Ether whales continued to purchase the cryptocurrency in droves, according to onchain experts, as ETH recuperates from a weekend dip.

” Someone is purchasing a lots of ETH,” blockchain analytics firm Arkham Intelligence stated on Sunday, with one address building up $300 million worth of Ether (ETH) from over the counter (OTC) trading at Galaxy Digital.

The whale address presently holds 79,461 ETH, worth around $282.5 million.

BlackRock has actually likewise been filling up on ETH, with the company’s iShares Ethereum Trust ETF seeing $1.7 billion in inflows over the previous 10 successive trading days.

Onchain holdings of Ether in exchange-traded funds have actually gone vertical over the previous month, rising by more than 40% over the previous one month, according to Dune Analytics.

ETH mega whales filling up

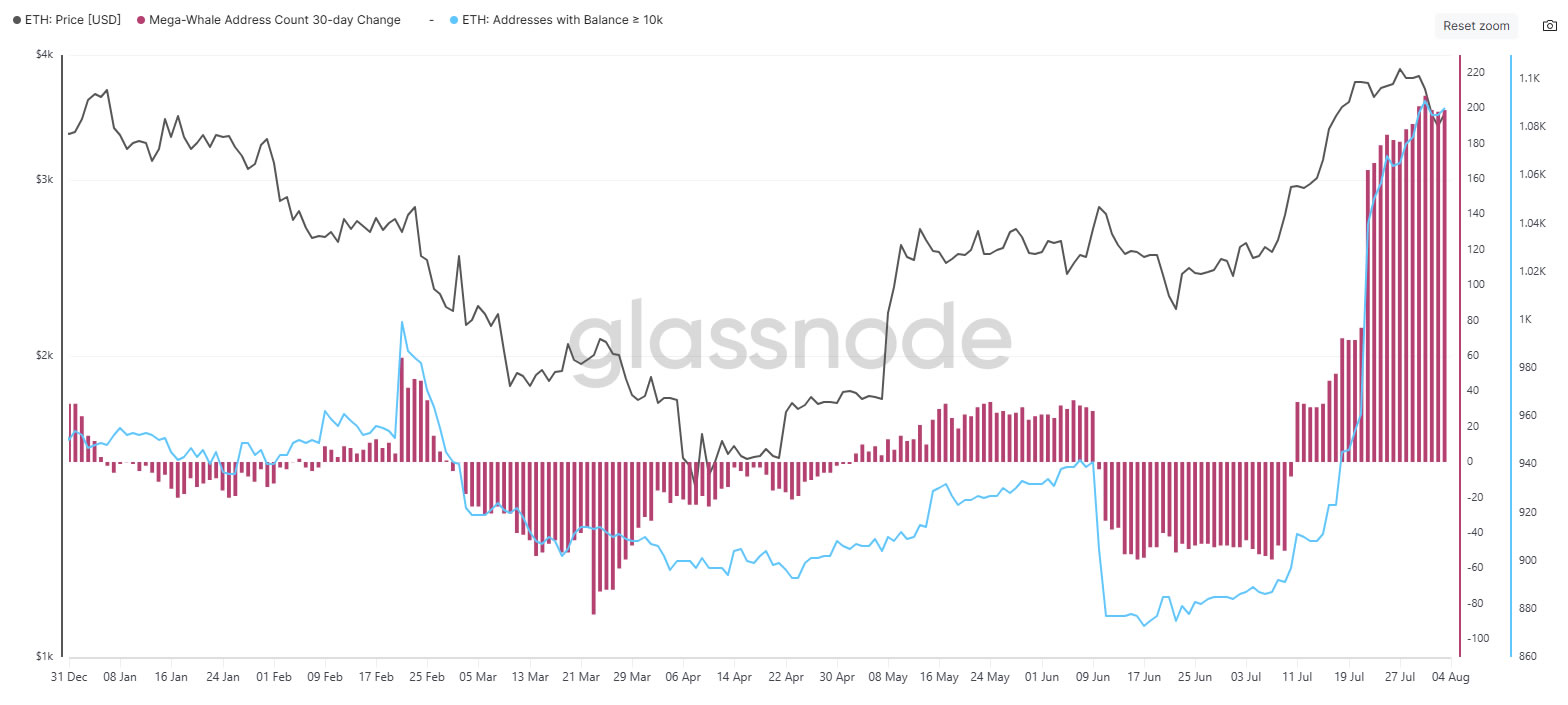

The Ether “mega whale” address count has actually likewise risen over the previous one month, according to Glassnode.

The mega whale mate is specified by addresses holding more than 10,000 ETH, with more than 200 included because the start of July.

These whale address counts consist of those held by exchanges, big custodians and exchange-traded items, which have actually been strongly building up.

ETH currently recuperating

Ether rates cooled down over the weekend with a dip listed below $3,400, however revealed indications of healing on Monday by recovering $3,560.

Related: Ethereum ‘mega whales’ are stacking more difficult than pre-95% rally in 2022

” While the labor market’s cooling pattern at first startled financiers, the increased probability of financial alleviating might quickly reverse the sell-off, providing crypto a bullish tailwind as liquidity expectations shift,” director of tactical collaborations at the CoinW exchange, Monika Mlodzianowska, informed Cointelegraph.

Ether bearish in August

Comparable to Bitcoin, which has actually been bearish in 8 out of the previous 12 months of August, Ether has actually seen losses over the previous 3 years in August.

The property fell by double digits in August 2023 and 2024, however rose a tremendous 35.6% throughout August 2021, which was a booming market year, according to CoinGlass.

Over the weekend, Eric Trump, the child of United States President Donald Trump, informed his X fans to purchase the ETH dip.

On the other hand, CNBC identified Ethereum “Wall Street’s unnoticeable foundation” in a post on Saturday.

Publication: China buffoons United States crypto policies, Telegram’s brand-new dark markets: Asia Express