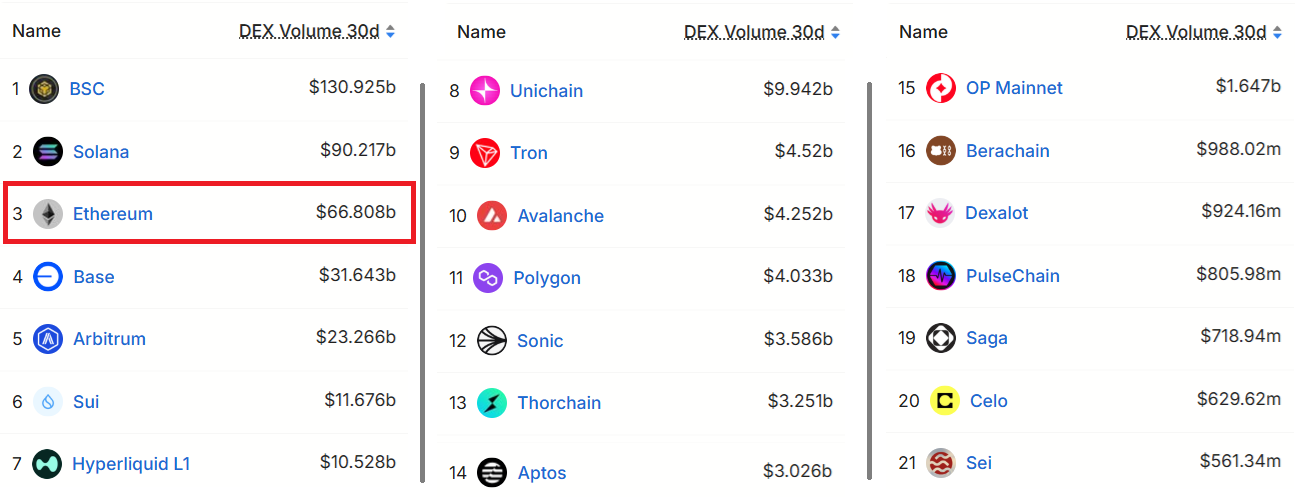

Ethereum did lose ground in decentralized exchange (DEX) volumes due to high base layer costs, which stay a barrier for the majority of users. Nevertheless, its layer-2 services jointly tape-recorded a remarkable $70 billion in DEX activity over one month, preserving Ethereum’s lead throughout the environment. Noteworthy factors consist of Base, Arbitrum, Unichain, and Polygon.

Remarkably, some networks that when intended to challenge Ethereum’s supremacy with base-layer scalability are now missing from the leading 6 in DEX activity. For instance, Tron supposedly published simply $4.5 billion in 30-day volume, while Avalanche tape-recorded $4.2 billion. By contrast, Ethereum and its scaling services amounted to $136.8 billion.

Critics of Ether have actually raised issues about Ethereum’s sustainability, indicating its modest $43.3 million in chain costs over one month. Current network updates have actually focused on advantages for rollups, presenting big, inexpensive short-lived information packages referred to as blobs. As an outcome, returns for stakers have actually been adversely affected, because ETH’s supply decrease mainly depends upon network costs.

Beyond its onchain supremacy, Ether stays the only altcoin with authorized area exchange-traded funds (ETFs) in the United States. This benefit has actually assisted strengthen a $10 billion market, while rivals like Solana and XRP still wait for choices from the United States Securities and Exchange Commission. Experts anticipate a last judgment by mid-October.

Given That Might 16, the area ETH ETFs have actually not tape-recorded a single day of net outflows, accumulating $837 million in net inflows throughout the duration. While this purchasing pressure might appear modest compared to the $4 billion in typical everyday ETH volume on significant exchanges, it indicates growing institutional interest.

Related: Everybody enjoys crypto ETFs, however not after checking out the small print

Ether’s short-term supply, as determined by exchange deposits, has actually been up to a record low near 16.33 million ETH. All at once, 28.3% of the overall Ether supply is now secured staking, a dynamic that supports favorable cost relocations when need boosts.

The sharp 48% ETH rally in between Might 7 and Might 14 highlights the imbalance in between holders and possible purchasers. Thinking about Ethereum’s onchain metrics and increasing area ETF need, a breakout above $2,800 in the near term promises.

This short article is for basic details functions and is not meant to be and need to not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.