Secret takeaways:

-

Traders stay mindful about ETH’s rate action, however positive belief is starting to return.

-

The Might 7, Ethereum Pectra upgrade might improve financier belief, however ETH’s rate action reveals financiers are still reluctant to open brand-new positions.

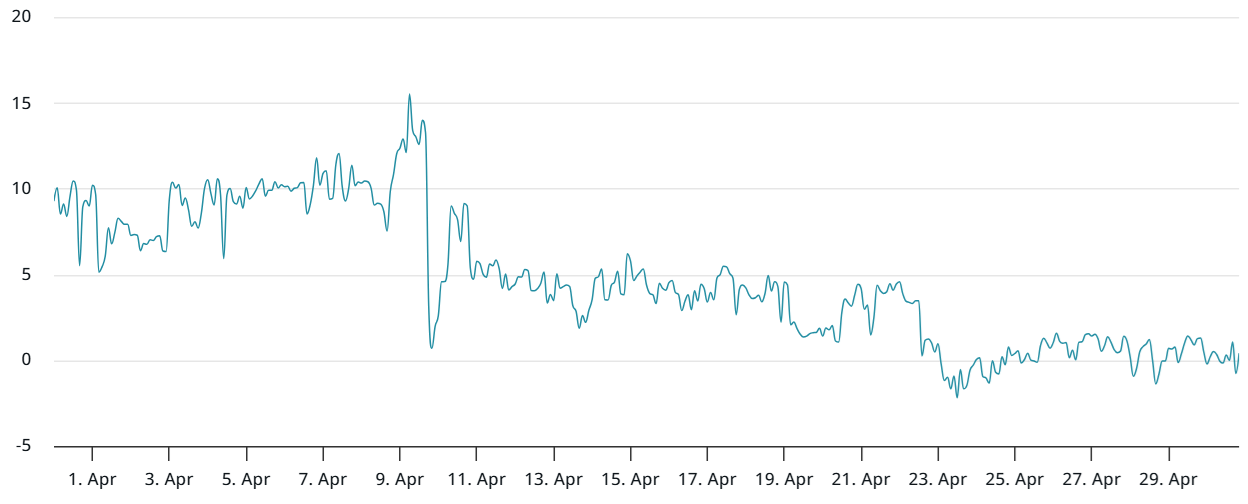

Ether (ETH) has actually been trading listed below $1,900 because March, leading financiers to question whether the unsuccessful effort to recover $4,000 in December 2024 signified completion of an age for the leading altcoin. Issues continue to install as derivatives market information reveals that expert traders stay mindful about ETH’s rate outlook.

ETH regular monthly futures must trade at a premium of 5% or more compared to identify markets to make up for the longer settlement duration, however this indication has actually held listed below the neutral limit.

Part of the absence of interest comes from frustration with the United States federal government, as Ether was categorized together with other altcoins in the “Digital Property Stockpile” Executive Order on March 6. The Trump administration chose that just Bitcoin (BTC) was substantial adequate to be consisted of in its own “Strategic Reserve.” In useful terms, altcoins currently held by the federal government might be maintained, however not recently obtained.

Ether’s market cap falls listed below its leading 4 competitors

For the very first time ever, in April 2025, Ether’s market capitalization dropped listed below the combined worth of its 4 biggest rivals: Solana (SOL), BNB, Cardano (ADA), and Tron (TRX).

After rebounding from lows near $1,400, Ether’s overall market capitalization now stands at $217 billion, which suffices to go beyond the combined worth of its 4 primary rivals. Nevertheless, unless Ether regularly outshines these competitors, belief is not likely to enhance. Some traders have high expect the upcoming ‘Pectra’ network upgrade, however existing derivatives information does not show a bullish outlook.

Ether’s decrease has actually likewise accompanied weak need for the Ethereum area exchange-traded fund (ETF) in the United States. Institutional interest was doing not have, in spite of ETH’s rate increasing from $2,400 to $4,000 in between October and December 2024. On the other hand, Bitcoin ETFs saw possessions more than double, growing from $50 billion in October 2024 to $110 billion presently.

Ethereum leads in TVL, however there’s a catch

Although Ethereum stays dominant in regards to overall worth locked (TVL), it has actually had a hard time to match Solana’s incorporated user experience or Tron’s supremacy in the stablecoin sector. Traders appear unenthusiastic in Ethereum’s greater decentralization or enhanced security, particularly for activities including regular deposits and withdrawals, where layer-2 services supply minimal advantages.

The lack of need for leveraged bullish ETH positions does not always suggest that expert traders anticipate more rate decreases. If whales and market makers hesitated to use disadvantage security, this would be shown in the ETH alternatives markets, signaling increased danger of a market recession.

Contrary to some expectations, put (sell) alternatives are trading at levels comparable to call (buy) alternatives. Especially, expert traders are now more comfy with disadvantage dangers than they were 2 weeks back. While ETH derivatives are not indicating strong bullish belief, they likewise do not recommend that expert traders are stressed over more decreases at existing rate levels.

Related: 3 Ethereum charts flash signal last seen in 2017 when ETH rate rallied 25,000%

There is a possibility that the upcoming ‘Pectra’ network upgrade might favorably impact Ether’s rate. Set up for Might 7, this occasion may restore financier interest in the task by closing the space with a few of its rivals. Staking systems developed for institutional financiers might lead to more ETH being secured validator nodes, decreasing the flowing supply. Historically, Ethereum upgrades have actually frequently been connected with short spikes in ETH’s rate.

This short article is for basic details functions and is not planned to be and must not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.