Ether (ETH) has actually oscillated around $3,000 for the previous 3 weeks, a combination duration following its flash crash to $2,620 on Nov. 21. Ether traders are now questioning the possibility of a more correction if assistance at $2,800 is lost.

Secret takeaways:

-

Ether moved listed below $3,000 once again due to an absence of futures need and aggressive selling by long-lasting holders.

-

Decreasing Ethereum network charges and activity recommend lower onchain need.

-

Weak technical setups alerted of a drop to $2,300 if the next assistance is lost.

ETH cost stuck in between 2 trendlines

Ether’s current healing was declined by resistance from the 50-day rapid moving average (EMA), which presently sits at $3,260, as revealed on the day-to-day chart listed below.

Related: Ether cost pattern projections triple-digit rally as ETH ETF inflows resume

This relocation, nevertheless, saw ETH/USD discover assistance from the $2,800-$ 2,600 need zone. The 200-week EMA is presently within this zone.

ETH need to increase above the resistance at $3,000 and exceed the 50-day EMA to break out of combination for a continual healing towards $4,000.

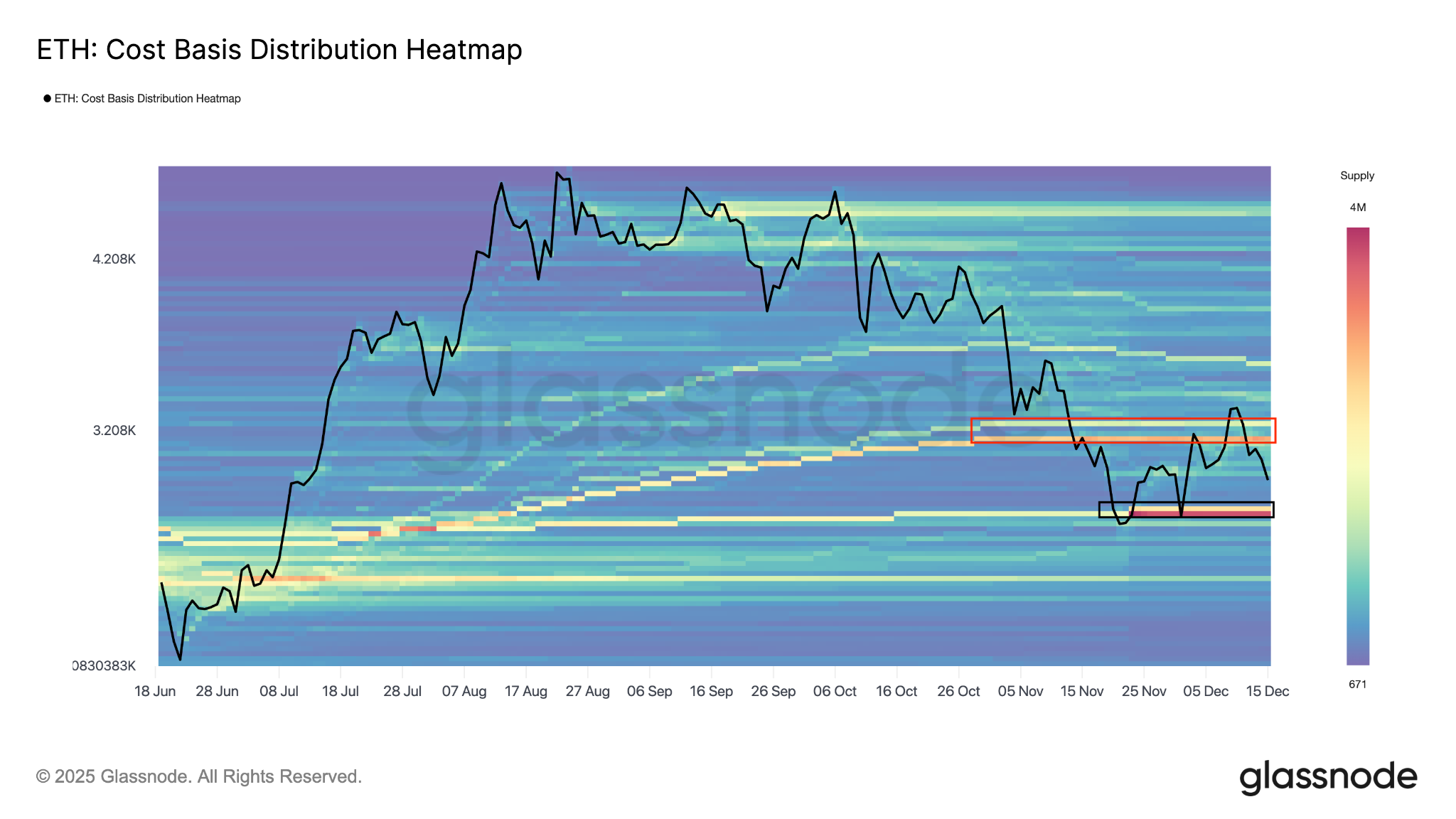

The Glassnode expense basis circulation heatmap revealed resistance in between $3,100 and $3,250, where financiers obtained approximately 5.9 million ETH.

On the disadvantage, the essential assistance location is around $2,800, where 5.8 million ETH were formerly acquired.

Ether cost does not have bullish momentum

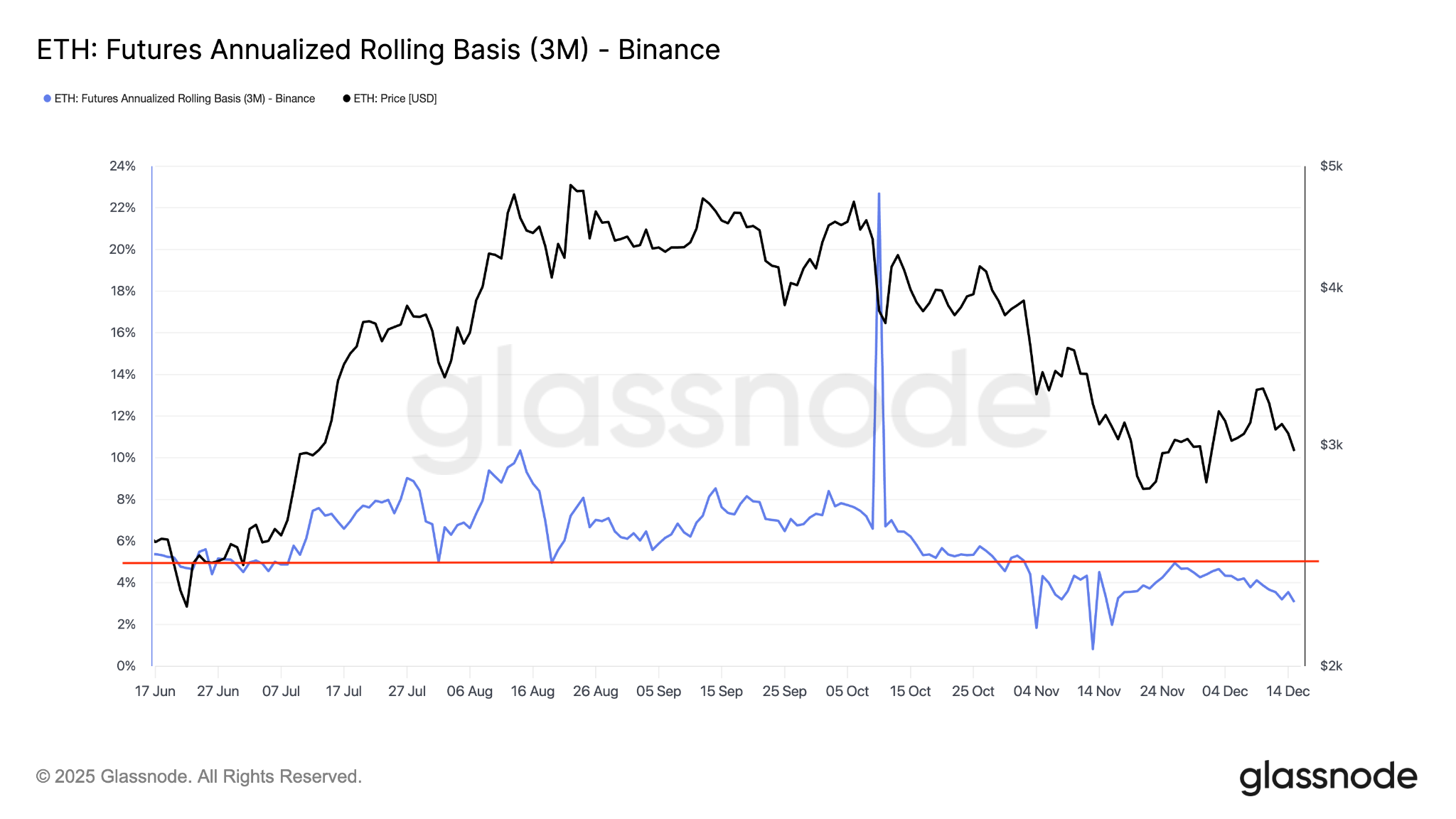

Ether futures are presently trading at a 3% premium relative to bearish ETH area markets, showing decreasing need from purchasers utilizing utilize.

In bearish market conditions, futures premiums normally remain listed below 5%, indicating weak need for leveraged long positions and less optimism amongst traders.

More concerningly, even recently’s healing to $3,750 did not bring back continual bullish belief amongst traders.

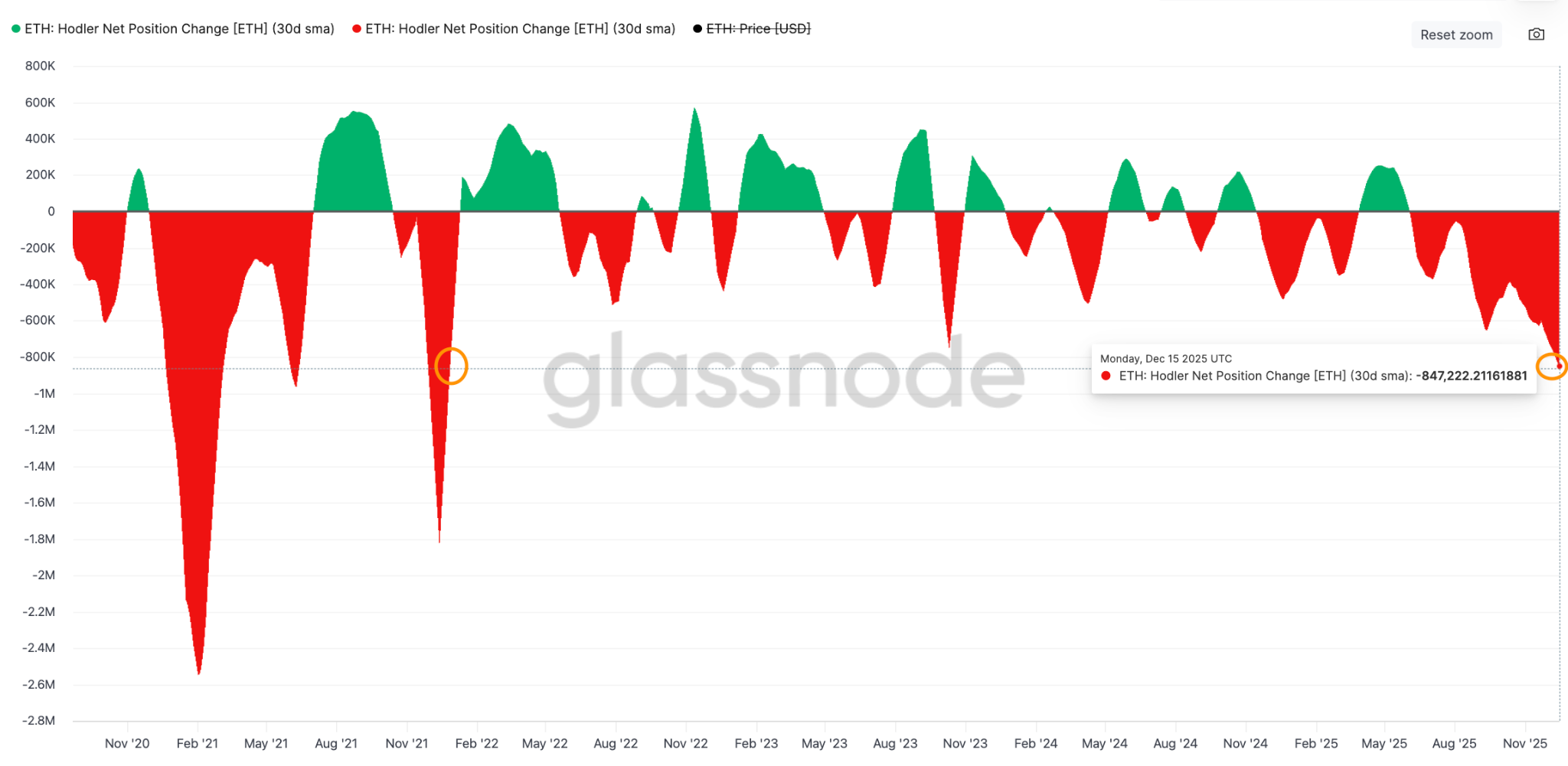

The bearish pattern in Ether futures accompanied a decrease in long-lasting holder supply, which has actually reduced by 847,222 coins over the previous 1 month, the biggest drop considering that January 2021. This contributes to the sell-side pressure that keeps ETH from remaining above $3,000.

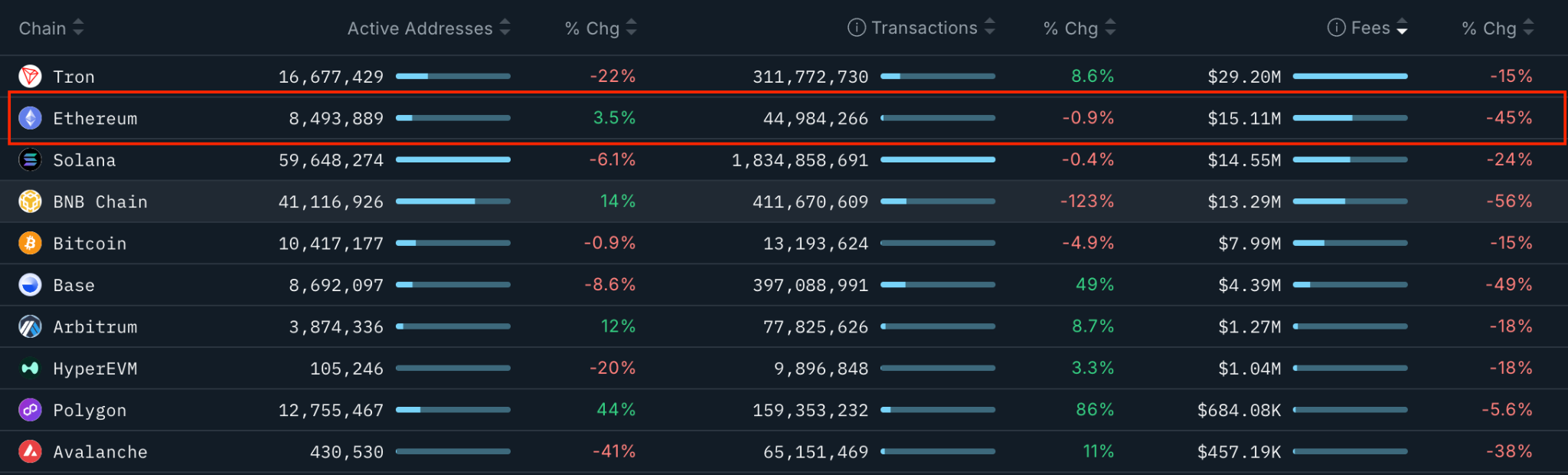

Ether’s failure to remain above $3,000 can likewise be credited to the decrease in Ethereum network charges, although this concern has actually impacted the whole cryptocurrency market.

Ethereum chain charges amounted to $15.1 million over the previous 1 month, representing a 45% decline from the previous month. By contrast, charges on BNB Chain dropped 56%, and Tron experienced a 15% decrease.

Although the variety of active addresses on Ethereum’s base layer increased by 3.5% over the very same duration, it has actually reduced by 14% over the last 7 days. The variety of deals is down by 11% over a seven-day duration.

Ethereum bears target $2,300 ETH cost

The ETH/USD set has actually confirmed a bear flag on the day-to-day chart after dropping listed below its lower limit at $3,200, as revealed listed below.

” Ethereum is combining after a sharp sell-off, forming a bear flag underneath previous assistance near the 3,173 to 3,250 zone,” stated expert Danny Naz in an X post on Sunday, including:

” That location has actually turned to resistance.”

The determined target of the flag is $2,300, representing a 22% drop from the existing cost.

Zooming into the 12-hour amount of time, a break and a close listed below the lower trendline of a loudspeaker pattern at $2,800 would break the ice for a much deeper correction towards the determined target of the pattern at $2,376.

Such a relocation would represent an 18% drop from the existing cost.

If this assistance stops working and the bears handle to pull the cost listed below $2,800, ETH cost might come down to the next $2,716 to $2,623 assistance zone.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we make every effort to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this details.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we make every effort to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this details.