Ether (ETH) rate dropped to $1,410 on April 7, marking its most affordable level because March 2023. This sharp decrease set off liquidations of leveraged ETH futures worth over $370 million in 2 days, according to CoinGlass information. Nevertheless, the altcoin handled to recuperate above the $1,500 mark as the S&P 500 index recovered its mental 5,000 assistance level.

Ether/USD (blue) vs. overall crypto market capitalization (magenta). Source: TradingView/ Cointelegraph

Over the previous one month, Ether has actually underperformed the wider cryptocurrency market by 14%. In spite of this, expert traders are not yet prepared to turn bearish, as recommended by Ethereum’s derivatives information and onchain metrics. While this information does not ensure that Ether’s rate has actually reached its bottom, the minimized need for bearish positions listed below $1,600 uses some peace of mind for bullish financiers.

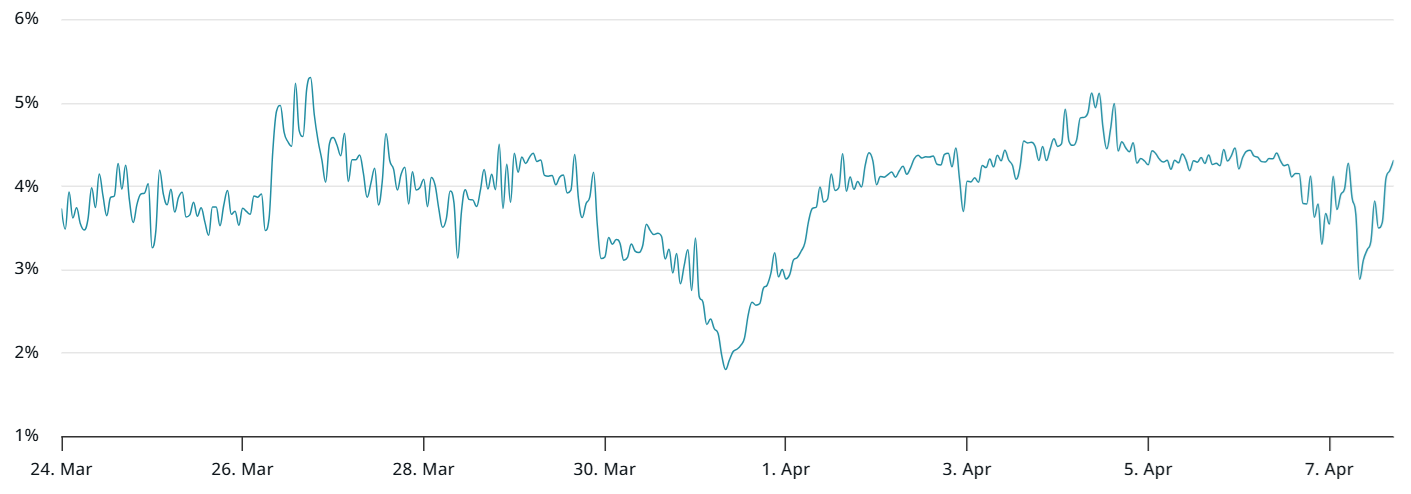

Ether 2-month futures annualized premium. Source: laevitas.ch

On April 7, the Ether month-to-month futures premium increased to 4% after dipping to 3% earlier in the day. Although still listed below the neutral limit of 5%, this marks an enhancement from March 31, when the indication struck a low of 2%. Presently, there is an obvious absence of need from long positions (purchasers), however this is not uncommon following a high 30% drop in ETH’s rate over the previous month.

Ether is a victim of getting worse macroeconomic conditions

Financiers stay worried that intensifying worldwide trade stress might cause a financial recession and minimize interest in risk-on possessions. This situation likewise compromises the possible favorable effect of a possible rates of interest cut throughout the United States Federal Reserve’s (Fed) next conference on Might 6-7. Usually, such a relocation would benefit the cryptocurrency market by reducing returns on fixed-income financial investments.

In Spite Of United States President Donald Trump’s strong push for rates of interest cuts, as revealed in his Reality Social post on April 7, Fed Chair Jerome Powell stays careful about inflation patterns. Powell apparently specified on April 4: “It is prematurely to state what will be the proper course for financial policy,” according to Yahoo Financing.

Including more pressure to Ether’s rate was Ethereum designers’ choice to postpone the Pectra upgrade, initially set up for April. Designers have actually now set Might 7 as the time frame for its mainnet launch however offered no particular factor for the hold-up. This comes despite the fact that the Hoodi testnet upgrade was effectively executed on March 26.

Ether derivatives show moderate durability while Ethereum TVL leaps to an all-time high

Provided the unfavorable news circulation, one may have anticipated Ether bears to control the marketplace totally. Nevertheless, derivatives information recommends that bears are not as positive as expected. When traders anticipate a correction, put (sell) alternatives tend to trade at a premium, pressing the 25% delta alter metric above 6%. Alternatively, throughout bullish durations, this indication normally falls listed below -6%.

Ether 30-day alternatives alter (put-call) at Deribit. Source: Laevitas.ch

Presently, the ETH alternatives alter stands at 10%, the very same level as March 31, which stays within bearish area. Nevertheless, this reading is considerably less severe compared to Might 2024, when it peaked at 20% amidst a sharp ETH rate drop from $3,700 to $2,860 within 5 weeks. In essence, while Ether derivatives markets signal bearish belief, they do not show panic levels.

Onchain information for Ethereum reveals durability in spite of wider market obstacles. The overall worth locked (TVL) on the Ethereum network reached an all-time high of 30.2 million ETH on April 6– a 22% boost compared to the previous month. This development exceeded Solana’s 12% boost in SOL (SOL) terms and BNB Chain’s 16% TVL increase throughout the very same duration.

Eventually, macroeconomic conditions stay the main chauffeur of cryptocurrency need. Nevertheless, when evaluating Ether derivatives information and Ethereum’s TVL efficiency, it appears that ETH’s rate disadvantage might be restricted.

This post is for basic details functions and is not planned to be and need to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.