Secret takeaways:

-

A surprise Federal Reserve rates of interest cut might lower the appeal of set earnings, pressing some capital towards possessions like Bitcoin.

-

Bitcoin take advantage of loose financial policy as excess liquidity and strong macro conditions improve danger hunger.

Bitcoin (BTC) might rally above $140,000 if the United States Federal Reserve (Fed) provides a surprise cut listed below the present 4% level. While the majority of market individuals prepare for no modification in rates for today’s Federal Free market Committee (FOMC) policy conference, even a little decrease might reduce returns on set earnings, pressing traders towards higher-yielding options and increasing need for danger possessions.

Fed conference comes in the middle of strong macro information and inflation relieving

According to the CME FedWatch tool, which determines implied rate of interest from United States Treasury note rates, the chances of keeping present levels stand at 97%. What makes the scenario uncommon is that the conference comes as macroeconomic information has actually been regularly strong– inflation has actually cooled, economic downturn threats have actually faded, and development has actually held consistent.

The United States economy broadened at a 3% annualized rate in the 2nd quarter, based upon the Bureau of Economic Analysis’s advance quote. This development followed a rise in imports ahead of President Trump’s worldwide trade war. Market belief has actually moved dramatically: the likelihood of a United States economic downturn in 2025 was up to 17% on the Polymarket forecast platform, below a 66% peak in Might.

Inflationary pressures have actually likewise alleviated. The June Manufacturer Cost Index (PPI), launched July 16, increased simply 2.3% from a year previously, the most affordable reading because September 2024. CNBC reported that United States import tariffs are having just a minimal impact on the economy and customer rates. Nevertheless, Fed authorities stay careful of prospective downstream impacts from trade policy.

United States President Trump has actually consistently slammed the Fed’s financial position, getting in touch with Chair Jerome Powell to cut rates without hold-up. “No Inflation! Let individuals purchase, and re-finance their homes!” the President advised. Powell, nevertheless, has actually provided no indicator he prepares to alter course today, according to Yahoo Financing.

Bitcoin take advantage of loose policy, however depends upon more comprehensive cash supply development

For Bitcoin financiers, looser financial policy is normally helpful, though it depends upon more than the Fed’s benchmark rate. Risk-on possessions are greatly affected by the development of the cash supply, particularly M2, that includes money, cost savings accounts, certificates of deposit, and cash market funds. M2 growth is likewise impacted by the United States Treasury’s choices on financial obligation issuance.

A greater liquidity environment tends to benefit both the S&P 500 and Bitcoin, though the impact is frequently progressive. A rate cut to 3.75% from 4% might press financiers far from the $25.4 trillion federal government and business bond markets. Even if inflation holds listed below 2.5%, the set earnings yield benefit would reduce, making danger possessions more appealing.

Lower rate of interest likewise lower loaning expenses for business and homes, motivating higher take advantage of with time. This included liquidity fuels financial activity and, in turn, financier desire to handle danger. Historically, Bitcoin carries out well throughout such stages, when more capital is offered and task market conditions stay steady.

Related: Bitcoin momentum loss is pre-FOMC derisking, not a pattern modification

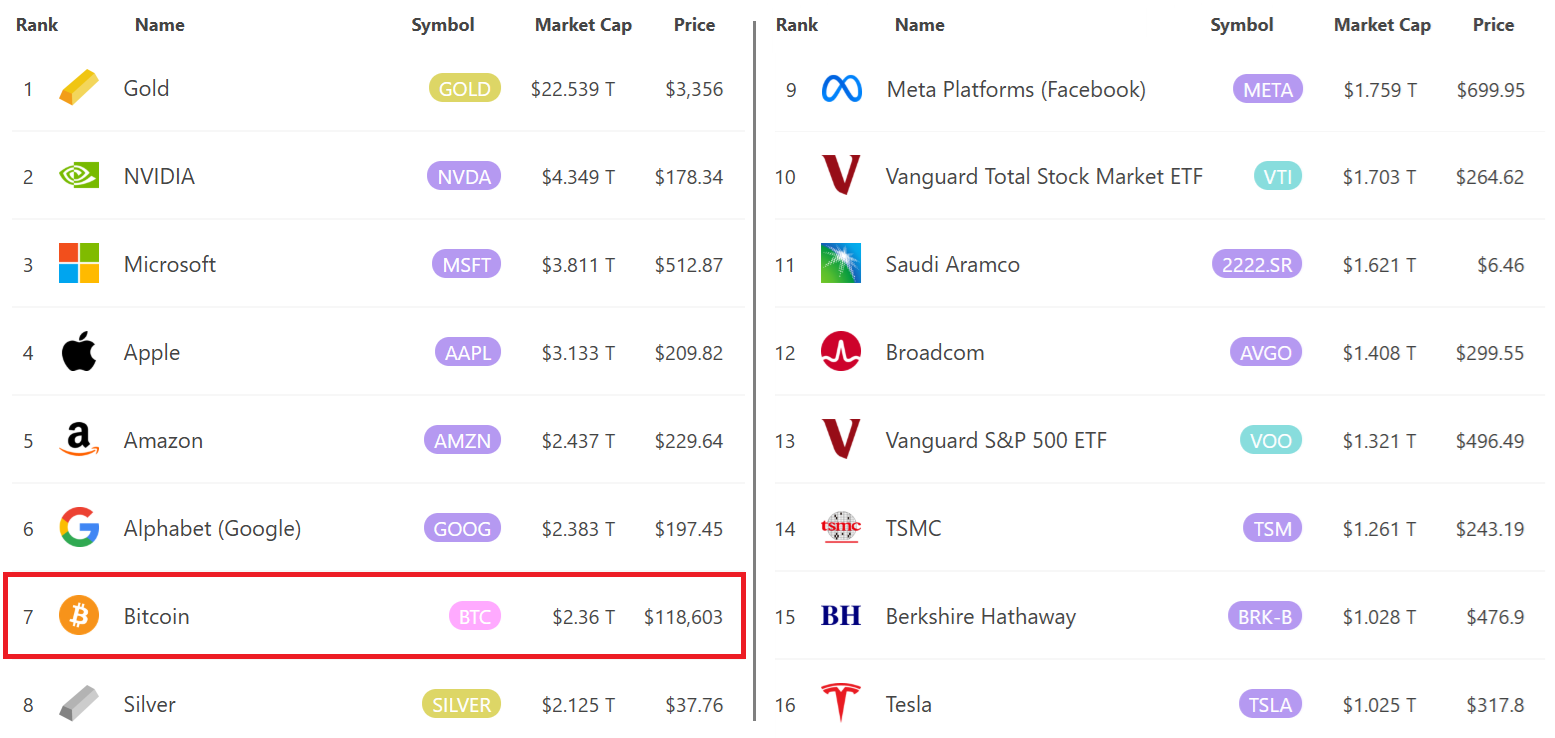

In the beginning look, a $140k Bitcoin rate might appear enthusiastic, needing a 19% increase from the present $117,600. Nevertheless, such a relocation would suggest a $2.78 trillion market capitalization, still an 87% discount rate to gold’s $22.5 trillion appraisal. For viewpoint, Nvidia (NVDA), now the world’s most important business, commands a $4.36 trillion market cap.

While the likelihood of a rate cut this Wednesday is low, Bitcoin stands to be among the greatest recipients if it takes place. The S&P 500, currently valued at $56.4 trillion, has far less space to acquire from financiers moving out of set earnings.

This post is for basic info functions and is not meant to be and ought to not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.