Secret takeaways:

-

An Ethereum whale protected a $9.87 million revenue after simply 2 week.

-

ETH’s RSI is signifying a possible short-term correction towards $3,000.

-

In spite of profit-taking, long-lasting holders are revealing continual bullish conviction.

A prominent Ethereum whale secured an almost $10 million revenue after dumping a significant piece of their Ether (ETH) holdings. The profit-taking took place as Ether ended its eight-day winning streak by tipping over 3% on Tuesday.

Ethereum whale ‘0x8C08’ exits with 38% gains

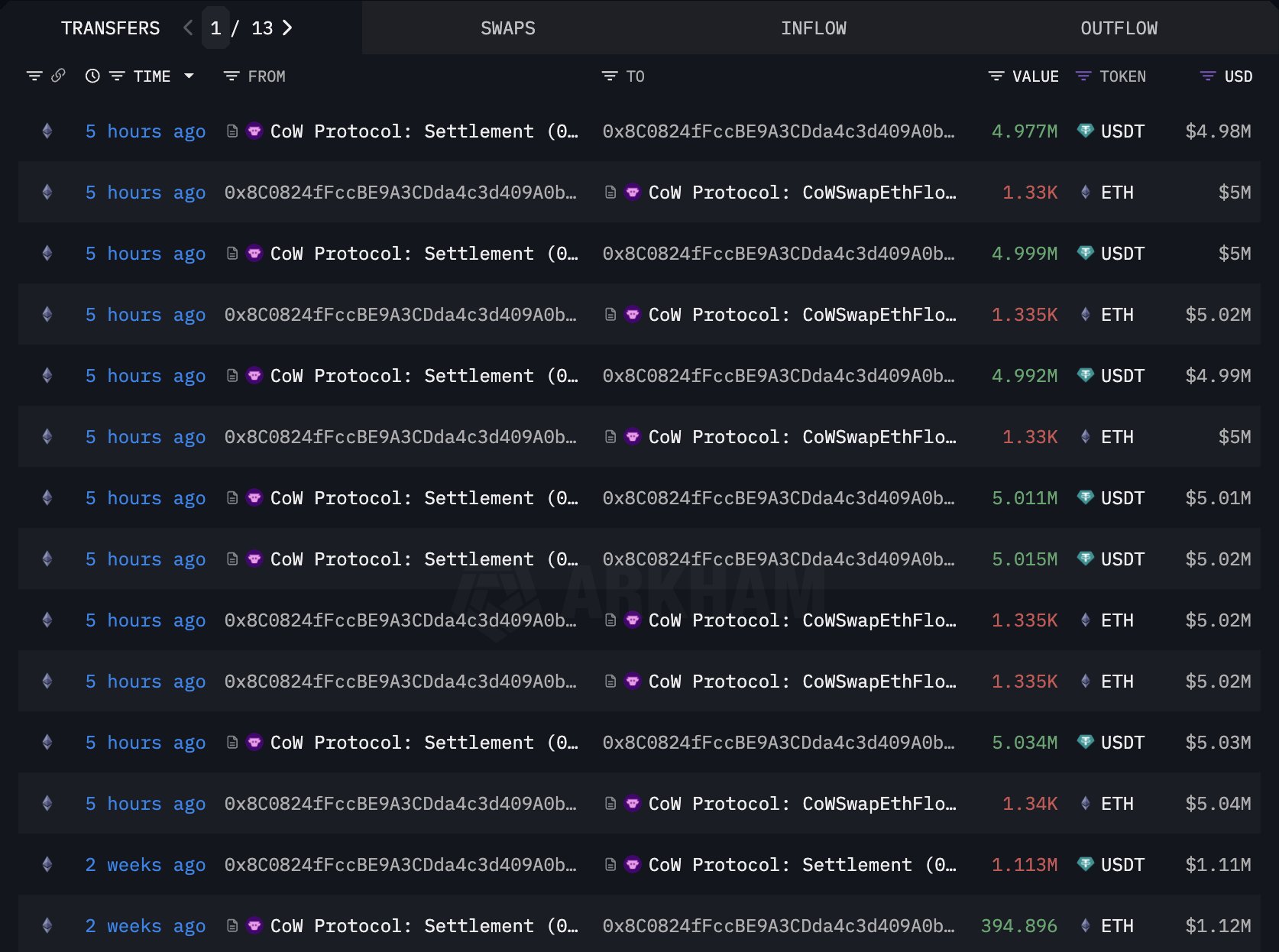

On Tuesday, Ethereum address “0x8C08 …” unloaded 8,005 ETH for about $30.03 million, at a typical rate of $3,751, according to information resource Lookonchain.

The whale at first collected 9,582 ETH simply 2 weeks prior at a typical entry of $2,725, totaling up to a financial investment of $26.11 million. The current sale yielded a $9.87 million revenue, marking a 38% return in under 2 week.

The wallet still keeps 1,577 ETH (worth around $5.96 million), recommending a tactical partial exit instead of a total liquidation.

It likewise recommends that the whale anticipates Ethereum’s bullish momentum to continue, having actually currently gotten more than 50% month-to-date (MTD).

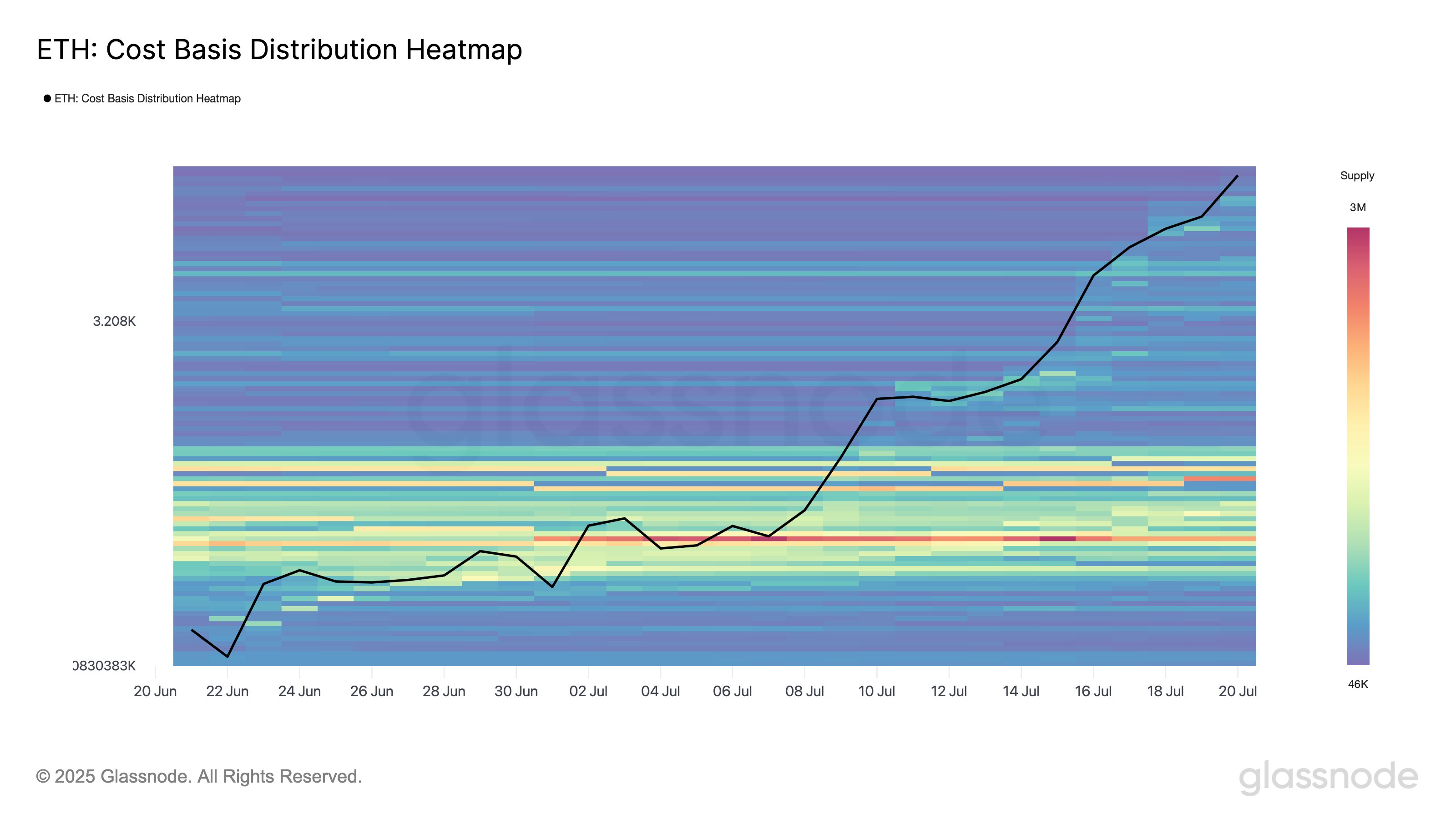

Extra proof of tactical profit-taking originates from Glassnode’s “Expense Basis Circulation Heatmap,” which highlights clusters of purchasing based upon the typical acquisition rate.

The red band around the $2,520 level, representing high-volume purchasing in early July, has actually faded just recently.

This visual shift indicates that a number of these holders, now resting on substantial latent gains, have actually started to secure revenues.

Wallets in this rate variety continue to hold almost 2 million ETH, showing that a lot of holders are not offering.

As kept in mind by Glassnode, this habits recommends that fresh need is efficiently taking in the sell-pressure, an indication of likely long-lasting bullish conviction instead of circulation.

Ethereum overbought correction targets $3,000

Ethereum’s eight-day winning streak has actually pressed its 14-day RSI into overbought area, now near 78.

Historically, such readings have actually preceded short-term pullbacks, as seen in late Might, when ETH remedied 18.6% after a comparable RSI spike.

An equivalent circumstance is now unfolding. The very first indications of cooling emerged on Tuesday, with ETH drawing back from its regional high near $3,800.

The rate might review the $3,000–$ 3,200 variety by August if momentum fades even more. This variety accompanies the 20-day rapid moving average (20-day EMA; the purple wave), a crucial assistance level.

An approach $3,000 would still put Ethereum easily above its multi-year rising trendline, as revealed on the weekly chart.

As long as ETH holds above its multi-year rising trendline, the rate structure stays beneficial for ongoing benefit.

Related: Cathie Wood offers Coinbase, Roblox shares for Tom Lee’s ETH company

That might permit a duration of reaccumulation before trying an approach the $3,800–$ 4,100 resistance location and beyond. Some experts expect the ETH rate to reach $8,000 in the coming months.

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.