Secret takeaways:

-

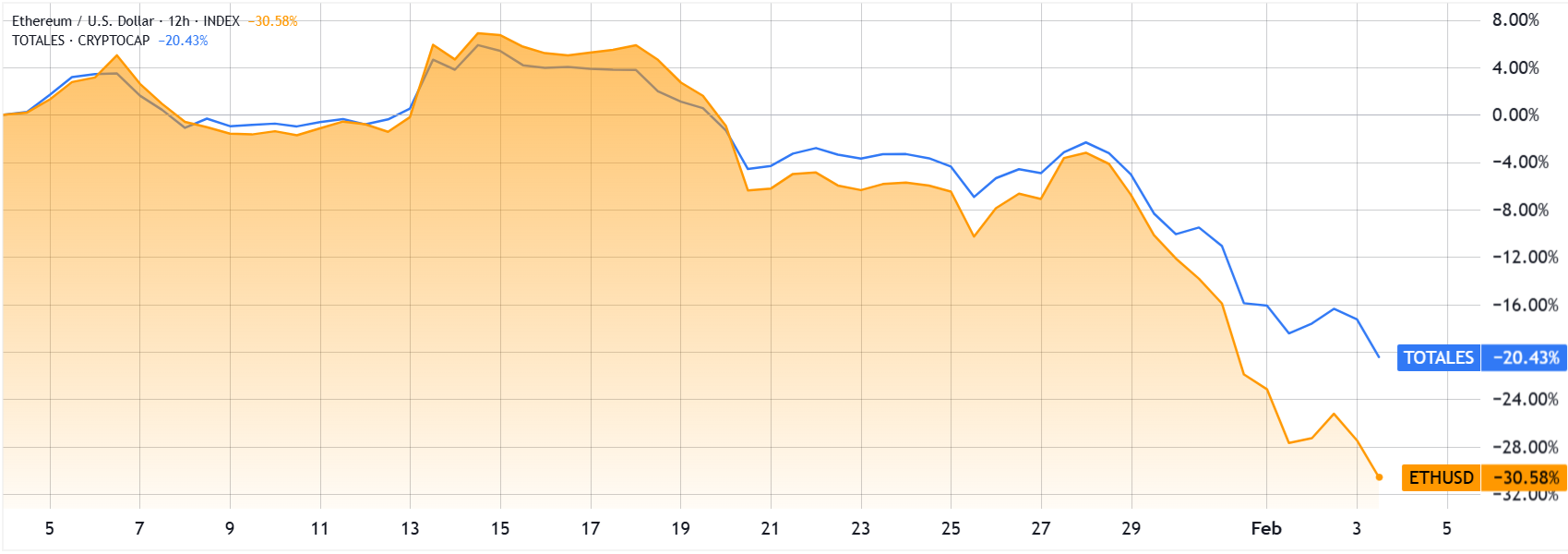

Ether dropped 28% in a week to $2,110 as financiers cut threat and markets erased leveraged traders.

-

Area ETH ETF outflows reached $447 million as Ethereum network activity fell by 47%.

Ether (ETH) dropped to $2,110 on Tuesday, indicating fragility following a harsh 28% cost correction over 7 days. Financiers pulled away into money and short-term federal government bonds as the tech-heavy Nasdaq Index likewise fell 1.4%.

Traders stress that assessments have actually ended up being overextended and excessively dependent on the expert system sector. Belief soured after Nvidia (NVDA United States) CEO Jensen Huang rejected strategies to invest $100 billion in OpenAI.

Financiers braced for extra volatility following frustrating quarterly arise from fintech huge Paypal (PYPL United States). On the other hand, gold costs climbed up 6%, and silver got 9%, recommending an uncertainty in the United States Federal Reserve’s capability to avoid an economic crisis.

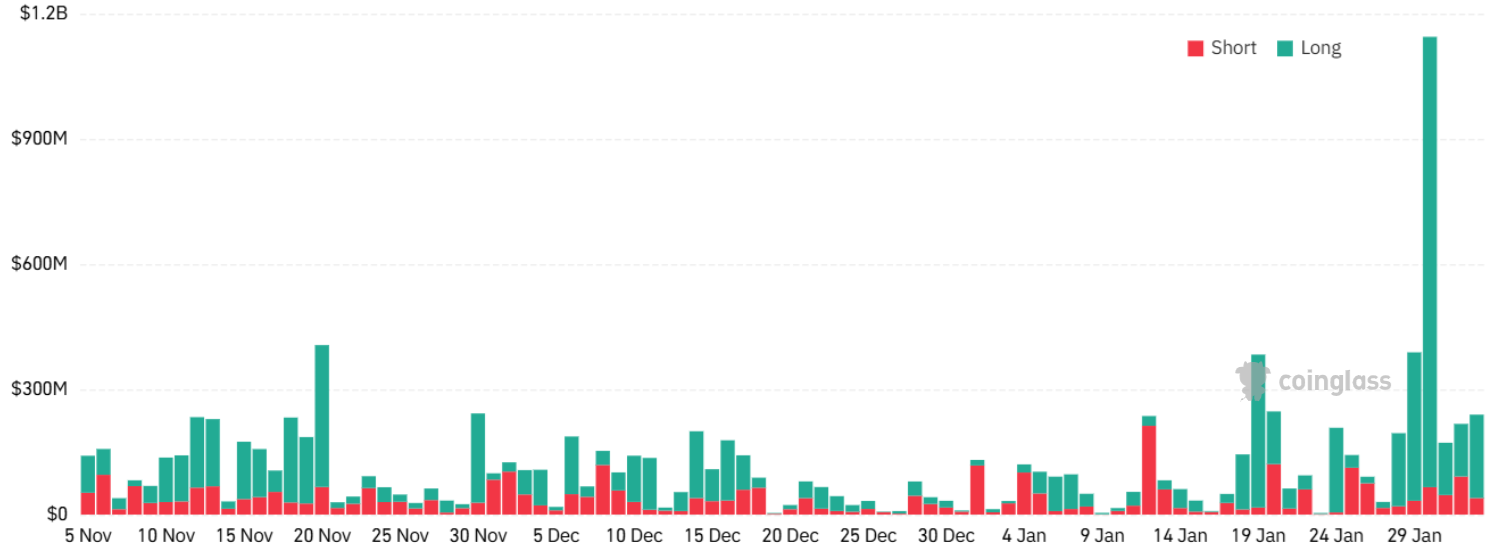

Issues over inflated stock exchange assessments triggered traders to end up being significantly risk-averse, triggering need for bullish leveraged ETH positions to vaporize.

The ETH continuous futures annualized financing rate turned unfavorable on Tuesday, showing that shorts (sellers) are paying charges to preserve their positions. This uncommon shift shows an extensive uncertainty from longs (purchasers).

Market individuals are now disputing whether this severe worry provides a tactical entry point, particularly considering that ETH has actually underperformed the wider cryptocurrency market by 10% over the last 1 month.

Ether financiers grew anxious as other significant cryptocurrencies weathered less serious corrections over the previous month; Bitcoin (BTC) dropped 17%, BNB (BNB) fell 14%, and Tron (TRX) decreased 4%. Ether’s weekly slide to $2,110 required the liquidation of over $2 billion in leveraged bullish ETH futures, sustaining issues of more drawback as market belief turns bearish.

Ether pressured as exchange-traded funds outflows signal cooling need

Ether cost was more strained by $447 million in net outflows from US-listed Ethereum area exchange-traded funds (ETFs) over 5 days. Institutional need has actually cooled, in spite of ongoing build-up from companies like Bitmine Immersion (BMNR United States), Sharplink (SBET United States), and The Ether Maker (ETHM United States). Traders stay cautious of prospective sell pressure coming from the $14.4 billion kept in aggregate Ethereum ETFs.

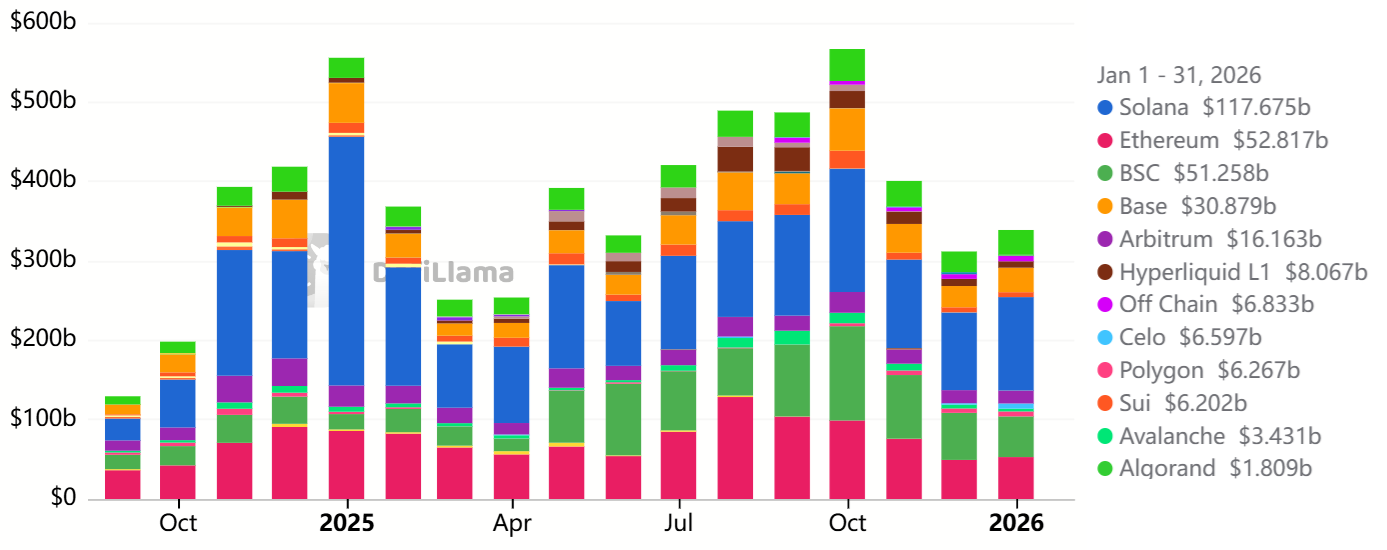

As interest in decentralized applications (dApps) subsided, the hunger for ETH decreased considerably.

Trading volumes on Ethereum decentralized exchanges (DEX) reached $52.8 billion in January, a sharp drop from $98.9 billion in October 2025. This 47% decrease in activity decreases rewards for holders; generally, high need for blockchain processing activates the network’s burn system, which diminishes the overall ETH supply.

Related: Area crypto volumes plunge to 2024 lows amidst financier need deteriorates

Deals with connected to Ethereum co-founder Vitalik Buterin offered roughly $2.3 million in ETH after allocating $45 million for contributions towards personal privacy innovations, open hardware, and protected software application. Buterin stated that an overall of 16,384 ETH from his individual holdings will be slowly released over the coming years.

The existing absence of need for bullish ETH continuous futures must not be considered as a signal for a fast turnaround. Onchain metrics continue to damage, and general belief stays mindful provided the dominating macroeconomic unpredictability.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we aim to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might consist of positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage developing from your dependence on this details.