Secret takeaways:

-

The stablecoin market cap has actually doubled to $280 billion because 2023, with projections striking $2 trillion by 2028; over half of it currently operates on Ethereum.

-

Real-world properties onchain have actually grown 413% because early 2023 to $26.7 billion, with BlackRock, Franklin Templeton, and others leading the charge on Ethereum.

-

The GENIUS Act and clearness Act might lead the way for massive institutional adoption and enhance Ethereum’s function.

Ether (ETH) rate has actually risen 88% in simply 2 months, outmatching most large-cap cryptocurrencies. Some associate it to the much-awaited altcoin season. Others indicate ETH ETFs lastly discovering their purchasers, or the wave of business treasuries purchasing Ether. Yet all that buzz feels more like fallout than the genuine motorist. What’s really powering the rally is the peaceful, unrelenting increase of institutional adoption in crypto.

By protecting supremacy in 2 sectors most yearned for by conventional financing– stablecoins and tokenized real-world properties (RWAs)– Ethereum is placing itself as the wise agreement platform of option. New United States policies, especially the GENIUS Act and the clearness Act, might magnify this pattern and speed up Ethereum’s combination into institutional financing.

Stablecoins are the blood circulation of financing

Because the start of the 2023-2026 cycle, the stablecoin market cap has actually doubled to $280 billion, according to DefiLlama. McKinsey experts approximate this number to go beyond $400 billion by year-end and reach $2 trillion by 2028. When just acting as trade sets for other cryptocurrencies, stablecoins have actually become a direct opposition to conventional money-transfer rails– quicker, less expensive, more inclusive, and significantly worldwide.

Ethereum controls here. Dune Analytics reveals 56.1% of all stablecoins work on Ethereum. The mathematics is easy: the more stablecoins take control of cross-border payments, the more Ethereum makes in deal costs.

Guideline now offers this development legal teeth. The GENIUS Act, checked in July 2025, sets the very first federal structure for stablecoins. It mandates one-to-one support with dollars or short-term Treasurys, public reserve disclosures, and keeps stablecoins out of securities policy. That makes releasing and utilizing them much safer and more foreseeable, and it connects their development to United States Treasurys and the dollar itself.

RWAs are the next action in bringing monetary properties onchain

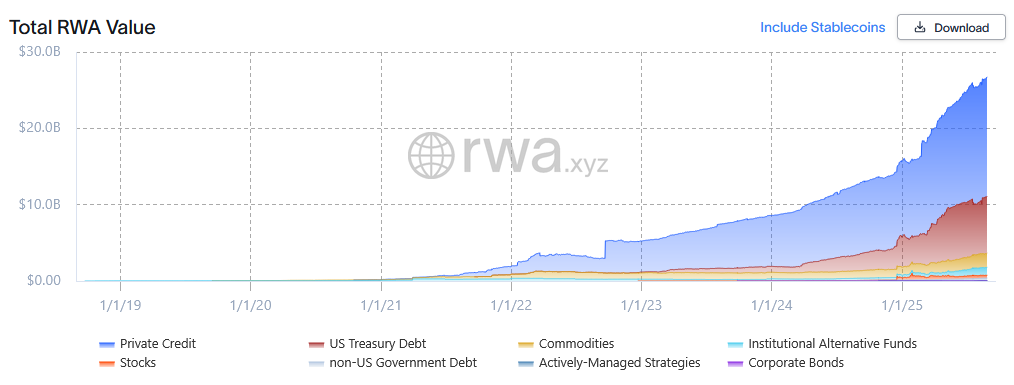

Tokenized real-world properties have actually ended up being the poster kid of this cycle. The sector is taking off as banks and property supervisors find just how much quicker it is to move tokenized properties than to wrangle with TradFi systems. Analytics site RWA.xyz puts its development at 413% because early 2023– from $5.2 billion to $26.7 billion today.

Significant gamers are driving this shift. BlackRock’s BUIDL, WisdomTree’s WTGXX, and Franklin Templeton’s BENJI now share the very same area as crypto-native providers’ properties, like Tether’s XAUT, Paxos’ PAXG, and Ondo’s OUSG and USDY. This merging demonstrates how quickly the line in between crypto and conventional financing liquifies.

Ethereum once again leads the pack, hosting over $7.6 billion in tokenized real-world properties and recording 52% of the whole RWA market.

Related: Ether ETFs catch 10x more inflows than Bitcoin in 5 days

Ethereum is the most “fully grown blockchain”

Ethereum’s benefit lies not just in market share however likewise in its trustworthiness. It has actually made institutional trust as the earliest wise agreement platform with 100% uptime and broad decentralization. Cointelegraph has actually formerly highlighted that TradFi significantly sees Ethereum as the most battle-tested and credibly neutral network. Paradoxically, these very same qualities now make Ethereum even more appealing to TradFi than the “personal” blockchains when hailed as the finance-ready future.

In a powerful turn of occasions, the United States regulative shift now puts that contrast into law. The clearness Act, gone by your house on July 17 and now awaiting its turn in the Senate, presents the principle of a “fully grown blockchain” and fixes a limit in between properties controlled as products by the CFTC and those falling under the SEC’s securities oversight. The ramifications are sweeping for crypto financing and RWAs in specific: any chain fulfilling the maturity test might host tokenized variations of almost any property.

To certify, no single entity can manage the network or own more than 20% of its tokens; the code needs to be open-source, governance transparent, and involvement broad. Ethereum quickly clears this bar, making it the apparent option for organizations preparing to bring the enormity of real-world properties onchain.

As policy develops the bridge in between DeFi and TradFi, Ethereum isn’t simply well-positioned; it’s ending up being the rails of option. Consider ETH not as a speculative property however as a piece of core monetary facilities. Which type of truth shift does not simply change environments– it alters rate trajectories.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.