Secret takeaways:

-

Lower network charges and slowing blockchain use continue to weigh on ETH’s efficiency regardless of Ethereum’s institutional supremacy.

-

Ether’s healing depends upon more powerful onchain activity, clearer upgrade advantages, and restored inflows from tactical reserve business.

Ether (ETH) has actually had a hard time to retake the $4,000 level last seen on Oct. 29. Ever since, every burst of bullish momentum has actually faded rapidly, leaving traders questioning what’s limiting Ether’s efficiency regardless of Ethereum’s supremacy in deposits and its strong institutional need.

An essential factor financiers hold Ether is the staking yield and its function as a source of calculating power for information processing. As such, a broad downturn in blockchain activity naturally puts pressure on rates, even if the previous activity was driven by memecoin launches and speculative trading, both of which are unforeseeable and unsustainable with time.

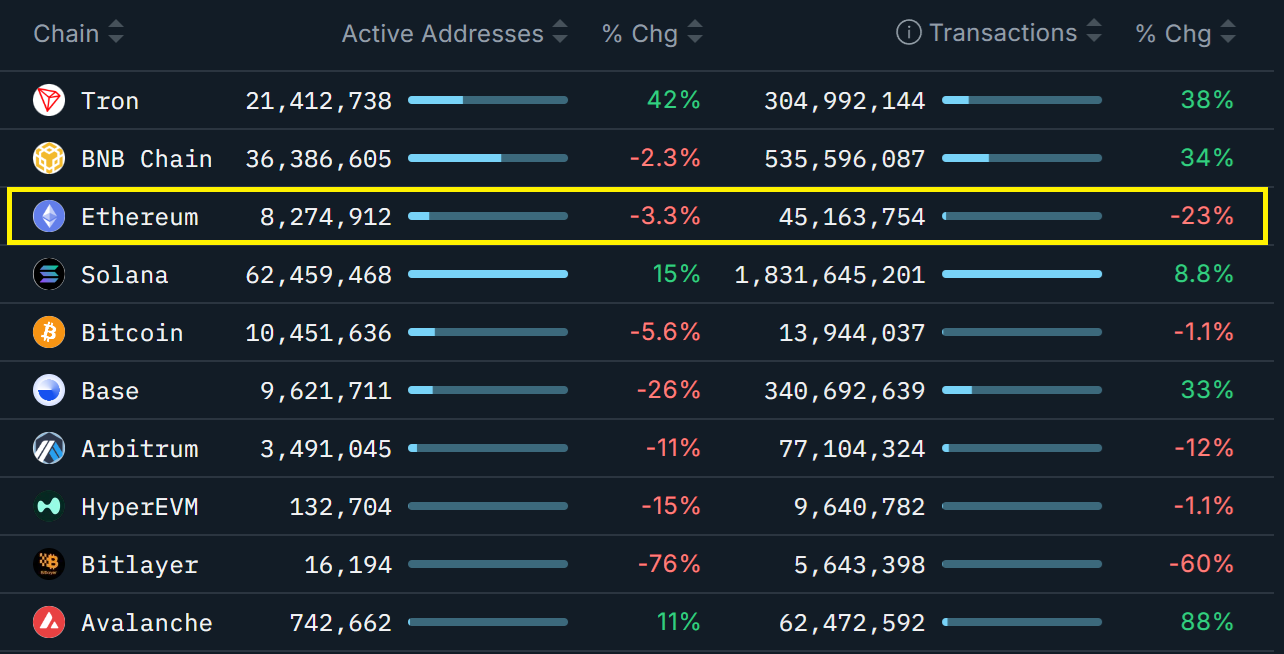

Ethereum has actually seen a 23% reduction in deals over the previous thirty days, with the variety of active addresses falling by 3%. By contrast, deals on Tron and BNB Chain increased by a minimum of 34% in the very same duration, while Solana’s active addresses increased by 15%.

Rivals that are normally considered as more central presently use lower charges and a smoother user experience. For ETH to restore resilient bullish momentum, the Ethereum network requires to boost how decentralized applications connect with wallets and decrease friction in bridge use.

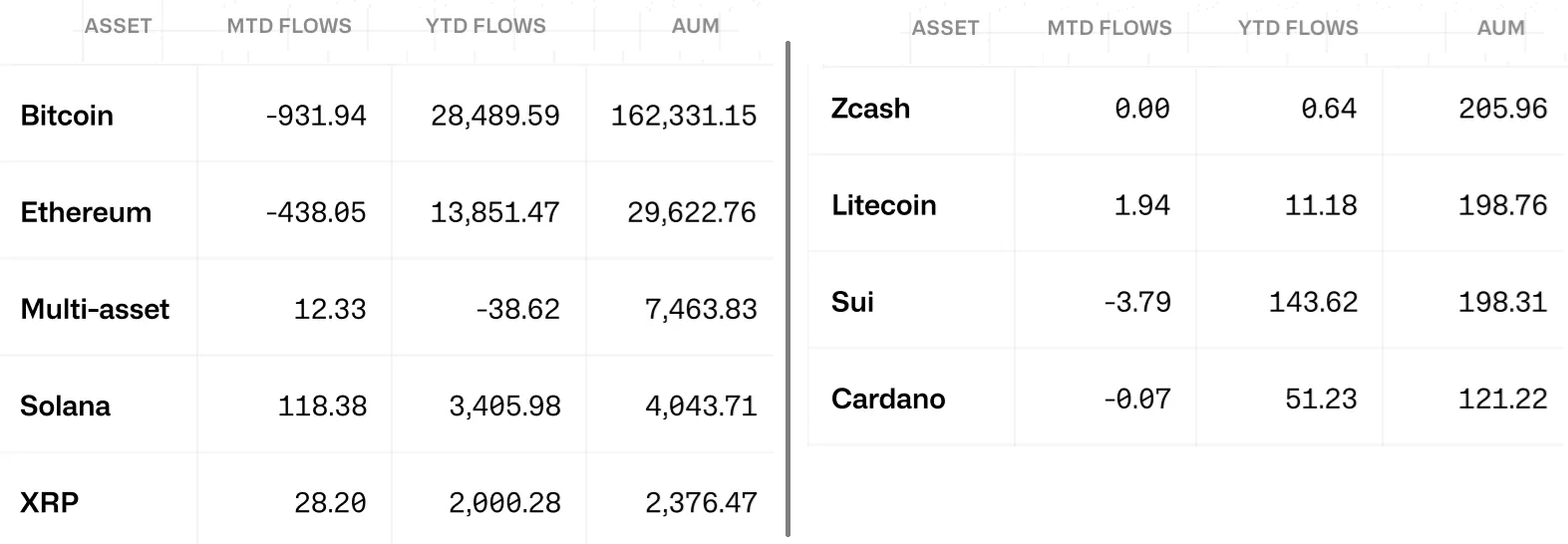

The Ethereum area exchange-traded fund (ETF) released in the United States in mid-2024, approximately 16 months ahead of completing altcoins. Following the effective launching of Solana ETF in the United States, traders now fret that competitors for institutional capital will magnify as XRP (XRP), BNB (BNB), and Cardano (ADA) get in the marketplace.

Inflows into Ethereum exchange-traded items sustained Ether’s 140% rally in the 100 days leading up to Aug. 9, when ETH reached $4,200 for the very first time because December 2021. A prospective rotation out of Ether might straight threaten its bullish momentum.

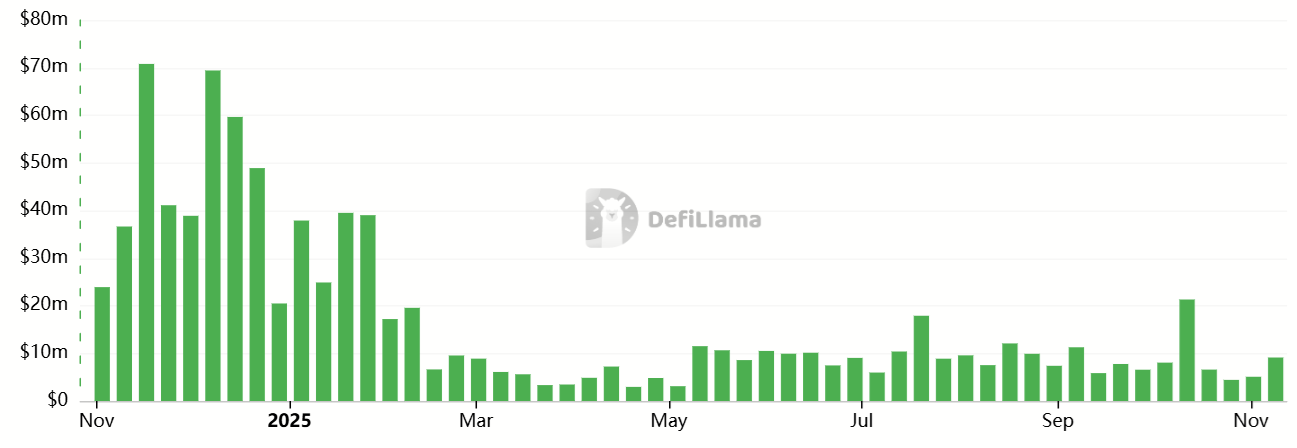

Ethereum network charges have actually plunged 88% because peaking at $70 million each week in late 2024, putting down pressure on staking yields. Financiers are now looking for clearness on the advantages anticipated from the upcoming Fusaka upgrade. While boosted information processing through layer-2 rollups is welcome, there stays little openness on how ETH holders will eventually benefit.

Traders question Ethereum’s supremacy will enhance DApp earnings

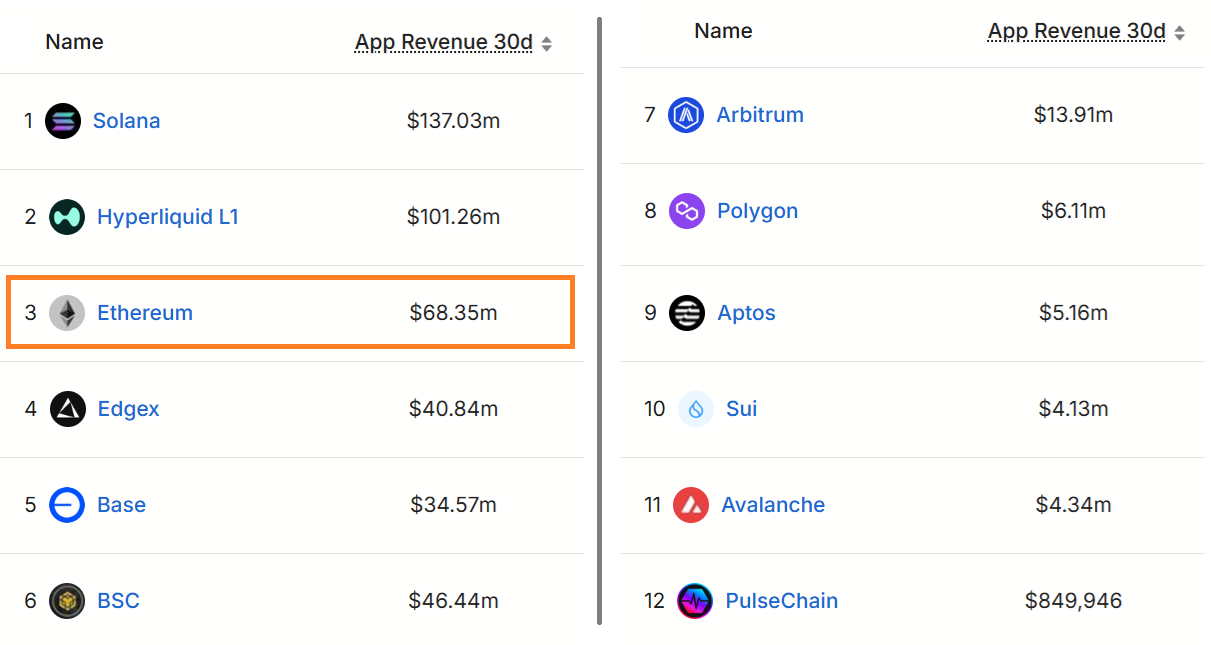

Ethereum’s supremacy in overall worth locked (TVL) and effective layer-2 adoption are indisputable. Still, traders question whether these strengths will equate into greater earnings for decentralized applications (DApps) constructed on Ethereum. Solana presently holds an one-upmanship in DApps earnings, while emerging gamers such as Hyperliquid likewise present growing obstacles.

While the growth of Base includes moderate worth to the Ethereum community, the much easier onboarding made it possible for by its native combination with Coinbase does not completely show the wider layer-2 landscape.

Related: Neighborhood anticipates very first United States area XRP ETF to introduce on Thursday

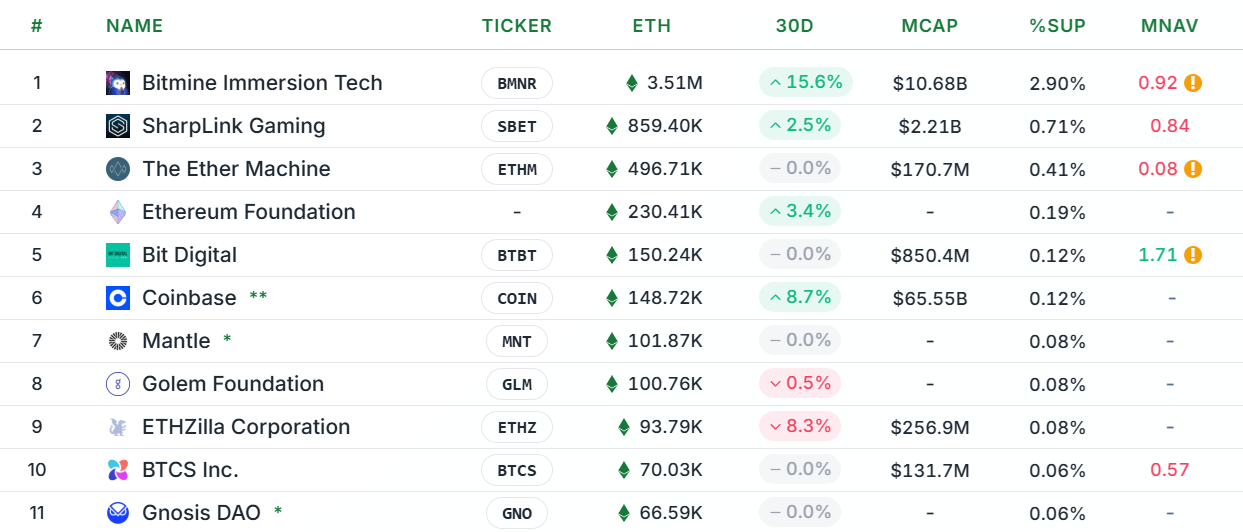

Ether’s drop to $3,200 on Thursday has actually led business building up ETH reserves to trade listed below their net possession worth (mNAV). Under such conditions, the reward to release brand-new shares to get ETH vanishes, requiring these companies to check out alternative techniques such as raising extra financial obligation.

Eventually, Ether’s course back to $4,000 will depend upon more powerful onchain activity, increasing network charges that support staking yields, higher clearness on the advantages of the upcoming Fusaka upgrade, and restored inflows from ETH tactical reserve business.

This short article is for basic info functions and is not planned to be and need to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.