Ethereum’s cost has actually risen after having actually remained in the doldrums for weeks, assisting enhance its market share after it struck record lows.

Ether (ETH) has actually risen nearly 15% over the previous 24 hr, topping $1,800 on April 23. It has actually exceeded Bitcoin, which notched a 6% gain, and the larger crypto market, which has actually climbed up nearly 5% to recover an overall market price of $3 trillion.

Ether has actually now handled to recuperate nearly 30% because its April 9 crash to $1,400, leading some experts to recommend that the worst might be over for the world’s second-largest crypto possession.

” You can dislike Ethereum all you desire, however when it has a wedding day, the whole crypto environment increases,” crypto trader and expert “Earnings Sharks” commented to their 640,000 X fans.

Market expert “Ash Crypto” stated ETH was “ready to blow up,” drawing contrast from the present chart pattern for Ether to that for Bitcoin’s efficiency in late 2024.

Jeff Mei, primary running officer at the crypto exchange BTSE, was not conviced Ethereum was moving idependently, and informed Cointelegraph that Ether’s gain “was mostly due to it tracking the cost of Bitcoin and the general market,” which that Paul Atkins’ verification as chair of the United States Securities and Exchange Commission had actually increased general market belief.

Previously this month, ETH had actually fallen back to bearish market rates and had actually seen its market share diminish in the middle of a broad market recession ruined by worries of a trade war.

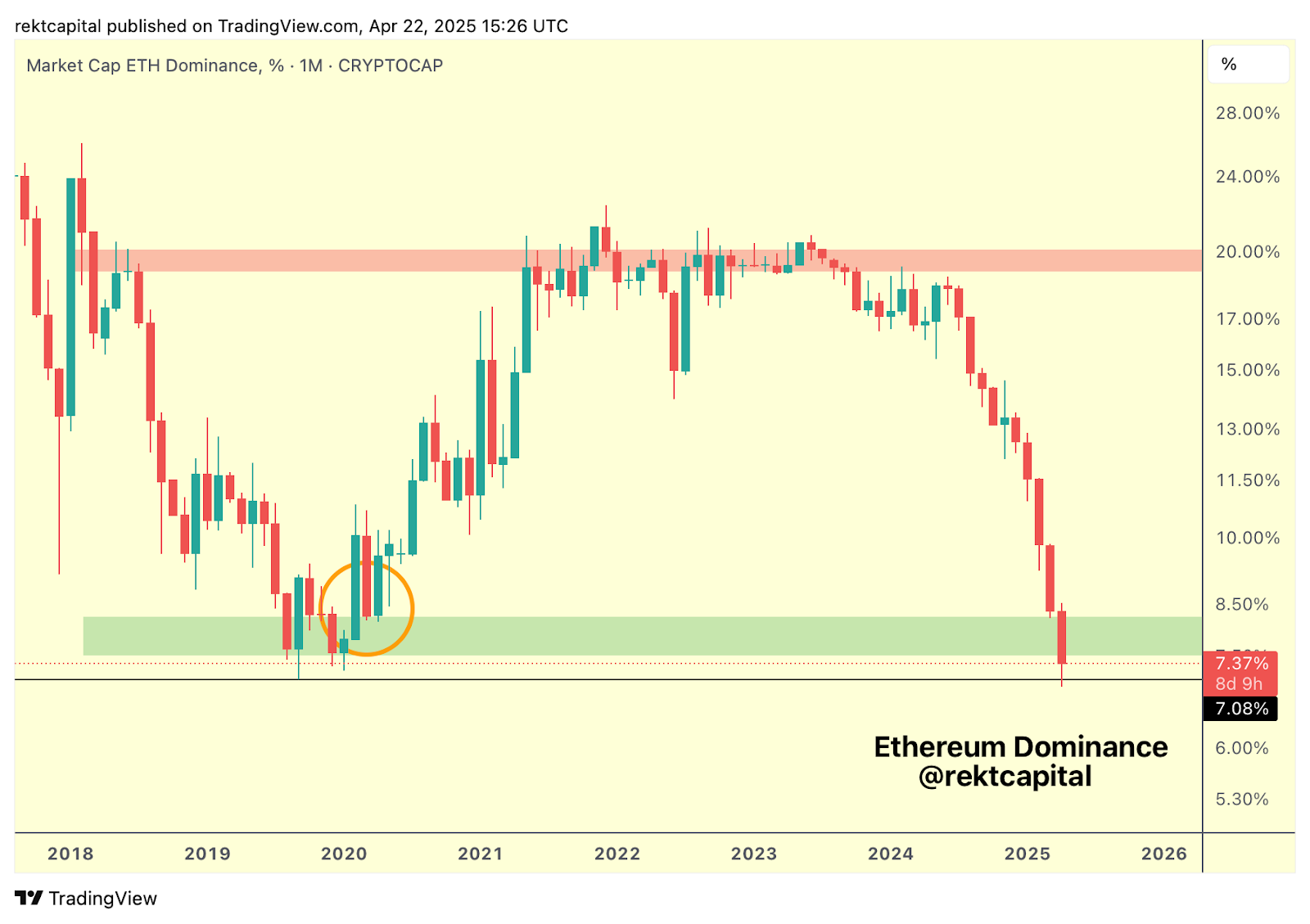

On April 22, expert “Rekt Capital” stated that ETH’s market supremacy has actually fallen back to lowest levels however “handled to safeguard 2019 lowest levels as assistance.”

ETH supremacy was up to its September 2019 low of 7% on April 22, according to TradingView. Nevertheless, its subsequent cost pump has actually seen that share bounce off this important assistance level and return above 7.5% on April 23.

Basic drivers supporting the relocation

10x Research study’s Markus Thielen informed Cointelegraph that it hasn’t taken much to drive Ethereum greater, as a “greatly shorted market is now experiencing a capture.”

Related: Ethereum Structure moves focus to user experience, layer-1 scaling

Technically, Ethereum was oversold on both day-to-day and weekly timeframes, setting the phase for a rebound, he stated.

” With the upcoming upgrade transferring to mainnet, there’s likewise an essential driver supporting the relocation.”

Publication: Altcoin season to strike in Q2? Mantra’s strategy to win trust: Hodler’s Digest