Secret takeaways:

-

Strong Ethereum ETF inflows signify high institutional need.

-

Ethereum’s $51.8 B TVL and 30% DEX weekly volume increase reveal robust network strength.

-

A bull flag pattern on the ETH’s four-hour chart targets $2,100.

Ether’s (ETH) rate increased to a brand-new variety high at $1,860 on April 28, its greatest worth considering that April 2.

A number of experts argue that the ETH rate requires to hold above $1,800 to increase the opportunities of increasing greater.

” As soon as ETH validates this 4H close above resistance [$1,800], Ether and altcoins will lastly get their time to shine,” trader Kiran Gadakh stated in an April 29 post on X.

” I can feel it in my bones, $2,000 ETH coming quick.”

Popular expert Nebraskangooner believed that if ETH deals with high volume rejection from the $1,800 level, it may drop to evaluate assistance levels around $1,600.

Ethereum ETF need returns

A number of information metrics recommend that Ether is well-positioned to break out towards $2,000 in the list below days or weeks.

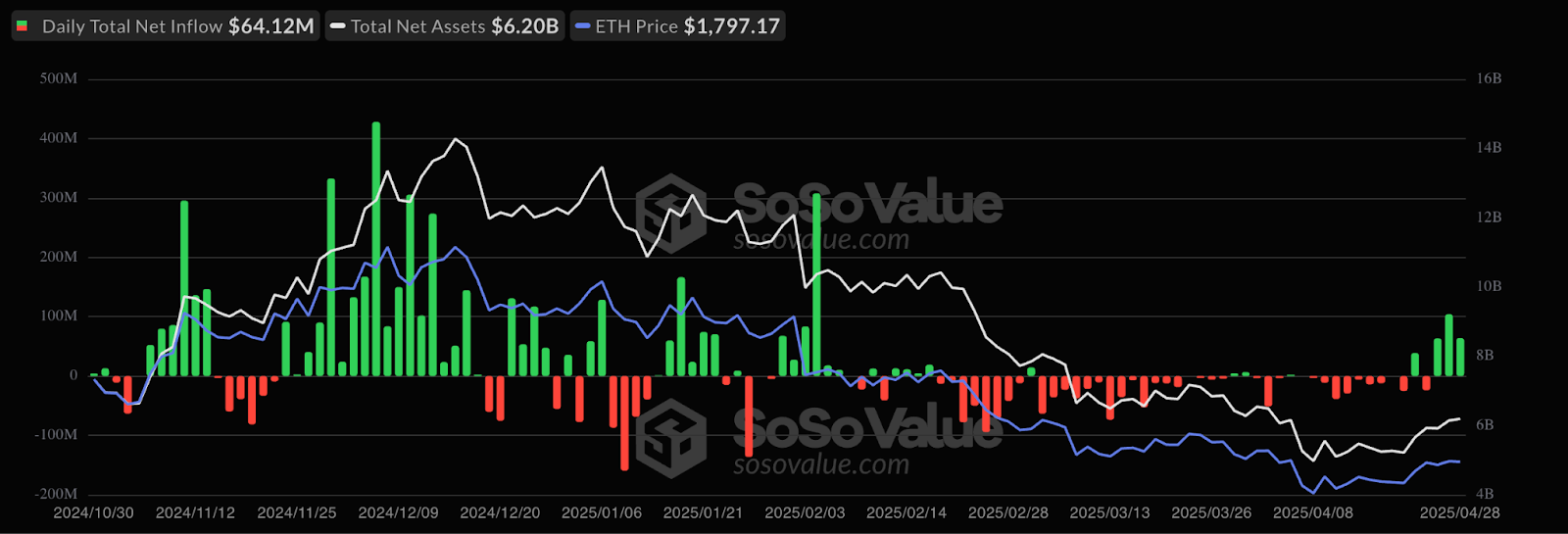

One element supporting Ether’s bull case is resurgent institutional need, shown by considerable inflows into area Ethereum exchange-traded funds (ETFs).

On April 28, Ethereum ETFs saw a net inflow amounting to $64.1 million. This followed inflows amounting to $151.7 million throughout the week ending April 25, the greatest considering that February 2025.

The boost in institutional need was strengthened by net inflows of $183 million into Ethereum financial investment items recently, ending an eight-week streak of outflows, as reported by CoinShares.

This pattern shows growing self-confidence amongst conventional financing gamers, as observed by market experts like CoinShares’ head of research study, James Butterfill, who kept in mind:

” Our company believe issues over the tariff effect on business profits and the significant weakening of the United States dollar are why financiers have actually turned towards digital possessions, which are being viewed as an emerging safe house.”

Institutional purchasing produces continual upward pressure on Ether’s rate by soaking up the readily available supply.

Strong Ethereum onchain activity is back

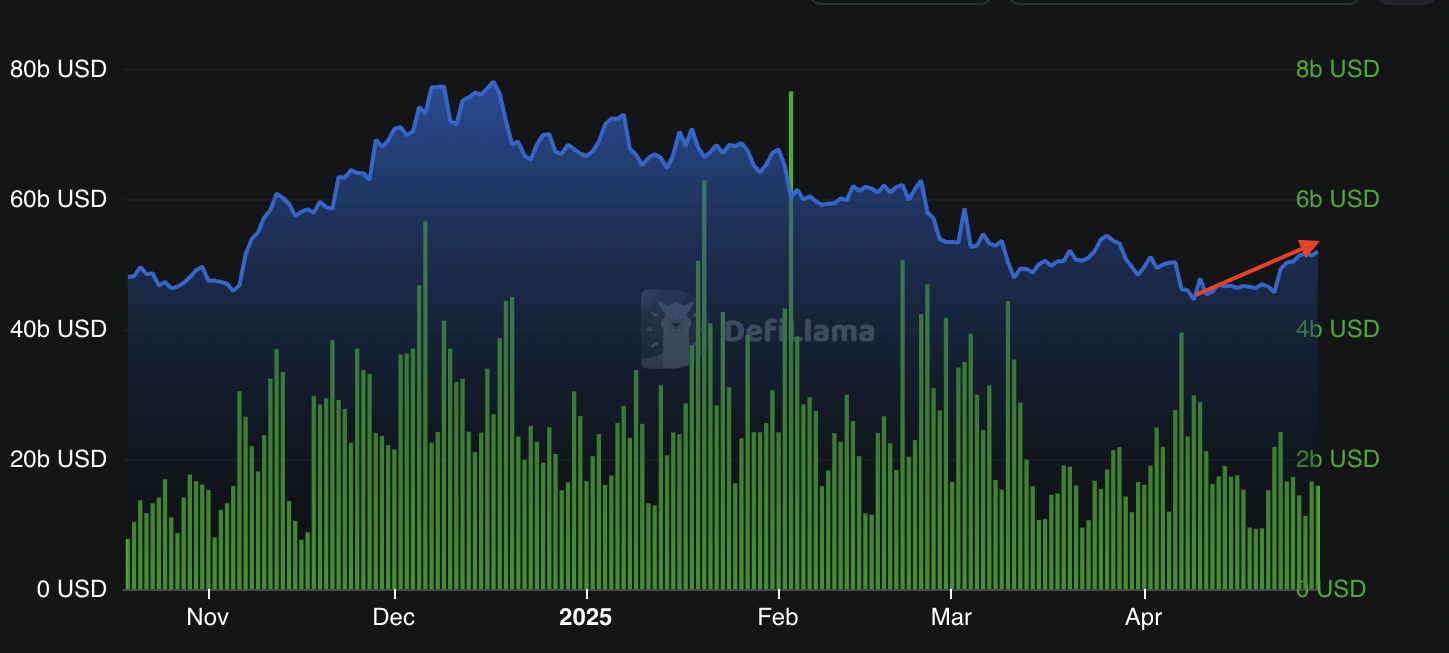

Ethereum stays the undeniable leading layer-1 blockchain with more than $51.8 billion in overall worth locked (TVL) on the network, according to information from DefiLlama. The chart listed below programs that Ethereum’s TVL has actually increased by roughly 16% over the last 7 days.

Aave was amongst the greatest entertainers in Ethereum deposits, with the TVL increasing 13.5% over 7 days. Other noteworthy boosts consisted of Lido (12%), EigenLayer (13%), and Ether.fi (12%).

Compared to other top-layer networks, the Ethereum network towers above its competitors in regards to TVL development in the everyday and weekly amount of time, other than SUI, which has actually seen a 47% boost in its TVL over the last 7 days.

Ethereum’s everyday DEX volumes have actually increased by more than 30% over the recently, to $1.65 billion. Nevertheless, this is substantially lower than the 78% and 44% boosts on SUI and Solana, respectively.

Related: Ethereum Structure mixes management, divides board and management

ETH rate bull flags targets $2,100

The ETH/USD set has a great chance of resuming its upward momentum regardless of the rejection at $1,860, as the chart reveals a timeless bullish pattern.

Ether’s rate action over the previous week has actually resulted in a bull flag pattern on the four-hour chart, as displayed in the figure listed below. A four-hour candlestick close above the flag’s upper limit at $1,800 on April 29 recommends the start of an upward relocation.

The flagpole’s height sets the target, which forecasts Ether’s rate climb to $2,100 or roughly a 15% boost from the present rate.

Another bullish indication is the relative strength index, which is moving within the favorable area at 60, recommending that the marketplace conditions still prefer the advantage.

As Cointelegraph reported, increased need from the $1,700 location (at the 20-day SMA) must work as a strong structure for ETH rate to reach the $2,110 level, ultimately peaking at $2,500.

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.