Secret takeaways:

-

An Ethereum whale opened a $11.15 M leveraged long position simply as ETH broke out of a bull flag.

-

ETH’s rate rose above $2,850, pressing the whale’s trade into a $366K latent revenue.

-

Ethereum alternatives alter turned dramatically unfavorable, showing growing bullish trader positioning.

A high-stakes Ether (ETH) long trade is making waves simply as the cryptocurrency breaks out of an essential technical pattern, sustaining expectations of a 30% rate rally towards $3,670.

$ 11M leveraged ETH long signals bullish belief

On June 10, an Ethereum whale opened a $11.15 million long position on ETH with 25x take advantage of, totaling up to a 4,000 ETH wager positioned at an entry rate of $2,758.35.

Ether rate reached around $2,850 on June 11, driven greater by hopes that the Federal Reserve would cut rates of interest following the cooling inflation information.

The ETH rate increase sent out the whale’s position into a much deeper revenue area. At existing levels, the whale is resting on a latent gain of around $366,600.

The position brings a liquidation rate of $2,466, providing a reasonably tight margin for mistake however likewise highlighting high conviction in the upside relocation.

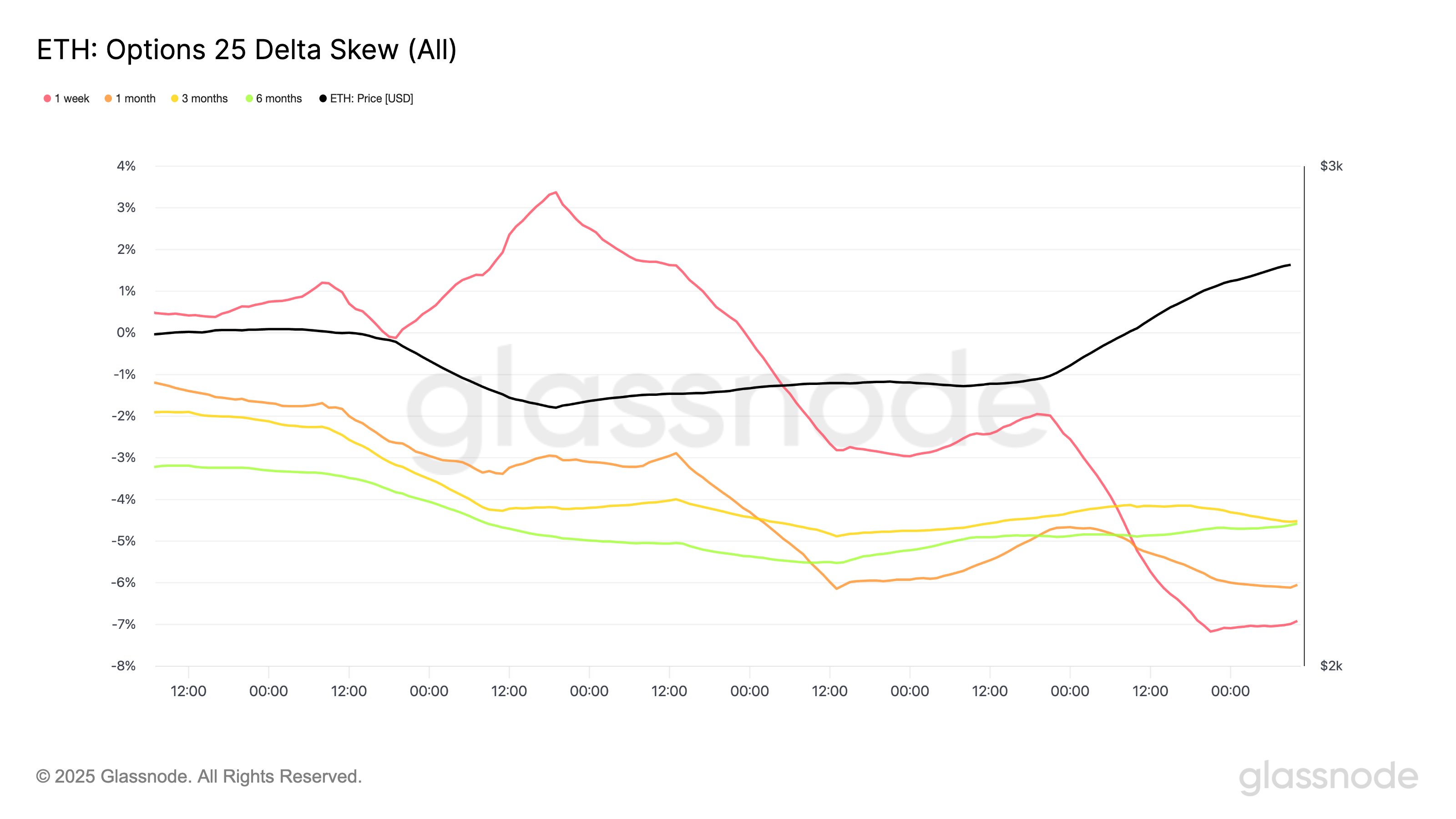

Ethereum alternatives information: traders are short-term bullish

Ethereum’s alternatives market has actually turned decisively positive in the previous two days.

The 25-delta alter, which determines the distinction in rates in between bullish calls and bearish puts, has actually moved dramatically lower considering that June 9.

The 1-week alter dropped from -2.4% to -7.0%, while the 1-month alter decreased from -5.6% to -6.1%, according to Glassnode information.

Such a deepening unfavorable alter shows increasing need for short-dated call alternatives, recommending that traders are progressively placing for near-term advantage.

Ethereum bull flag breakout raises 30% rally capacity

ETH’s rate has actually risen more than 100% over the previous 2 months, driven mostly by Ethereum’s Pectra upgrade in early Might and its core structure’s restructuring in early June.

On June 9, Ether broke above what seems a bull flag pattern, followed by an ongoing boost in rates and volumes.

The breakout and increasing trading volume show strong trader conviction that ETH rate might rally towards the bull flag target of around $3,670, up 30% from existing levels by June’s end.

Related: Ethereum network development, area ETH ETF inflows and rate gains draw brand-new financiers

Numerous experts, consisting of Requirement Chartered, are more considering an ETH rate approach $4,000 in 2025. Some fractal analyses, with one associated to gold, even forecast the cryptocurrency to strike $5,000-6,000 in the coming months.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.