Secret takeaways:

-

Ethereum network activity rose by 63% in 1 month, reinforcing the case for an impending breakout to $5,000.

-

Ether futures open interest leapt to $69 billion, highlighting robust need for leveraged direct exposure.

Ether (ETH) rallied to its greatest level in almost 4 years on Friday, triggering $351 million in liquidations from leveraged bearish bets. The rise followed financiers priced in a less limiting financial policy in the United States, following remarks from United States Federal Reserve Chair Jerome Powell. Will this momentum lastly press ETH beyond the $5,000 barrier?

Nasdaq rally signals restored cravings for ETH and threat possessions

The tech-heavy Nasdaq Index climbed up 1.8%, recommending financiers are shedding threat hostility and reallocating far from fixed-income positions. Ether has actually currently acquired 33% over the previous 1 month, and 3 signs now indicate more strength, possibly strengthening the continuous bull run. With ETH trading above $4,800, a breakout to brand-new all-time highs might be minutes or days away.

Powell’s remarks at the Jackson Hole Economic Seminar enhanced expectations of numerous rate cuts: “The standard outlook and the moving balance of threats might call for changing our policy position.” According to the CME FedWatch tool, bond markets are pricing in a 45% possibility of rates being up to 3.5% or listed below by March 2026, up from 37% the previous week. Lower loaning expenses reduce monetary pressures on business, broadly lowering systemic threats.

Ether is likewise drawing strength from rising onchain activity. Deals on the Ethereum network leapt 63% in the previous 1 month, while active addresses increased 26%. For contrast, Solana handled simply a 2% boost in deals, with active addresses decreasing by 14%, according to Nansen information. On The Other Hand, BNB Chain published a high 50% drop in deal count.

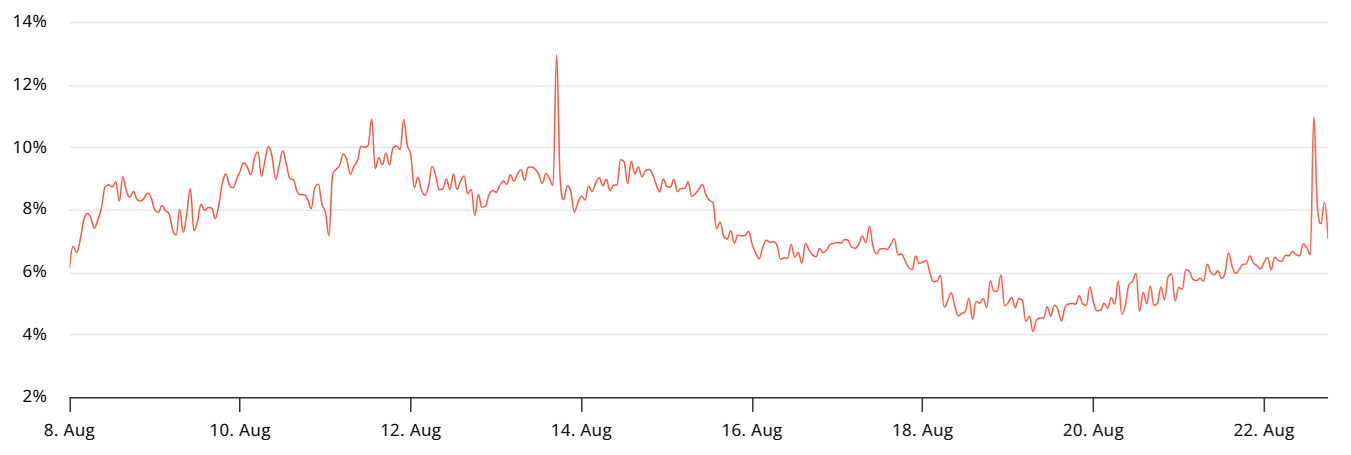

While onchain metrics highlight growing activity, futures markets expose a more careful position. ETH futures agreements generally trade at a 5% to 10% annualized premium over area rates to represent settlement hold-ups. At present, the regular monthly futures premium stands at 7%, up from a bearish 4% earlier in the week.

Part of this doubt comes from contrasts with rivals. Both BNB (BNB) and Tron (TRX) are trading well above their November 2021 all-time highs, while ETH continues to have a hard time listed below its $4,868 peak. This space highlights why some traders stay less passionate, even amidst strong network basics.

Related: BlackRock leads $287M area Ether ETF inflows after 4-day outflow streak

Healthy ETH futures metrics enhance the rally

According to X user JA_Maartun, futures purchasers have actually disappointed this level of aggressiveness in more than a month. Analytics firm CryptoQuant tracks these characteristics by determining the volume of buy orders filled versus sellers with pending deals, a signal of increasing conviction.

Regardless of current liquidations of bearish positions, aggregate open interest on Ether futures stays robust at 14.4 million ETH, the same from the previous week. In dollar terms, leveraged ETH bets stand at a remarkable $69 billion, showing constant need for direct exposure.

This mix of raised futures premiums, resistant open interest, and growing onchain activity enhances the case for a breakout, recommending the $5,000 turning point might get here faster than numerous traders anticipate.

This post is for basic details functions and is not meant to be and must not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.