Secret takeaways:

-

Ethereum treasury business are resting on countless dollars of latent losses, raising issues about their sustainability.

-

Ethereum treasury business trading listed below NAVs signal wearing down self-confidence, possibly pushing ETH cost even more.

-

An ETH cost fractal mean $2,500 as the 200-week moving typical ends up being the last line of defense.

Ether (ETH) fell 30% over the previous 1 month, dropping listed below $3,000 to a four-month low of $2,806 on Thursday. Technical signs and institutional need are leaning bearish, increasing the chances of a more correction listed below $2,500.

Ether cost mirrors a 2022-era fractal

ETH cost is dealing with a four-week losing streak as a bearish fractal from 2022 tips a a much deeper correction for the altcoin. A market fractal is a repeated pattern that enables traders to recognize pattern turnarounds in the charts. Ether is presently painting a bearish fractal setup, at first observed in 2022.

Related: ETH falls under ‘purchase zone,’ however volatility-averse traders take a wait-and-see technique

The chart listed below shows that the pattern includes a sharp drop from its 2021 all-time high at $4,800, with the cost bottoming around the 200-week SMA.

The exact same circumstance is playing out in 2025, with the cost having actually dropped 41% from its existing all-time high of $4,955 reached in August. This recommends that a much deeper correction is the cards with the 200-week SMA at $2,450 being the last line of defense for bulls.

On the other hand, Ether’s incredibly pattern indication has actually sent out a “sell” signal on its weekly chart, an event that last caused a 66% drop in cost when it took place in March 2025.

A comparable verification in January 2022 was followed by an 82% cost drawdown, bottoming simply listed below the 200-week SMA, as displayed in the chart below.

If history repeats itself, ETH might see a much deeper correction to as low as $2,500, driven by reduced institutional need and subsiding onchain activity.

Ethereum treasury business are undersea

Ether’s sharp pullback has actually pressed the typical Ethereum treasury business into the red, leading to countless paper losses.

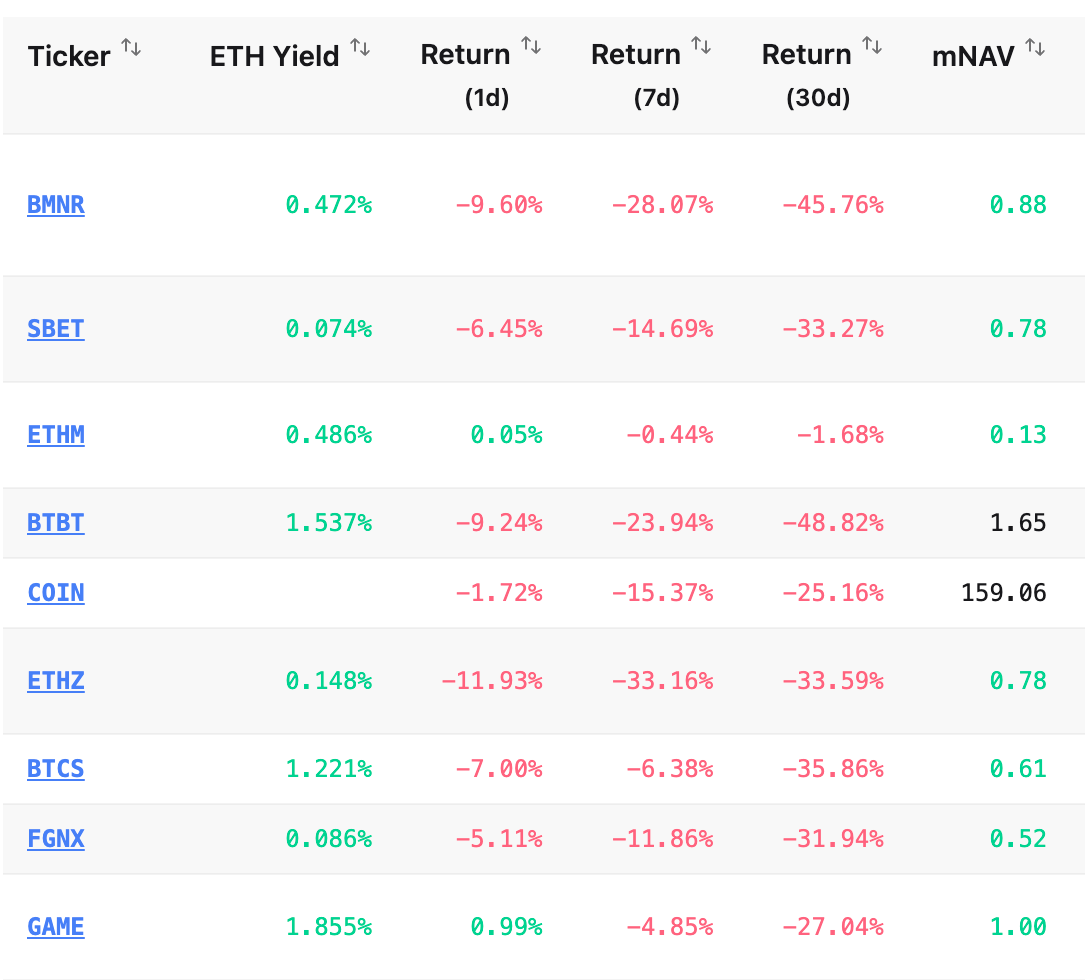

Information from Capriole Investments reveals that these business have actually seen unfavorable returns of in between 25% to 48% on their ETH holdings. The leading 10 DAT business are now at a loss in the weekly and everyday timespan, as displayed in the chart below.

BitMine Immersion Technologies, holding 3.56 million ETH (2.94% of the distributing supply), has actually seen a -28% and -45% return on its financial investments over the last 7 days and 1 month, respectively.

BitMine is presently down $1,000 per acquired ETH, suggesting a cumulative latent loss of $3.7 billion on its overall holdings.

LATEST: BitMine is resting on a $3.7 B latent loss from its enormous $ETH position.

Will we see more DATs emerge in the coming months regardless of the dangers? pic.twitter.com/11V5YZT2qO

— Cointelegraph (@Cointelegraph) November 20, 2025

SharpLink, The Ether Maker and Galaxy Digital likewise rest on millions in losses, down 50% to 80% from their annual highs.

Capriole Investments’ information likewise reveals that the marketplace Worth to Net Property Worth (mNAV)– a metric utilized to examine the evaluation of digital possession treasuries– of the majority of these business has actually plunged listed below 1, signifying an impaired capital-raising capability.

Information from StrategicETHreserve.xyz shows that cumulative holdings of tactical reserves and ETFs have actually come by 280,414 ETH given that Nov. 11.

As Cointelegraph reported previously, worldwide exchange-traded items, consisting of United States area Ether ETFs, experienced the biggest weekly outflows given that February, strengthening the ongoing decrease in institutional need for ETH.

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.