Bottom line:

-

Bitwise experts stated brand-new United States crypto laws prefer Ether, increasing its function in tokenization and stablecoins.

-

Organizations stack into ETH, with staking ETFs anticipated to include $20 billion-30 billion annual.

Ether (ETH) was recently’s leading entertainer, as Bitwise experts called it a “watershed minute” driven by brand-new United States crypto laws and a market rotation. The ETH/BTC ratio rose 27%, triggering a 6% decrease in Bitcoin supremacy and signifying a capital shift towards altcoins.

In a weekly market upgrade, Bitwise expert André Dragosch and Ayush Tripathi stated ETH’s rally confirms the company’s thesis on the reducing assessment space in between ETH and BTC. Ether’s increase was helped by macroeconomic tailwinds, consisting of the Senate’s bipartisan approval of the Genius Act and Home passage of the Clearness Act, both signed into law recently. These steps clarified regulative oversight and set the phase for more comprehensive institutional adoption.

According to Bitwise, the Ethereum network is distinctively placed to benefit, hosting 50% of the stablecoin market cap, crossing $140 billion on Tuesday, and 55% of tokenized property worth. Legal clearness is anticipated to open additional capital development and item development throughout Ethereum-native communities.

MARKET UPDATE: #Stablecoin supply on #Ethereum reaches brand-new all-time high, crossing $140 billion on July 22. The overall supply on the network has actually almost doubled because early 2024 lows.

( h/t: @tokenterminal) pic.twitter.com/nW0ohlsDID

— Cointelegraph Markets & & Research Study (@CointelegraphMT) July 22, 2025

Acquired markets likewise signified strong need, with open interest throughout leading exchanges leaping by $6 billion, while CME futures struck record highs. On the other hand, Ether exchange-traded items (ETPs) taped $2.1 billion in inflows, and Ether treasury holdings rose after The Ether Maker and Dynamix Corp SPAC offer included 400,000 ETH.

Regardless of modest volatility issues, the experts kept in mind ETH’s principles stay undamaged. The decrease in the SOL/ETH ratio recommends that organizations prefer Ethereum as the base layer for tokenization and TradFi combination.

Related: Ethereum whale webs $9.87 M revenue as ETH snaps 8-day winning streak

Could Ether make headway as a Shop of Worth?

Onchain analysis platform iCrypto stated that Ether might slowly end up being a Shop of Worth comparable to Bitcoin (BTC), due to the current increase of institutional capital, staking yield and the upcoming staking exchange-traded funds (ETFs). The platform highlighted how organizations have actually doubled down on ETH as a tactical treasury property.

Bit Digital offered all its Bitcoin holdings and designated $172 million to acquire over 100,000 ETH, making it among the biggest institutional ETH holders. BTCS Inc. increased its ETH position to 29,122 ETH after a 221% boost because late 2024. BitMine Immersion Technologies doubled its holdings to 163,000 ETH, while SharpLink now holds over 360,807 ETH, 2nd just to the Ethereum Structure.

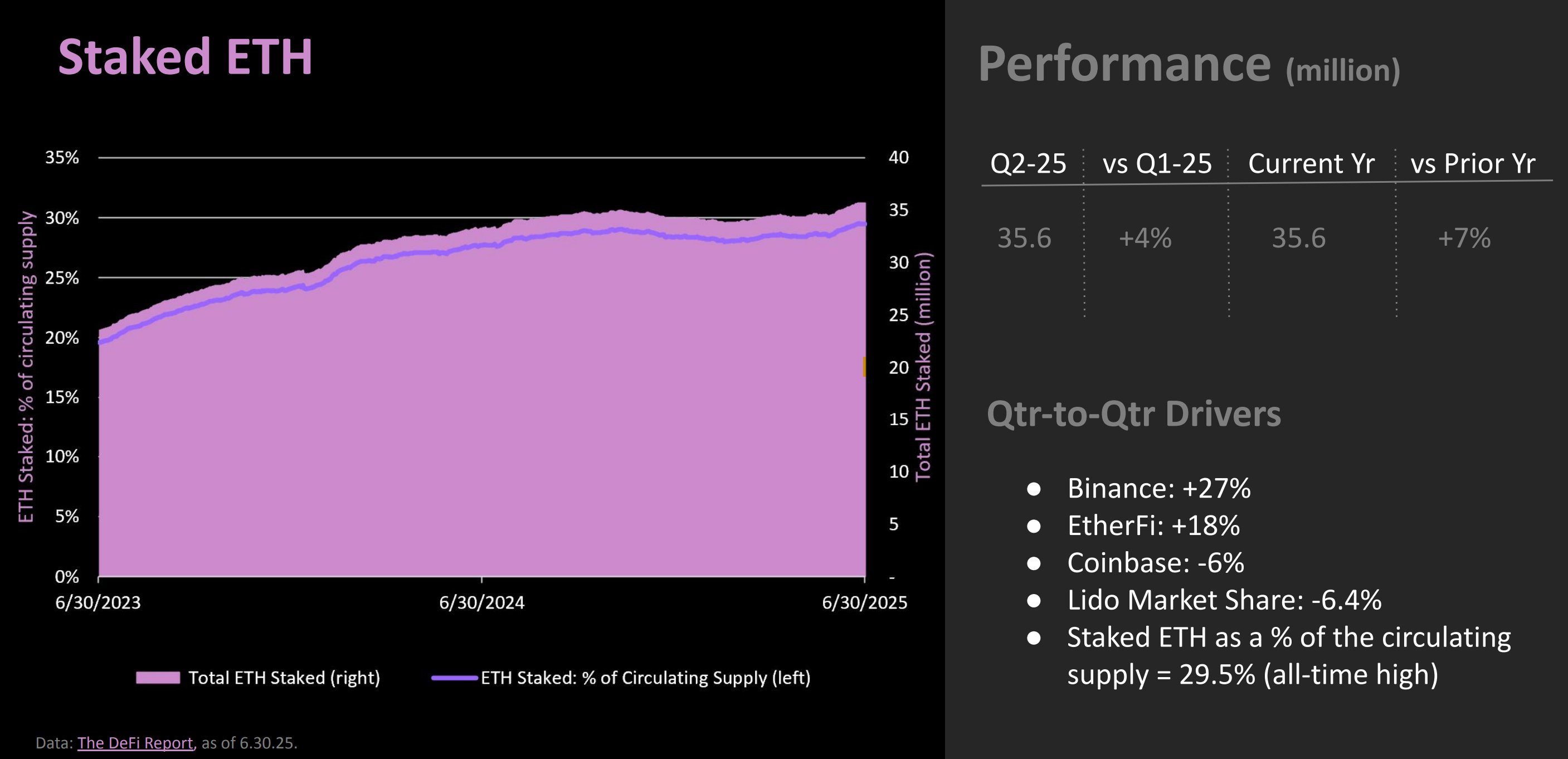

This growing need is likewise shown in ETH staking interest. Since July, 51 companies have actually divulged staked ETH holdings amounting to 1.26% of Ether’s overall supply.

The launch of Ether staking ETFs is anticipated by the end of Q3 2025. While area ETH ETFs have actually pulled $70 million in day-to-day inflows over the previous year, including a 3– 4% staking yield might draw in an additional $20– 30 billion annual.

Related: GENIUS’ restriction on stablecoin yield will drive need for Ethereum DeFi– Experts

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.