Secret takeaways:

-

Decreasing area purchasing and installing area Ethereum ETF outflows signal weak need, running the risk of more losses for Ether.

-

Ether’s bear flag jobs a 20% cost drop to $3,100.

Ether (ETH) was up to $3,800 on Tuesday, stopping working to hold $4,000 as area Ethereum ETF financiers continued their net redemptions. This came as the technical setup indicated a much deeper correction for ETH cost.

Ether cost deals with “strong resistance” at $4,000

Ether’s 16% healing from a $3,500 low reached on Oct. 11 was reduced by offering around the $4,000 mental barrier.

This revealed that “there is a strong resistance at $4K,” stated trader Philakone in an X post on Monday.

Related: BitMine’s Lee states Ether’s ‘cost dislocation’ is a signal to purchase

Keep in mind that the last time the ETH/USD set was declined from this zone remained in December 2024, before a 66% cost drop, as displayed in the chart below.

Bulls must, for that reason, push and sustain the cost above $4,000 to protect the healing.

” This has actually been a tough level to break for the bulls and is quite crucial in the short/mid term moving forward,” stated expert Daan Crypto Trades in a current X post.

A definitive everyday candlestick close above this level will get ETH “back into the previous cost variety and leave these lows behind,” the expert composed, including:

” It’s going to be a fascinating fight around that ~$ 4.1 K level.”

This level “specifies whether this pullback ends up being a much deeper correction or a quick reset, stated fellow expert Jas Crypto, including:

” If bulls safeguard $4K, momentum might reconstruct towards $5K.”

As Cointelegraph reported, bulls will need to drive the Ether cost above the $4,000-$ 4,300 supply zone to signify the start of a brand-new uptrend.

Absence of brand-new purchasers keeps ETH listed below $4,000

Ether’s capability to hold above $4,000 appears minimal in the meantime due to the lack of purchasers.

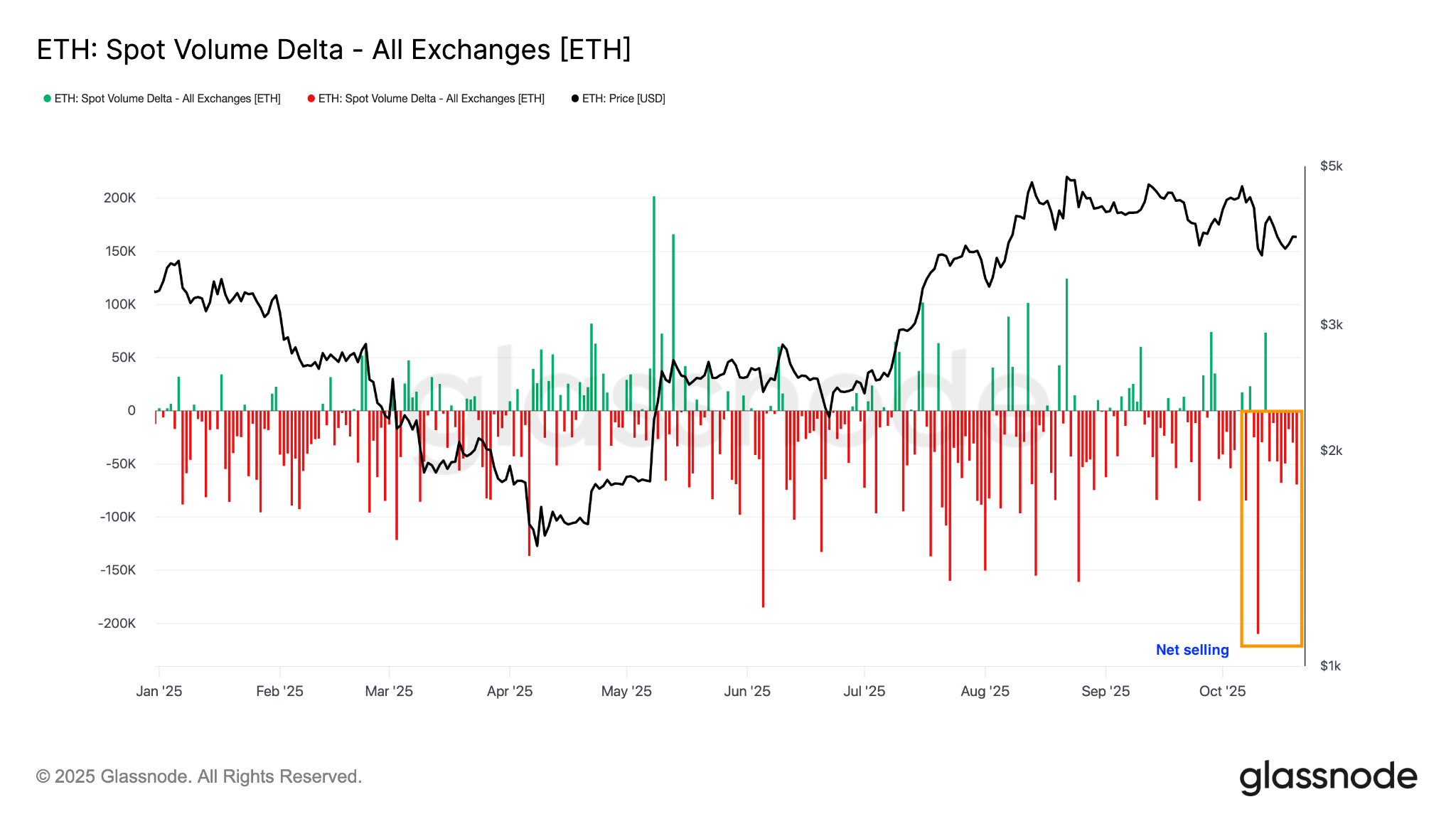

The area volume delta metric, a sign that determines the net distinction in between purchasing and offering trade volumes, exposes that net area purchasing on exchanges stays unfavorable, in spite of the current efforts at healing.

This recommends that a cost rebound might do not have the momentum originated from constant purchasing pressure, possibly causing a much deeper pullback.

Without genuine need, any breakout effort may do not have the strength needed to press ETH above essential levels.

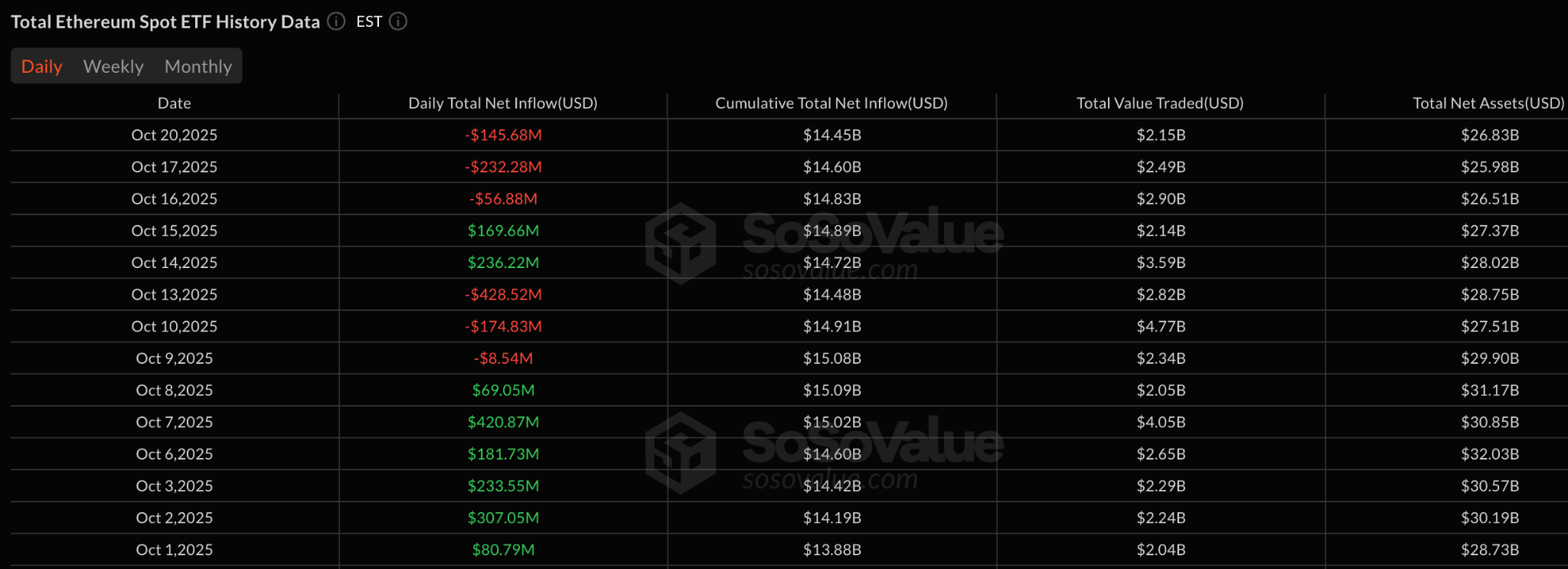

Need for area Ethereum ETFs has actually likewise been reducing, with these financial investment items publishing outflows 6 out of the last 8 days, information from SoSoValue revealed.

Monday alone saw Ether ETFs shed $145.7 million, bringing overall net outflows over the previous 8 days to $640.5 million.

ETF inflows should return and brand-new ETH purchasers should action in for the bulls to have a shot at returning to $5,000.

Ether’s bear flag breakdown targets $3,100

ETH cost is anticipated to resume its dominating bearish momentum after the verification of a timeless bearish pattern.

Ether’s cost action over the previous 2 week has actually caused the development of a bear flag pattern on the 12-hour chart, as displayed in the figure listed below. The cost dropped listed below the lower border of the flag at $4,000 on Tuesday, signifying the start of a considerable breakdown.

The determined target from the flagpole’s height becomes around $3,120, about a 20% drop from the present cost.

The relative strength index is still listed below the 50 mark, recommending that market conditions still prefer the drawback.

In spite of this bearish outlook, traders stay positive about Ether’s upside capacity, mentioning bullish signals from credit conditions and relentless purchasing by Ethereum treasury business.

Expert Jelle stated that Ether is simply retesting an essential breakout level around $4,000 before resuming its uptrend.

” This looks really prepared for a quick growth greater.”

Evaluating from belief on CT, you ‘d believe $ETH remained in the seamless gutter – however it’s simply holding the breakout location as assistance.

This looks really prepared for a quick growth greater.

Shakeouts are working, it appears. pic.twitter.com/IUpfnpf5VQ

— Jelle (@CryptoJelleNL) October 15, 2025

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.