The majority of financiers in area Ether exchange-traded funds from possession supervisors BlackRock and Fidelity Investments are dealing with considerable losses, according to crypto analytics firm Glassnode.

” The typical financier in the BlackRock and Fidelity Ethereum ETFs are now significantly undersea on their position, holding a latent loss of roughly -21% usually,” Glassnode stated in its Might 29 report.

Ether (ETH) is presently trading at $2,601, according to CoinMarketCap information. Nevertheless, BlackRock’s area Ether ETF has an expense basis of $3,300, while Fidelity’s is greater at $3,500.

Funds dropped on Trump tariffs

The last time Ether was trading above $3,000 was Feb. 2, before getting in a drop after United States President Donald Trump signed an executive order to enforce import tariffs on products from China, Canada, and Mexico.

” We can see that net outflows start to speed up when the area rate dropped listed below this typical ETF financier cost-basis level in August 2024 and January and March of 2025,” the company included.

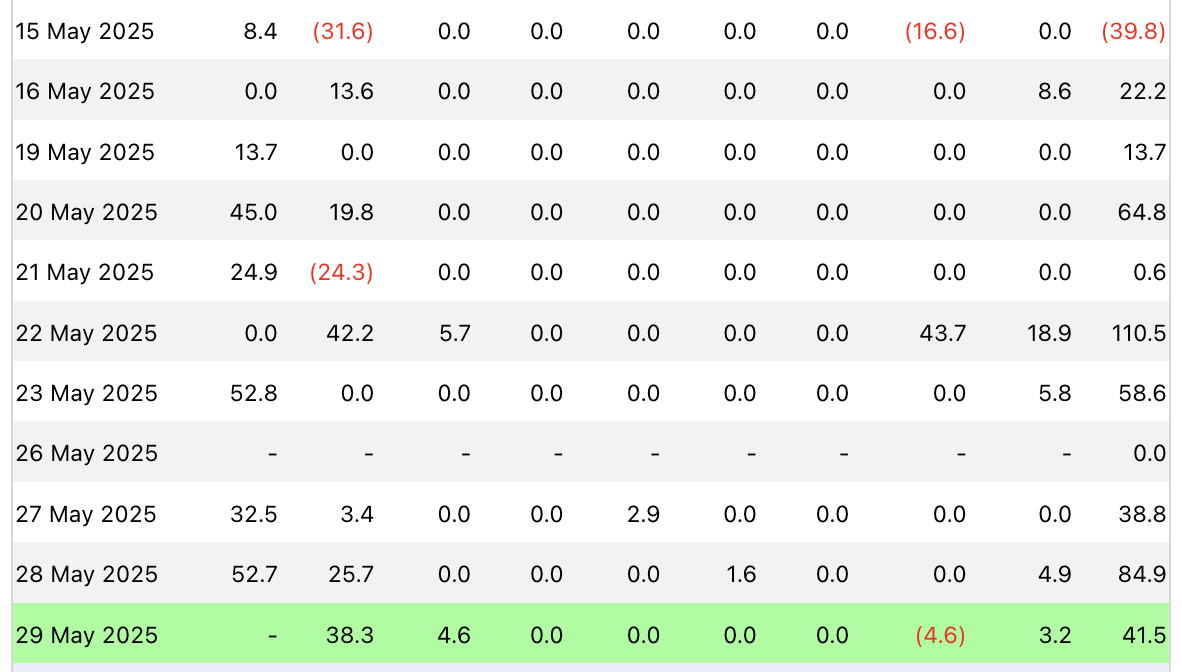

Ether struck its annual low of $1,472 on April 9, the very same day Trump’s sweeping worldwide tariffs entered impact. Nevertheless, Ether has actually climbed up 44.25% over the previous month, and area Ether ETFs have actually taped 9 successive days of inflows amounting to $435.6 million because Might 16, as the trade war unpredictability has actually started to cool off.

Some experts prepare for more uptrend for the crypto market after a United States federal court obstructed the majority of Trump’s tariffs on Might 28.

Given that area Ether ETFs released in the United States in July 2024, they have actually taped $2.94 billion in overall inflows. On their July 23 launch, Ether was trading at roughly $3,536.

On the other hand, Glassnode recommended the ETFs have actually had little influence on Ether’s area rate. “The Ethereum ETFs at first represented simply ± 1.5% of the trade volume in area markets, recommending a reasonably lukewarm reception on launch,” it stated.

Related: No more ETH discards? Ethereum Structure turns to DeFi for money

Glassnode stated the ETFs experienced a duration of more powerful development in November 2024, where the procedure increased to over 2.5%.

This accompanied Trump winning the United States governmental election throughout the very same month, the whole crypto market went into a month-long rally that saw Ether reach $4,007 on Dec. 8.

The procedure has actually because decreased back towards 1.5%, Glassnode stated.

On March 20 at the Digital Possession Top, BlackRock’s head of digital properties, Robbie Mitchnick, kept in mind that the area Ether ETF is “less best” without staking.

Publication: Coinbase hack reveals the law most likely will not safeguard you: Here’s why

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.