XRP (XRP) rate versus Ether (ETH) reached its greatest level in 5 years over the weekend, extending its healing.

On March 15, the XRP/ETH set touched 0.00128 ETH for the very first time because April 2020. That totals up to a 925% rebound when determined from its lowest level of 0.00013 ETH developed in June 2024 and roughly 620% gains because November 2024, when Donald Trump won the United States governmental election.

XRP/ETH weekly rate chart. Source: TradingView

XRP prospective breakout versus ETH

The XRP/ETH rally is sustaining speculation amongst market watchers that XRP might turn Ether to end up being the second-largest cryptocurrency by market capitalization.

For example, expert Dom highlights 0.0012 ETH as a traditionally substantial resistance level, a limit that has actually regularly preceded explosive rallies in previous cycles. He keeps in mind that XRP has actually gone parabolic after breaking this resistance, providing gains of a minimum of 160% in previous circumstances.

XRP/ETH 12-hour rate charts. Source: TradingView/Dom

He showed the very same with 3 crucial breakout points– in early 2017, late 2017, and 2018 when XRP’s rose versus Ether following a verified breach of the 0.0012 ETH resistance.

Since March 16, XRP was as soon as again checking this crucial level. If history repeats itself, even a partial rally of 80% would suffice for XRP to turn ETH in market capitalization, DOM recommends, particularly as Ether’s rate threats more disadvantage in 2025.

Related: XRP rate poised for 46% gains after Ripple protects very first Dubai license

At $138 billion, XRP’s market cap is less than $100 billion except striking Ethereum’s. Additionally, XRP’s totally watered down appraisal (FDV) briefly went beyond Ethereum’s previously today.

For context, FDV represents the overall theoretical worth of all tokens, consisting of those not yet in blood circulation, whereas market capitalization just represents tokens presently in blood circulation.

Why is Ethereum underperforming XRP?

XRP’s market supremacy has actually grown by over 300% because Trump’s reelection on Nov. 5.

XRP.D vs. ETH.D day-to-day rate chart. Source: TradingView

The very same duration has actually experienced Ethereum losing its market share by over 35.50%, revealing a clear absence of interest amongst traders for Ether compared to other top-level crypto properties.

A crucial consider this divergence is regulative belief. Trump has actually placed the United States as the future “world’s crypto capital,” designating pro-crypto regulators and promising to promote a more beneficial environment.

This shift has actually particularly benefited XRP, which accommodates business users, especially as Ripple revealed an institutional DeFi roadmap in February.

On The Other Hand, Ethereum has actually dropped due to increasing competitors from competing layer-1 blockchains, especially Solana (SOL).

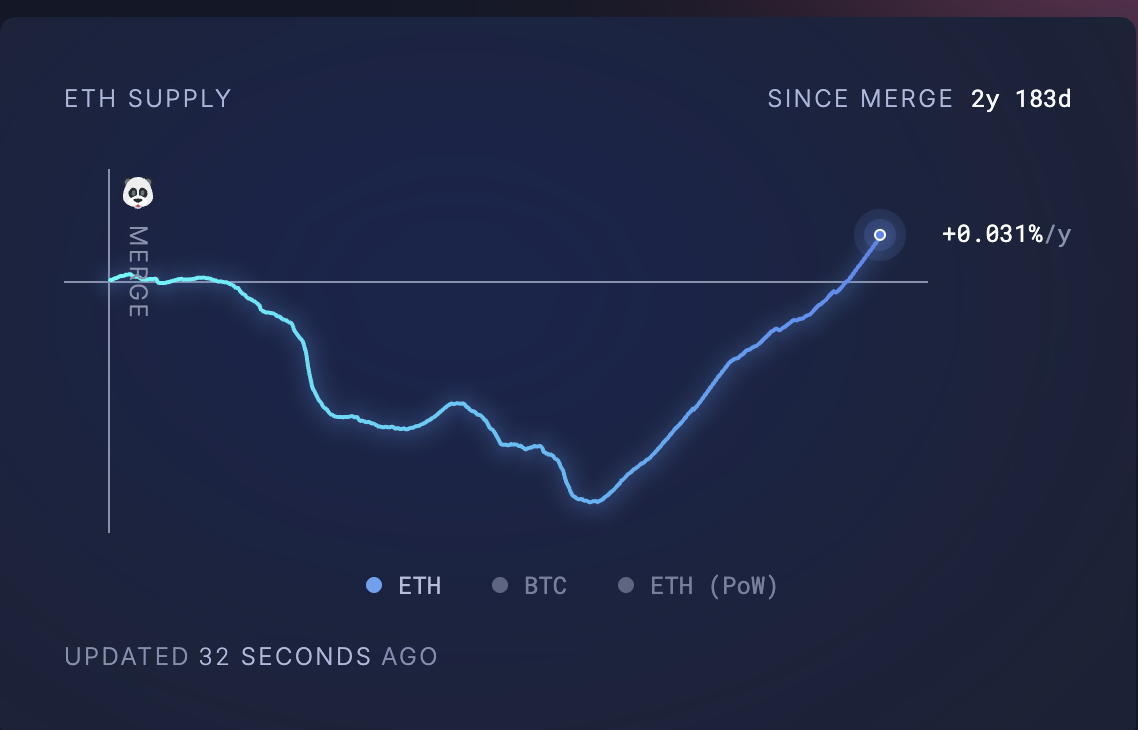

The Dencun upgrade in March 2024, which slashed Ethereum’s deal costs by 95%, was meant to enhance scalability. Nevertheless, it has actually likewise minimized ETH burn rates, increasing supply and damaging its deflationary appeal and “ultrasound cash” story.

ETH supply rate because the Merge. Source: UltraSound Cash

At the very same time, Solana’s supremacy has actually increased, with its trading volume now matching Ethereum and all its layer-2 chains integrated.

The network’s faster and more affordable deals have actually made it the go-to platform for DeFi activity, memecoin trading, and NFT markets, which Ethereum formerly controlled. This shift has actually worn down Ethereum’s market share, especially amongst traders and designers looking for high-speed, inexpensive deals.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.