Secret takeaways:

-

Ethereum presently hosts $201 billion in tokenized possessions, which is almost two-thirds of the worldwide overall of $314 billion.

-

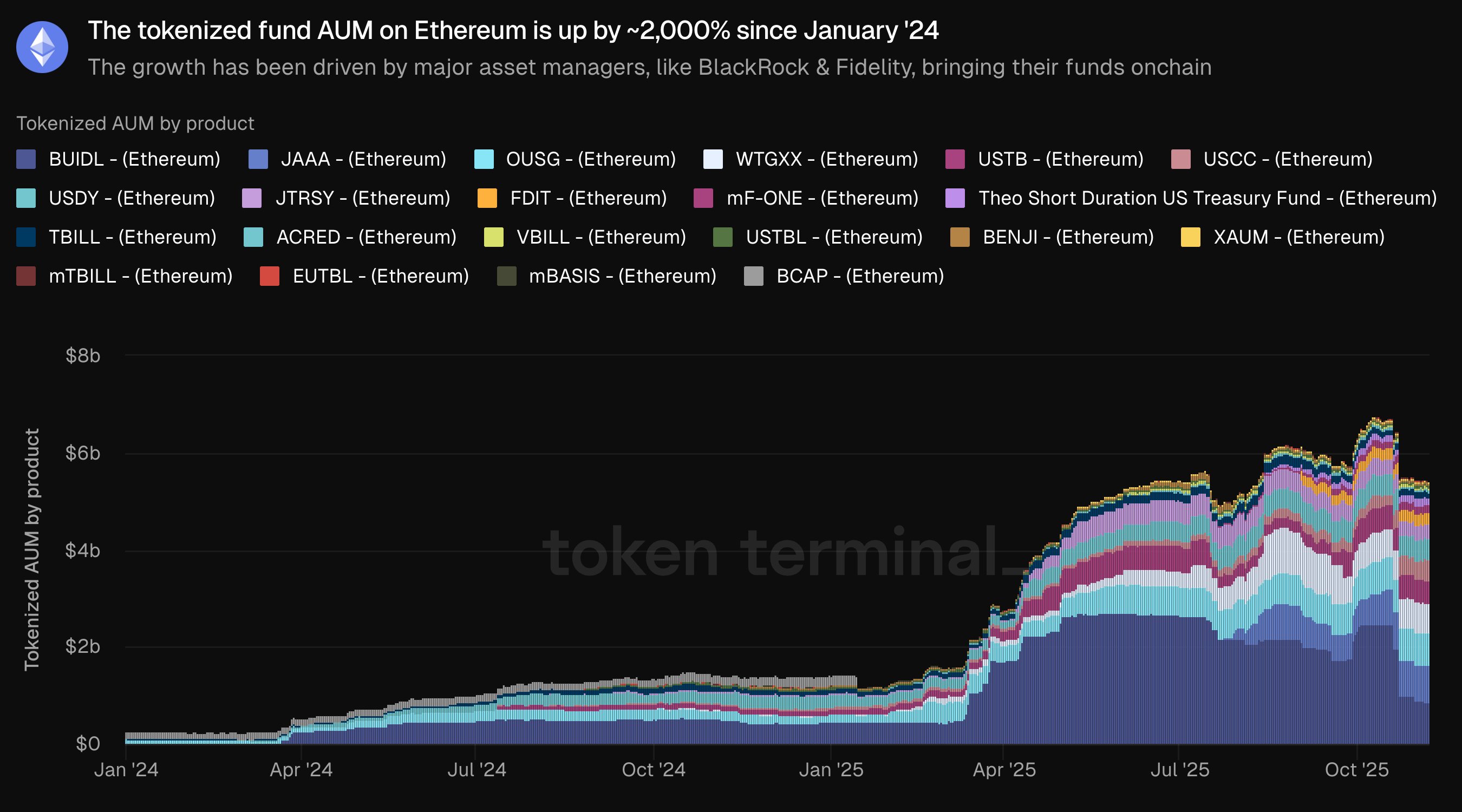

Institutional development led by BlackRock and Fidelity has actually driven a 2,000% rise in onchain fund AUM given that 2024.

-

ETH exchange supply struck an annual low, meaning financier build-up and a more powerful market flooring.

Ethereum’s growing supremacy in the tokenized property landscape is improving how financiers value its network basics and its native token, Ether (ETH). Since Nov. 11, tokenized possessions throughout all blockchains total up to approximately $314 billion, with Ethereum accounting for $201 billion, almost two-thirds of the marketplace. This highlighted its part as the most made use of settlement layer in crypto in 2025.

Stablecoins continue to form the foundation of Ethereum’s network economy, representing the huge bulk of deal activity. Integrated USDT and USDC issuance on Ethereum has actually sustained deep liquidity swimming pools throughout DeFi, cross-border payments, and exchanges, assisting the network keep among the greatest deal throughputs in the market.

The growth extends beyond stablecoins. Tokenized fund property under management (AUM) on Ethereum has actually risen by almost 2,000% given that January 2024, driven by institutional entrants like BlackRock and Fidelity bringing conventional financial investment items onchain.

Fidelity Digital Assets kept in mind that, “beyond Bitcoin and Ethereum, a few of the most notable advancements in digital possessions are occurring in stablecoins and tokenized real-world possessions (RWAs).”

The company highlighted that stablecoins have actually ended up being a worldwide circulating medium, processing $18 trillion in volume over the previous 12 months, even going beyond Visa’s yearly throughput of $15.4 trillion.

On The Other Hand, RWAs have actually become Ethereum’s fastest-growing classification. Tokenized treasuries, funds, and credit instruments on Ethereum now amount to $12 billion, representing 34% of the $35.6 billion worldwide RWA market. Procedures such as Ondo, Centrifuge, and Maple are sustaining the rise by using yields of 4– 6% on tokenized United States Treasury direct exposure and guaranteed financing items.

Analytics platform Token Terminal kept in mind that this growth efficiently anchors Ethereum’s $430 billion market capitalization to concrete onchain energy, keeping in mind that, “the marketplace cap of tokenized possessions on Ethereum has actually set the flooring for ETH’s market cap.”

Related: BitMine got 34% more ETH recently as rates dipped

ETH exchange supply indicate a bullish setup

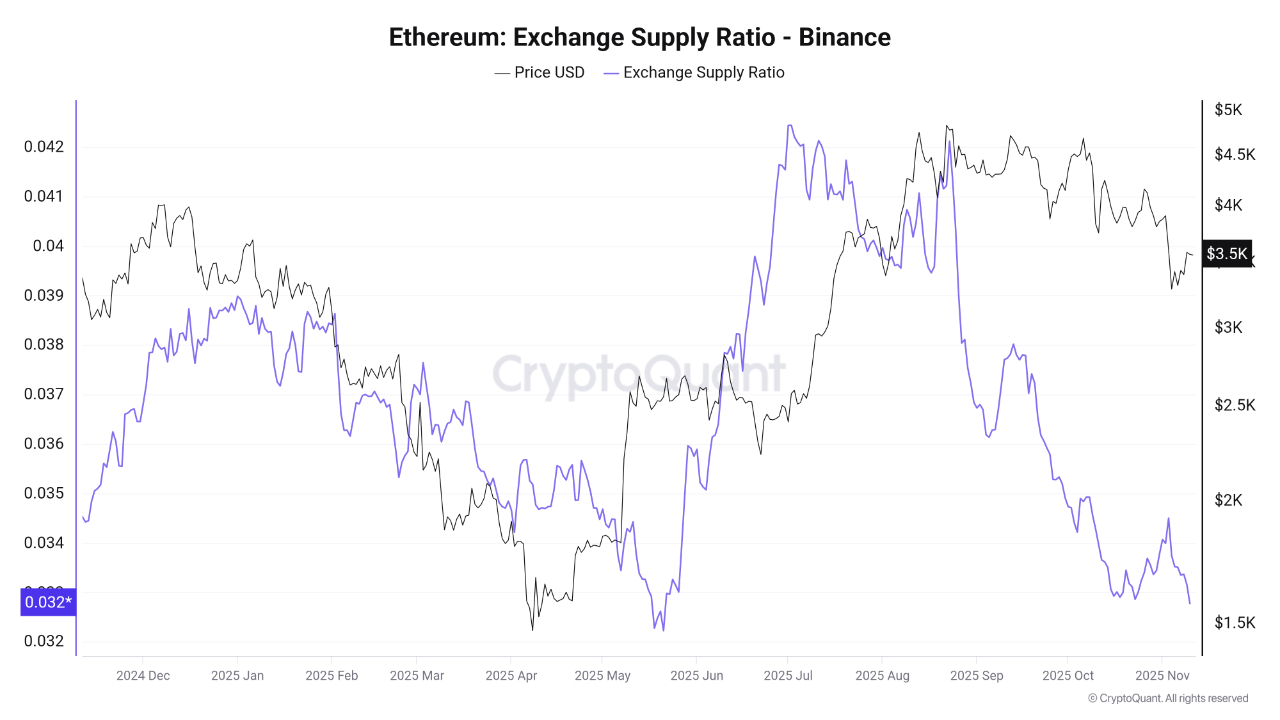

Information from CryptoQuant explained that Binance, the biggest Ether trading place by volume, suggested that ETH exchange supply has actually decreased greatly given that mid-2025, striking its most affordable level given that Might 2024. After peaking in early summer season, supply fell constantly through November, reaching around the 0.0327 level.

This relentless outflow signals coins moving into freezer or long-lasting wallets, a habits usually connected with build-up stages. Remarkably, this decrease in exchange balances accompanied Ether’s rate peaking near $4,500 to $5,000 in August and September before backtracking to around $3,500 presently.

Experts kept in mind that a decreased supply on exchanges tends to minimize sell pressure, possibly setting the phase for rate stabilization or restored upside if financier danger hunger enhances.

Related: Ethereum holders back in revenue as ETH rate get ready for $4K breakout

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.