Secret takeaways:

-

Capital rotation prefers Ether as “Hot Capital Ratio” strikes an annual low for Solana.

-

ETH futures supremacy grows with open interest striking $58 billion.

-

ETH eyes on $4,000, backed by low financing rates and strong area build-up.

Capital streams favor Ethereum over Solana

Ether (ETH) has actually become the main recipient of capital rotation within the altcoin market.

According to Glassnode, the SOL/ETH Hot Capital Ratio, a procedure of short-term understood capital motion, has actually decreased to a year-to-date low of 0.045, marking a 42% drop considering that April.

This recommends that while ETH and SOL saw inflows in July, capital circulation is now preferring Ether.

The Hot Recognized Cap metric programs which property short-term speculators are preferring. With the ETH/SOL trading set in a multimonth sag, the information signals “a fading however significant ETH-led rotation,” states Glassnode.

Another bullish indication for Ether is the ETH/BTC set, which is likewise back to multimonth highs, increasing above the 200-day rapid moving average for the very first time in over 2 years.

As Cointelegraph reported, ETH cost rebounded to its typical trading variety while Bitcoin continues to deal with heavy selling at $116,000 and below.

Ether financing rates remain cool

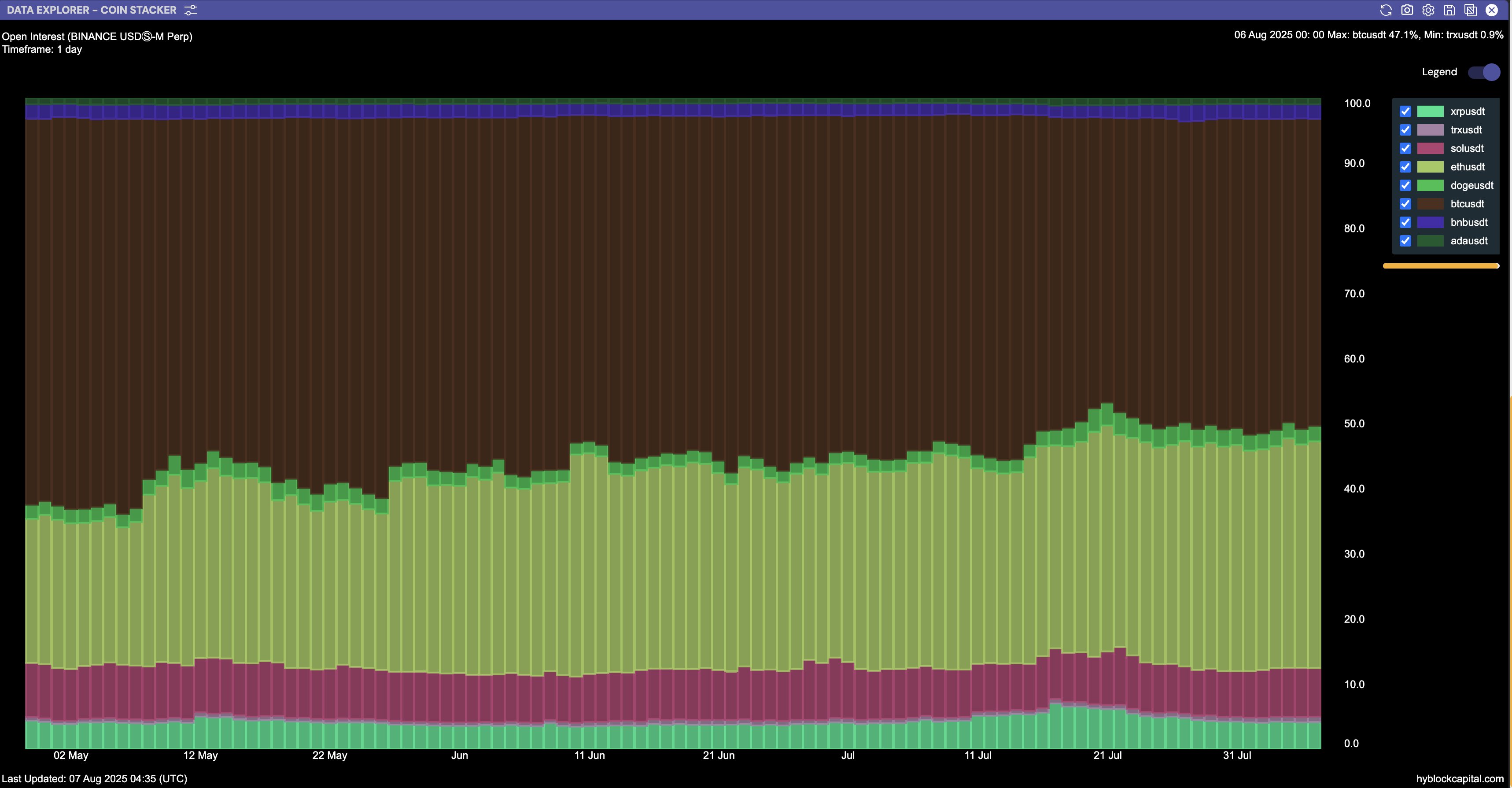

Ether’s open interest (OI) just recently reached an all-time high of $58 billion. This rise in OI, together with Ethereum’s record-high everyday deal count, shows more cash going into the marketplace and increasing network involvement.

In addition, Ethereum’s share of overall OI throughout significant exchanges has actually reached 34.8%, while Bitcoin’s decreased from 59.3% to 47.1%.

Nevertheless, while ETH has yet to recover the crucial $4,000 resistance level, futures financing rates recommend the rally still has space to run.

Existing aggregated financing rates stay considerably lower than throughout previous efforts to breach $4,000 in March and December 2024. In truth, compared to March, financing rates have actually almost cut in half.

This dynamic is bullish for 2 crucial factors: First, lower financing rates suggest that traders are not extremely leveraged to the long side, decreasing the threat of abrupt liquidation.

2nd, it reveals that the existing cost action is being driven more by area need (led by Ether treasury business) instead of extreme speculative positioning.

In truth, NovaDius president Nate Geraci highlights,

” Eth treasury business & & area eth ETFs have * each * purchased approx 1.6% of existing overall eth supply considering that start of June.”

Related: Ether cost headed for $4K face-off: Is this time various?

Ether cost fixed by 9.72% over the previous 7 days after rallying for 5 successive weeks. ETH has actually quickly recuperated 9% considering that, retesting $3,800 on Thursday.

With $4,000 in sight, crypto expert Jelle keeps in mind that the mental level “has actually been resistance considering that permanently.” The expert states,

” As soon as it breaks, I question we return listed below anytime quickly. Rate discovery is close.”

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.