Ethereum build-up addresses have actually seen a rise in everyday inflows because Friday, recommending growing self-confidence in Ether’s (ETH) long-lasting cost trajectory in spite of its most current drop listed below $2,000.

Secret takeaways:

-

Ether’s drop listed below $2,000 has actually left 58% of addresses with latent losses.

-

Build-up addresses have actually taken in about $2.6 billion in ETH over 5 days.

-

Secret Ether levels to view listed below $2,000 consist of $1,800, $1,500, $1,200, and possibly $1,000-$ 750 in severe situations.

58% of Ether addresses are now at a loss

Ether’s 38% drop over the last month has actually seen it fall listed below essential assistance levels, consisting of the typical entry cost of build-up addresses, the expense basis of area Ethereum ETF financiers, and the mental level at $2,000.

The ETH/USD set now trades 60.5% listed below its all-time high of $4,950, leaving a substantial part of holders undersea. This consists of BitMine, the world’s biggest Ethereum treasury connected to financier Tom Lee, which saw its paper losses swell to over $8 billion.

Related: Big need zone listed below $2K ETH cost offers signal on where Ether might go

With ETH trading at $1,954 on Wednesday, just 41.5% Ethereum addresses remain in earnings, while over 58% remain in the red.

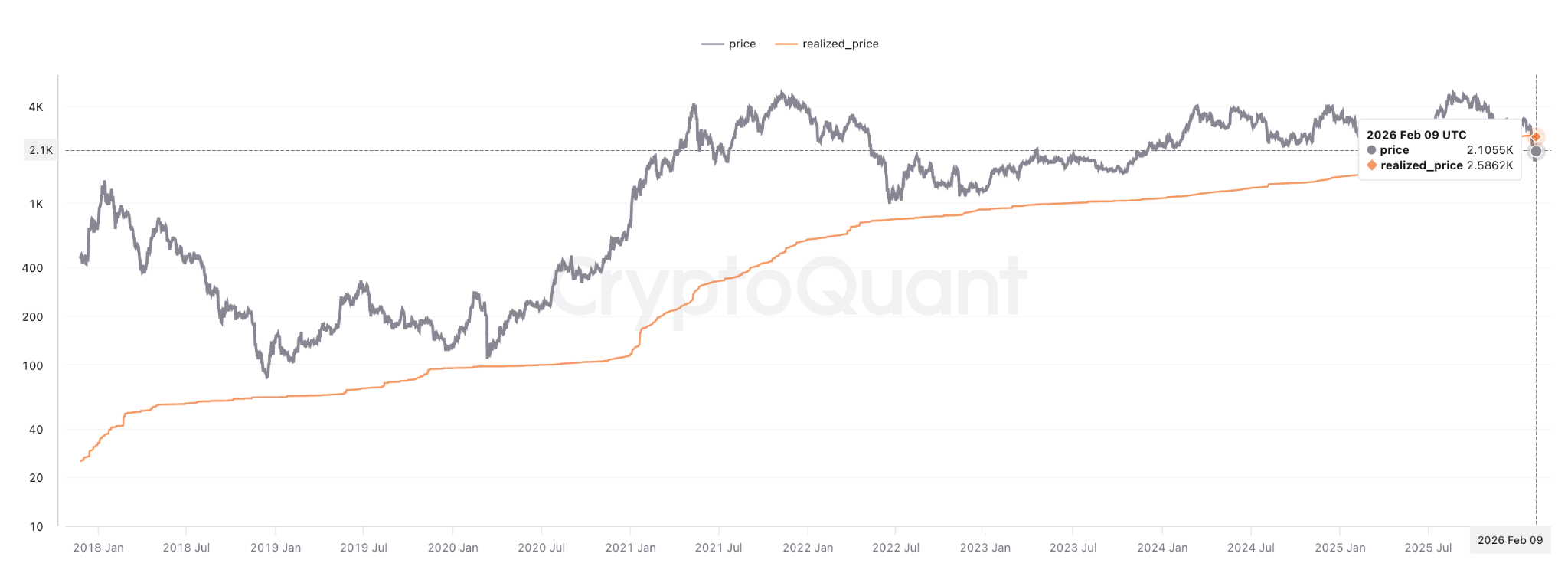

Ether’s existing market value is likewise listed below the typical expense basis of build-up addresses presently at $2,580, recommending that long-lasting holders are progressively under stress.

ETF financiers are likewise feeling the pressure. James Seyffart, senior ETF Expert at Bloomberg, highlighted that Ethereum ETF holders are presently in an even worse position than their Bitcoin equivalents.

With ETH hovering listed below $2,000, the altcoin trades well listed below the approximated typical ETF expense basis of about $3,500.

Ether build-up soaks up 1.3 million ETH in 5 days

Regardless of the sharp recession, financier self-confidence has actually not completely worn down. Information from CryptoQuant revealed Ethereum build-up addresses have actually gotten 1.3 million Ether worth about $2.6 billion at existing rates.

The “full-blown build-up” of ETH started in June 2025, and is “continuing a lot more strongly,” CryptoQuant expert CW8900 stated in Wednesday’s Quicktake analysis, including:

” The existing cost will likely appear appealing to $ETH whales.”

As an outcome, the overall ETH held by these long-lasting holders has actually reached a record 27 million. That marks a 20.36% gain up until now in 2026 in spite of the ETH cost decreasing 34.5% over the very same duration.

Build-up addresses are wallets that continually get ETH without making any outbound deals. They might come from long-lasting holders, institutional financiers, or entities tactically building up Ether instead of actively trading.

Big spikes in inflows to these addresses typically indicate strong self-confidence in Ether’s long-lasting capacity, with previous patterns revealing that such rises often precede cost rallies.

For instance, on June 22, 2025, Ethereum build-up addresses taped a then-all-time high everyday inflow of over 380,000 ETH. Almost thirty days later on, ETH’s cost increased by practically 85%. A 25% cost rally followed November 2025’s inflow spike into the build-up addresses.

Secret ETH cost levels to view listed below $2,000

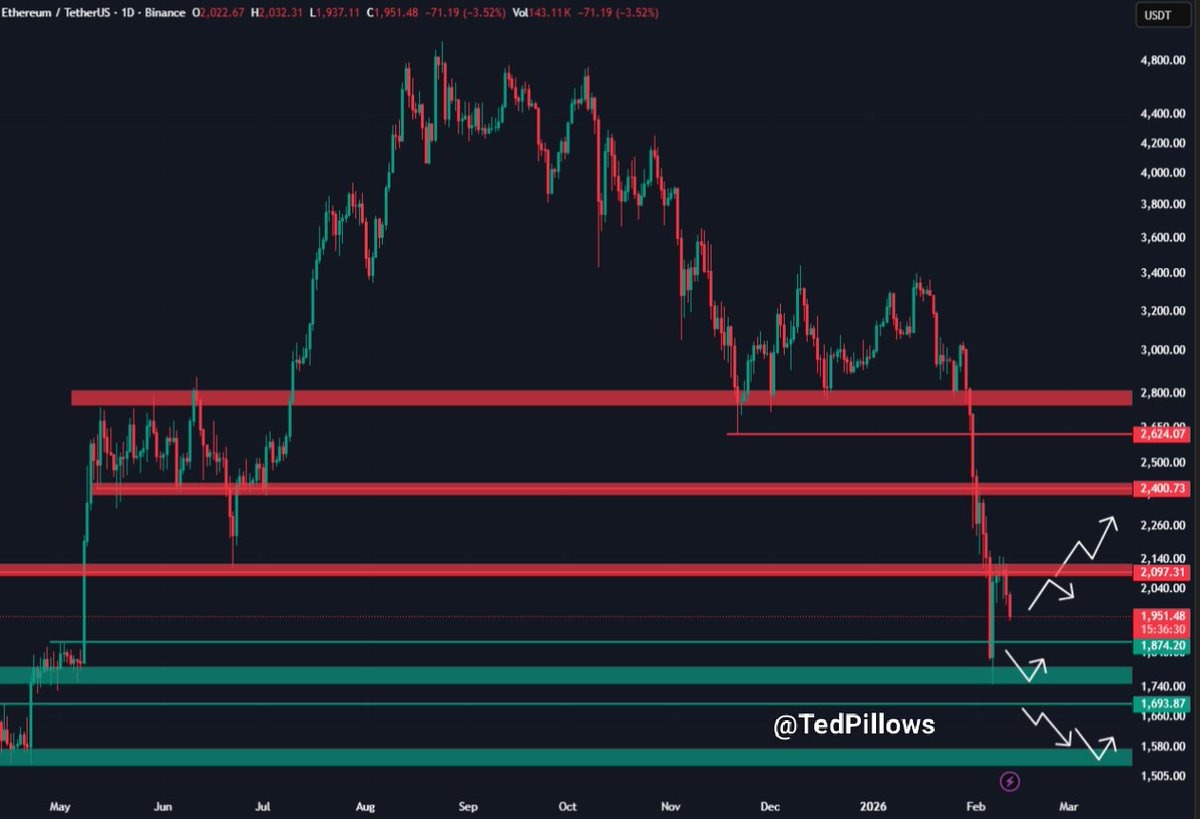

The ETH/USD set extended its losses listed below $2,000, a crucial assistance level, which the bulls should recover to avoid more drawback.

“$ ETH stopped working to hold above the $2,000 level and is now decreasing,” crypto expert Ted Pillows stated in an X post on Wednesday, including:

” The next essential level is around the $1,800-$ 1,850 level if Ethereum does not recover the $2,000 level quickly.”

Fellow expert Crypto Thanos shares comparable views, informing fans to “prepare yourself” for a $1,500 ETH cost if $2,000 is not recovered by the end of the week.

Zooming out, LadyTraderRa stated Ether is “certainly going” to retest the $750-$ 1,000 zone, based upon previous cost action on the regular monthly candle light chart.

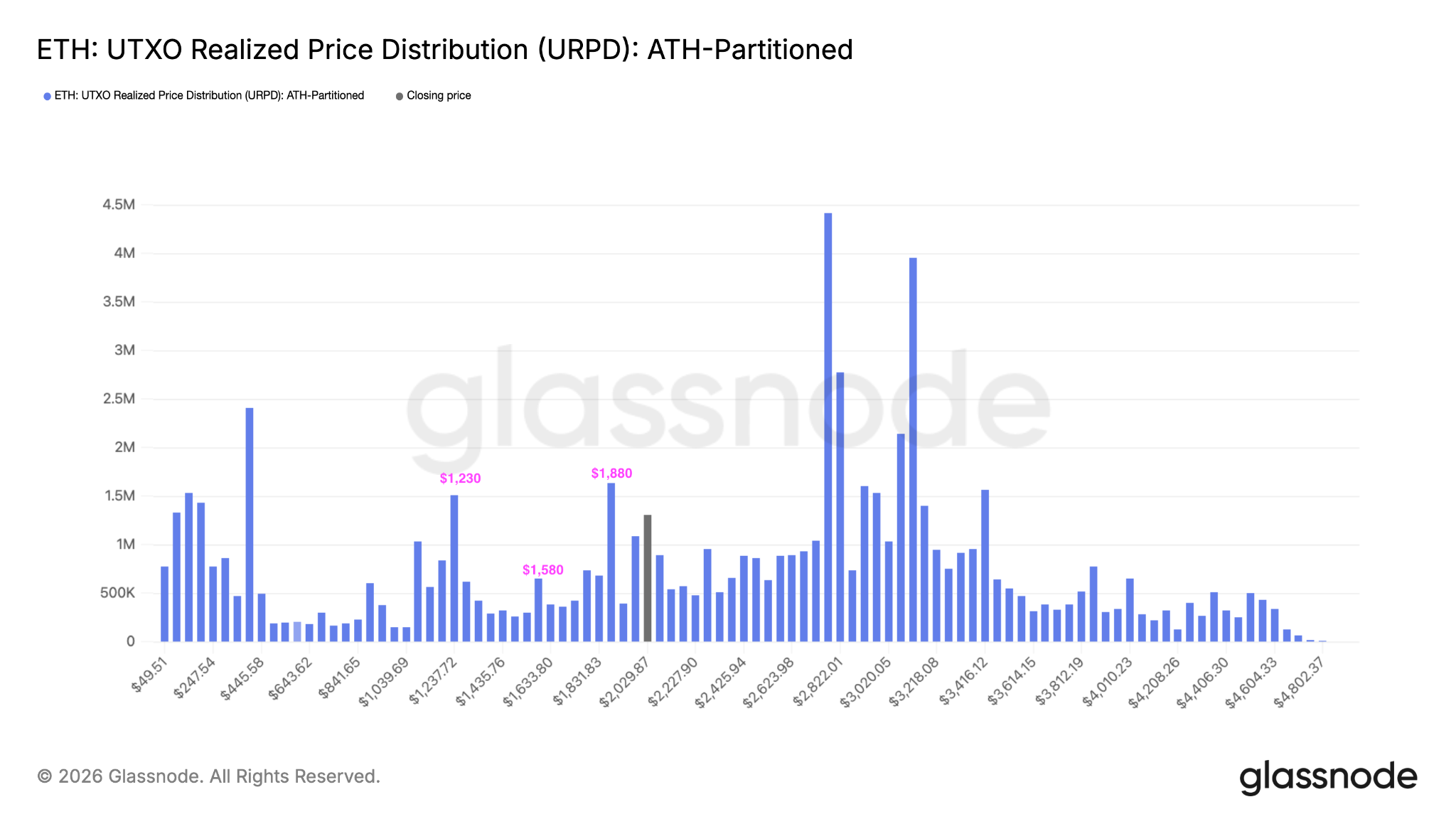

Glassnode’s UTXO recognized cost circulation (URPD), which reveals the typical costs at which ETH holders purchased their coins, exposes that listed below $2,000, essential assistance levels for ETH sit at $1,880, $1,580 and $1,230.

As Cointelegraph reported, the ETH/USD set might drop to $1,750 and after that $1,530, after stopping working to hold above $2,100.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we aim to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might consist of positive declarations that go through threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage developing from your dependence on this info.