Secret takeaways:

-

Bitcoin runs the risk of a correction towards $96,500–$ 100,000 if the $110,000 assistance stops working.

-

Onchain and technical patterns recommend a healthy mid-cycle reset, not a complete pattern turnaround.

Bitcoin’s (BTC) rebound after a significant weekend plunge revealed indications of fading on Tuesday.

The leading crypto dipped 4.65% to around $110,000, matching an international equity downturn after China enforced limitations on 5 United States companies connected to South Korea’s biggest shipbuilder, caution of more retaliation.

Bitcoin’s $110,000 level has actually consistently turned in between resistance and assistance in 2025. Earlier rejections activated 19– 30% decreases, while post-July rebounds from this zone sustained 12– 15% rallies.

Let’s analyze how low BTC might go if the $110,000 assistance stops working.

Bitcoin’s expanding wedge mean $100,000

Numerous analyses recommend that the chances of the BTC cost decreasing towards $100,000 boost if the $110,000 assistance level stops working to hold.

That consists of a “huge bullish channel” highlighted by chartist BitBull, which revealed BTC cost changing inside a widening wedge.

Since Tuesday, Bitcoin remained in the middle of a correction phase after checking the wedge’s upper trendline as resistance. Historically, such corrections tired near the channel’s lower trendline, which accompanies the $100,000-$ 103,000 location.

This area likewise lines up with Bitcoin’s 50-week rapid moving average (50-week EMA, represented by the red wave) and the 1.618 Fibonacci retracement line, providing technical weight to it as a prospective target zone.

BTC metric recommends $96,500 target (or even worse)

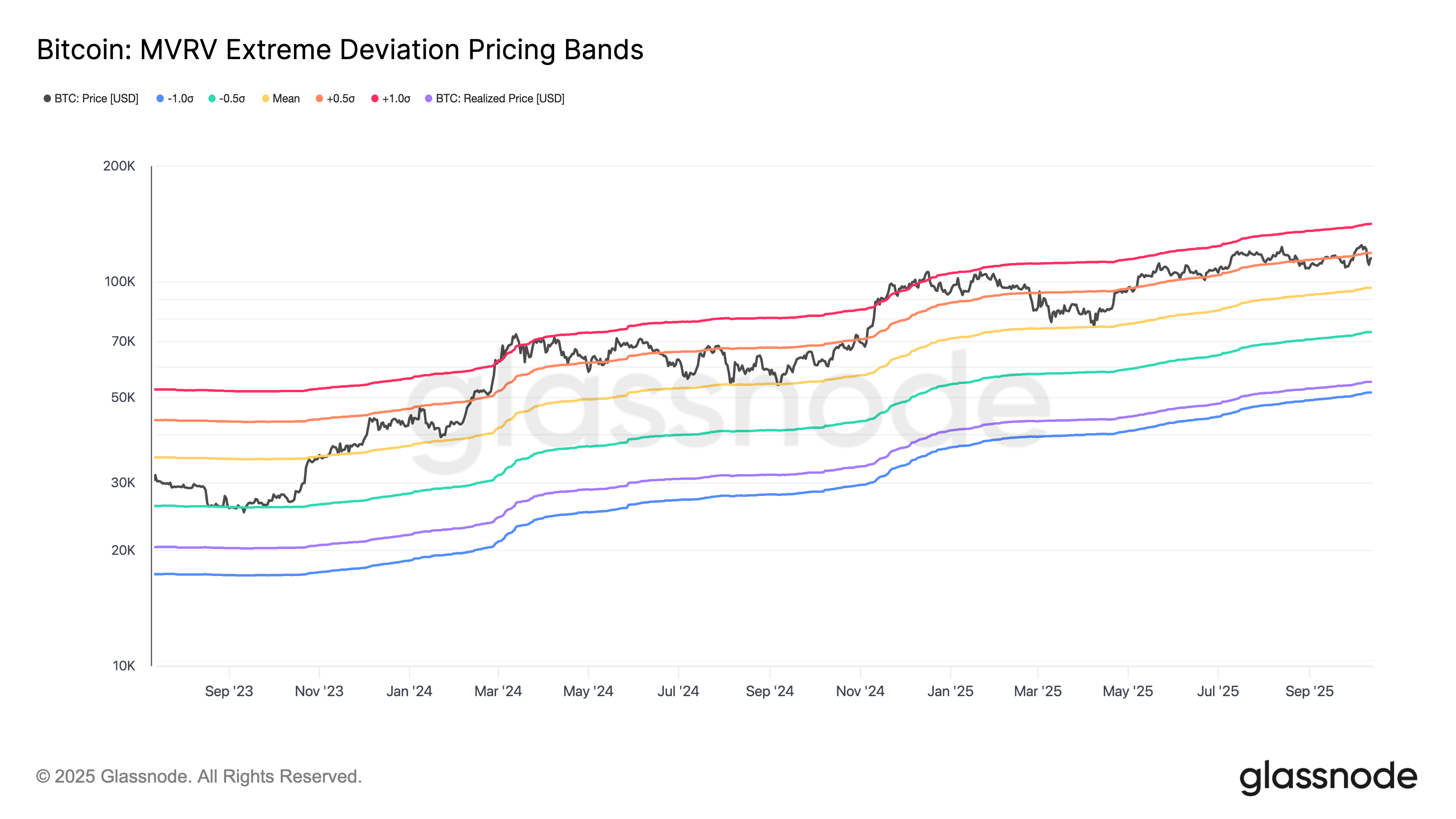

Bitcoin is now trading listed below its +0.5 basic variance band (+0.5 σ band; orange) near $119,000, according to Glassnode’s MVRV Extreme Variance Rates Bands.

The MVRV Extreme Variance Rates Bands is an onchain design that tracks how far the existing market value differs Bitcoin’s “reasonable worth,” based upon what a lot of holders spent for their coins (the recognized cost).

Historically, when BTC loses this +0.5 σ band as assistance, it tends to go back towards the mean band (yellow), which presently relaxes $96,500.

A comparable “suggest reversion” stage took place throughout the December 2024– April 2025 correction, when Bitcoin dropped from the +0.5 σ level (~ 66,980) to the mean band (~$ 53,900) before rebounding greatly.

Related: 3 reasons a Bitcoin rally to $125K might be postponed

This fractal recommends the existing setup might merely be another cooling-off stage within a wider booming market, a reset to clean excess take advantage of and overheated appraisals before the next leg greater.

A drop listed below the mean reversion target, nevertheless, might run the risk of activating a bearishness, with the next disadvantage target at around $74,000.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.