Ether exchange-traded funds (ETFs) in the United States might have the ability to begin staking a part of their tokens as quickly as May, according to Bloomberg Intelligence expert James Seyffart.

On April 9, the United States Securities and Exchange Commission (SEC) licensed exchanges to start noting alternatives agreements connected to find Ether (ETH) ETFs after greenlighting Bitcoin (BTC) ETF alternatives in September. Nevertheless, companies are still awaiting the regulator to permit Ether ETFs to use staking after submitting many ask for consent previously this year.

Source: James Seyffart

The approval of alternatives agreements might represent an essential action towards regulative approval for staking services in the United States. Bloomberg Intelligence expert James Seyffart stated on April 9 that clearance for staking on ETH funds might come as early as Might however would likely take up until completion of 2025.

” It’s possible they might be authorized for staking early, however the last due date is at completion of October,” Seyffart stated in a post on the X platform. “Possible intermediate due dates before the last approval (or rejection) remain in late Might & & late August.”

Alternatives are monetary derivatives that offer financiers the right, however not the commitment, to purchase or offer a possession at a fixed cost before a specific date. Staking, on the other hand, includes securing a cryptocurrency, like ETH, to support network operations– such as confirming deals– in exchange for benefits.

In ETH funds, alternatives agreements permit financiers to hedge or hypothesize on the tokens’ costs, while staking deals a method to make benefits by taking part in Ethereum’s proof-of-stake network.

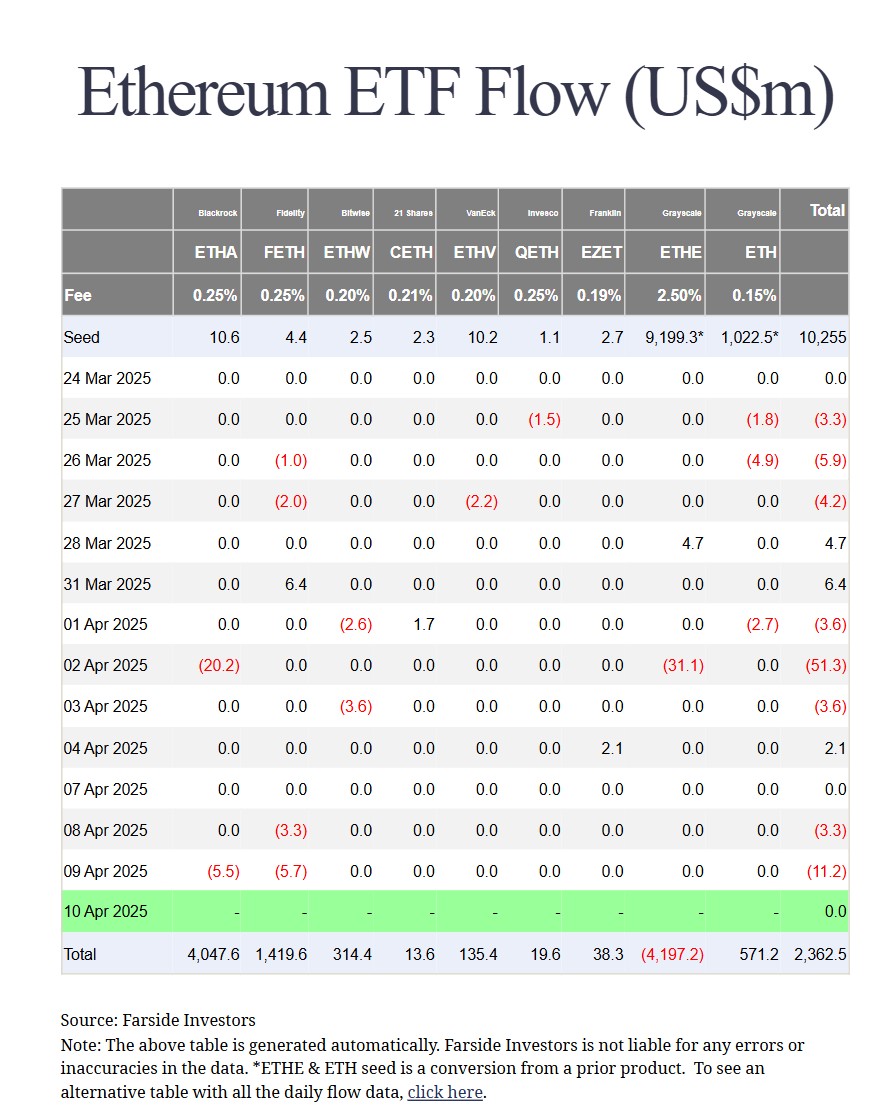

Ether ETF inflows. Source: Farside Financiers

Related: SEC authorizes alternatives on area Ether ETFs

Development towards adoption

Ether ETFs introduced in June 2024 however had a hard time to bring in considerable financier interest. According to information from Farside Investors, the funds have actually seen net inflows of $2.4 billion since April 10, compared to $35 billion for Bitcoin ETFs presented in January. Experts state the SEC’s approval of Ether ETF alternatives might assist stimulate adoption.

Property supervisors are likewise waiting on the SEC to greenlight demands to permit in-kind productions and redemptions for Bitcoin and Ether ETFs.

The introduction of alternatives markets connected to find crypto ETFs is a “huge improvement” in crypto markets and develops “exceptionally engaging chances” for financiers,” Jeff Park, Bitwise Invest’s head of alpha methods, stated in a Sept. 20 X post.

However staking might be the most considerable advance for Ether funds.

In March, Robbie Mitchnick, BlackRock’s head of digital properties, stated Ether ETFs are “less ideal” without staking. “A staking yield is a significant part of how you can produce financial investment return in this area.”

Publication: Memecoin degeneracy is moneying groundbreaking anti-aging research study