Secret takeaways:

-

ETH rate struck a 4-year high weekly close at $4,475, driven by ETF inflows and high network activity.

-

An essential assistance zone for Ether sits in between assistance at $4,000 and $4,150.

Ether (ETH) rate struck another turning point this cycle after the ETH/USD trading set attained its greatest weekly close given that November 2021.

Ether finishes finest week in 4 years

Ether closed the week at $4,475 on Aug. 13, according to information from Cointelegraph Markets Pro and TradingView verifies.

This considerable turning point follows a breakout above the $4,000 resistance level, which had actually remained in location given that 2021, indicating strong bullish momentum.

Among the factors are area Ethereum ETFs with huge inflows over the last month, and a record $1.02 billion on Aug. 11 alone. These inflows are led by BlackRock’s ETHA, now amounting to over $12.6 billion, per information from Farside Investors.

Related: Ether trader turns $125K into $43M, locks in $7M after market slump

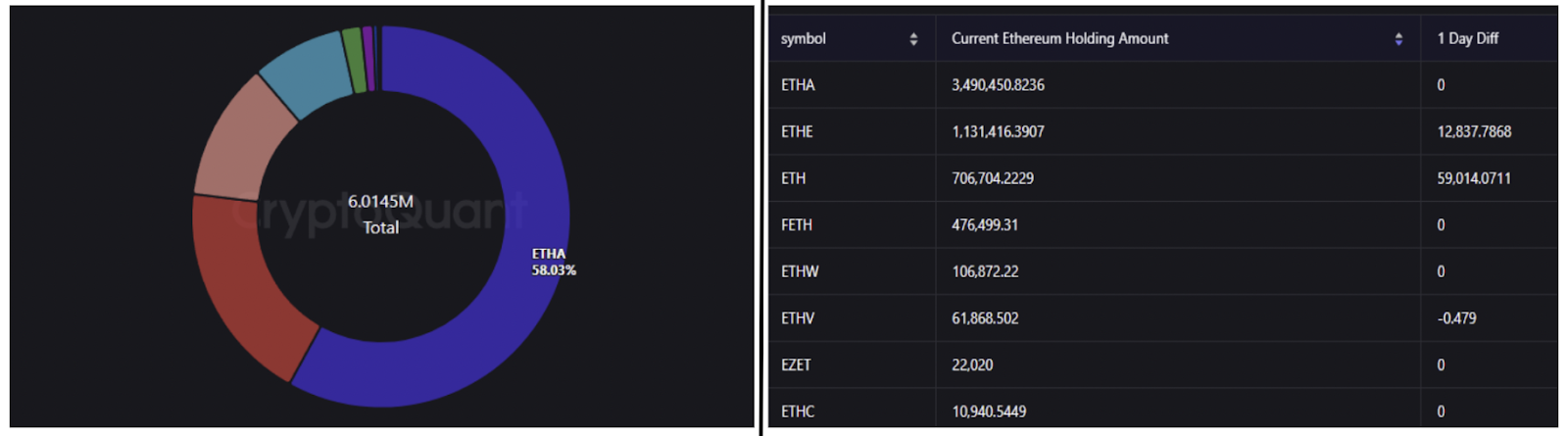

BlackRock now holds over half of all ETH ETF holdings, according to information from CryptoQuant.

” BlackRock’s ETHA now comprises 58.03% of all Ethereum ETFs, holding an enormous 3,490,450 ETH in its wallets,” stated CryptoQuant expert Burakkesmeci in a Monday Quicktake analysis, including:

” This momentum reveals a clear ETF-driven rally in Ethereum, led by BlackRock’s supremacy in the market.”

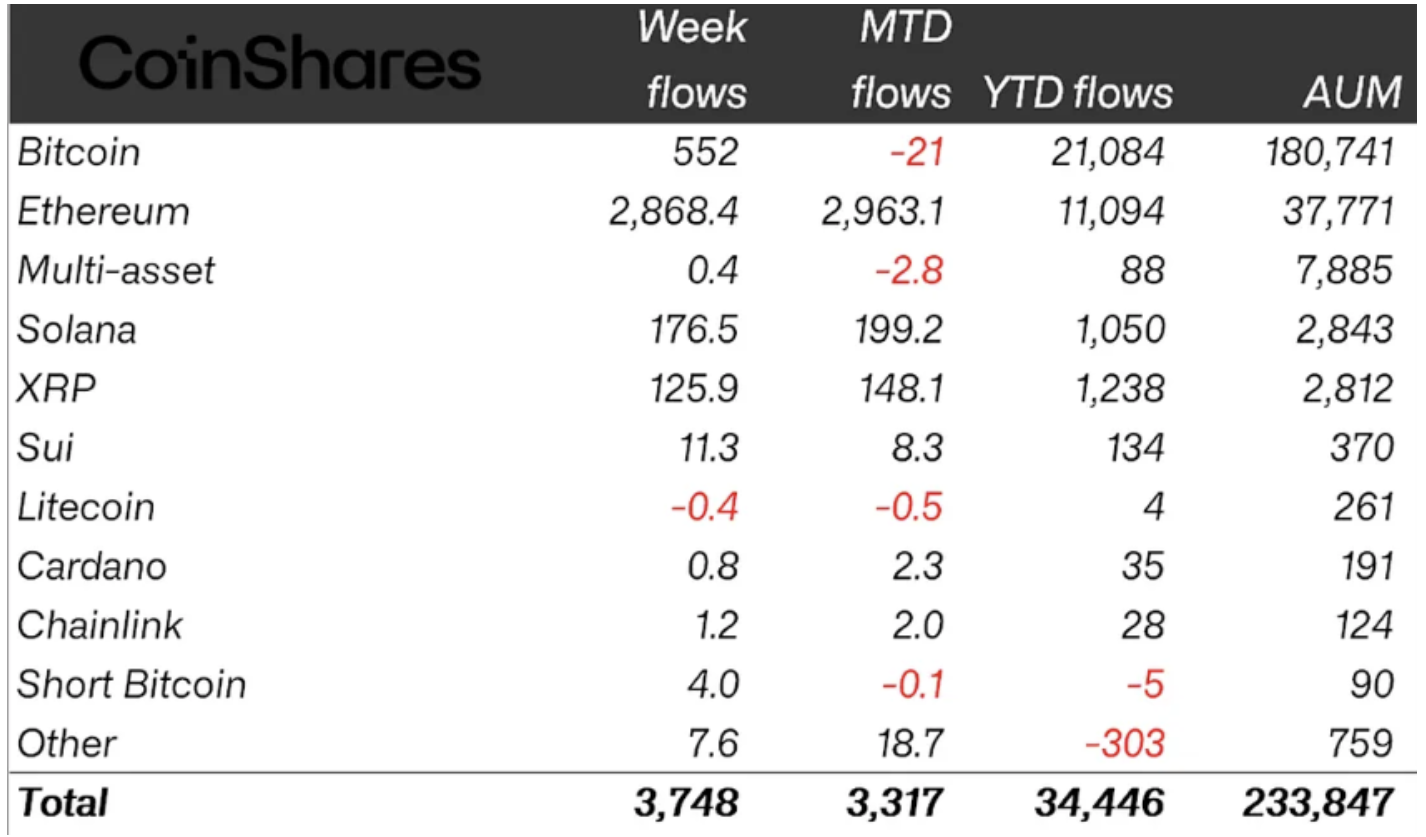

Ether continued controling capital inflows into exchange-traded items (ETPs) recently, according to CoinShares. Inflows into ETH financial investment items amounted to $2.9 billion, marking strong institutional financier hunger for the leading altcoin.

Business treasuries, with 69 entities holding $17.3 billion in ETH (3.4% of supply), likewise contribute to the buy pressure.

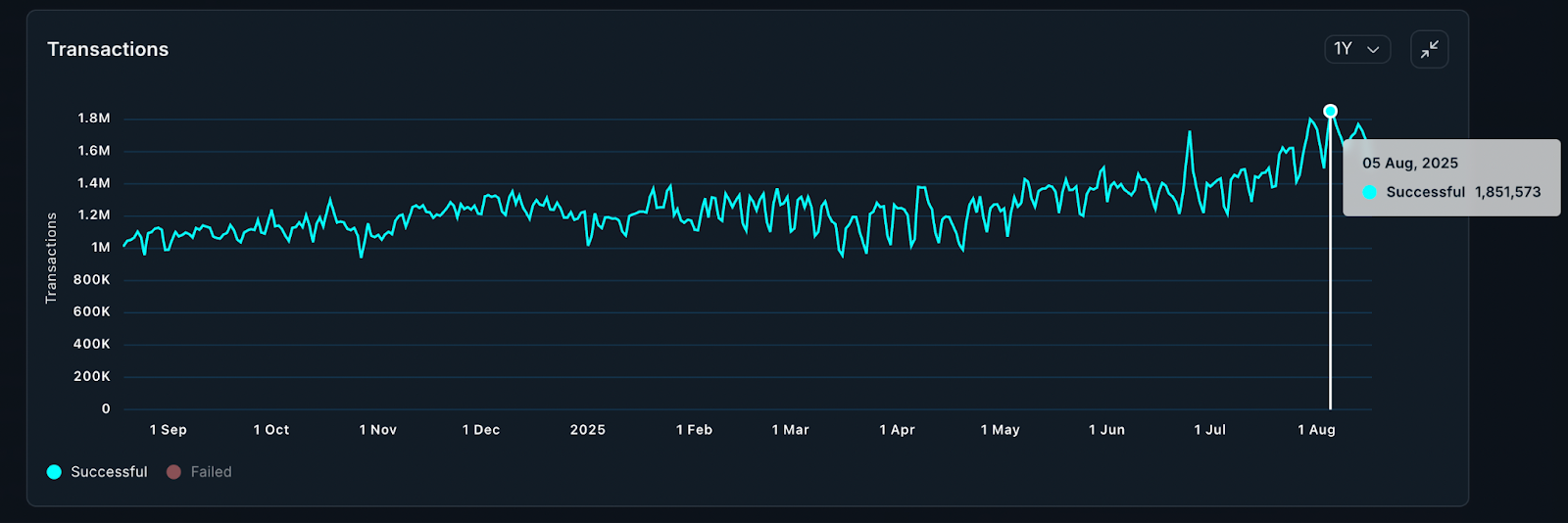

Need for ETH is likewise shown in high network activity, with deal volume striking a record 1.74 million everyday deals on Aug. 5, according to information from Nansen.

More than 46.67 million deals were taped in July, sustained by stablecoin transfers, DeFi, and layer 2 development.

ETH rate levels to enjoy today

As ETH trades at $4,300, numerous crucial rate levels call for additional attention, based upon technical analysis and market characteristics.

The instant assistance zone lies around $4,100 to $4,000, a variety that formerly served as a persistent resistance in 2021 however has actually now turned to a vital assistance location.

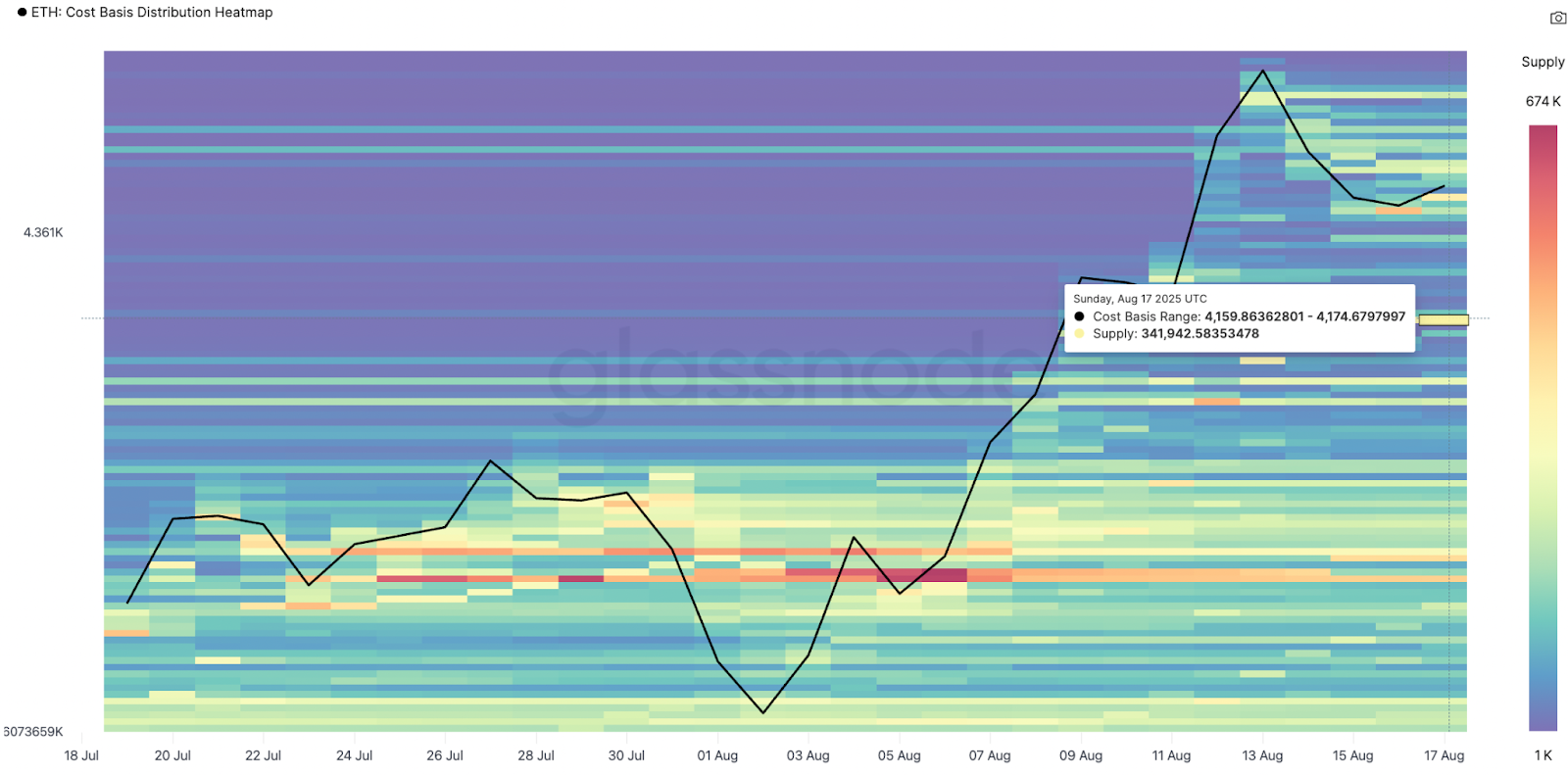

This level lines up with the 20-day rapid moving average (EMA) at $4,140, and $4,150 is crucial assistance, where 341,000 ETH tokens were collected, per Glassnode’s Expense basis circulation heatmap.

” As long as the weekly close holds the $4K–$ 4.25 K area, I deal with dips as combination,” stated popular expert Demi-Defi in an Aug. 18 post on X, including that a weekly close listed below $4,150 might set off a “much deeper drop” to the $3,650–$ 3,750 area.

On the advantage, the expert stated a weekly close above $4,550 might verify a breakout into brand-new all-time highs with targets set in between $5,000 and $5,800.

” I stay bullish while $4.15 K+ holds weekly.”

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.