Secret takeaways:

XRP (XRP) has actually consistently broken above the $3 level given that its November 2024 boom, however each effort has actually ended in a fakeout followed by much deeper corrections.

On Saturday, its rate when again slipped listed below its $3 assistance, accompanying its 200-4H rapid moving average (EMA; green wave).

Can the XRP rate decrease even further in the coming days? Let’s take a look at.

XRP chart fractal puts 15% correction in play

XRP is matching a bearish fractal that might activate a 15% drop towards $2.60 in the coming days.

In September, the token’s rate formed a rounded top, then slipped into a duration of balanced triangle debt consolidation before breaking down greatly. That relocation sent out XRP costs toppling towards the $2.70 location.

A comparable series is playing out once again in October.

On the four-hour chart, XRP has actually formed another rounded leading and is combining within a bearish flag. This structure frequently results in another leg lower by as much as the optimum range in between its upper and lower trendlines.

The four-hour relative strength sign (RSI) adds to this threat, as it has actually been fixing from overbought levels above 70 and still has space to decrease before the oversold limit of 30.

Related: XRP rate recovers $3, breaking the ice for 40% gains in October

XRP might initially check flag assistance at $2.93. A definitive close listed below it might verify a breakdown, possibly breaking the ice to $2.60, a decrease of almost 15% from existing costs.

That drawback target lines up with XRP’s 200-day EMA (the blue wave in the chart listed below).

A bounce from 20- ($ 2.93) or 50-day ($ 2.52) EMAs might revoke the bearish outlook, triggering a rebound towards $3 once again.

$ 500 million long capture can sustain the XRP sell-off

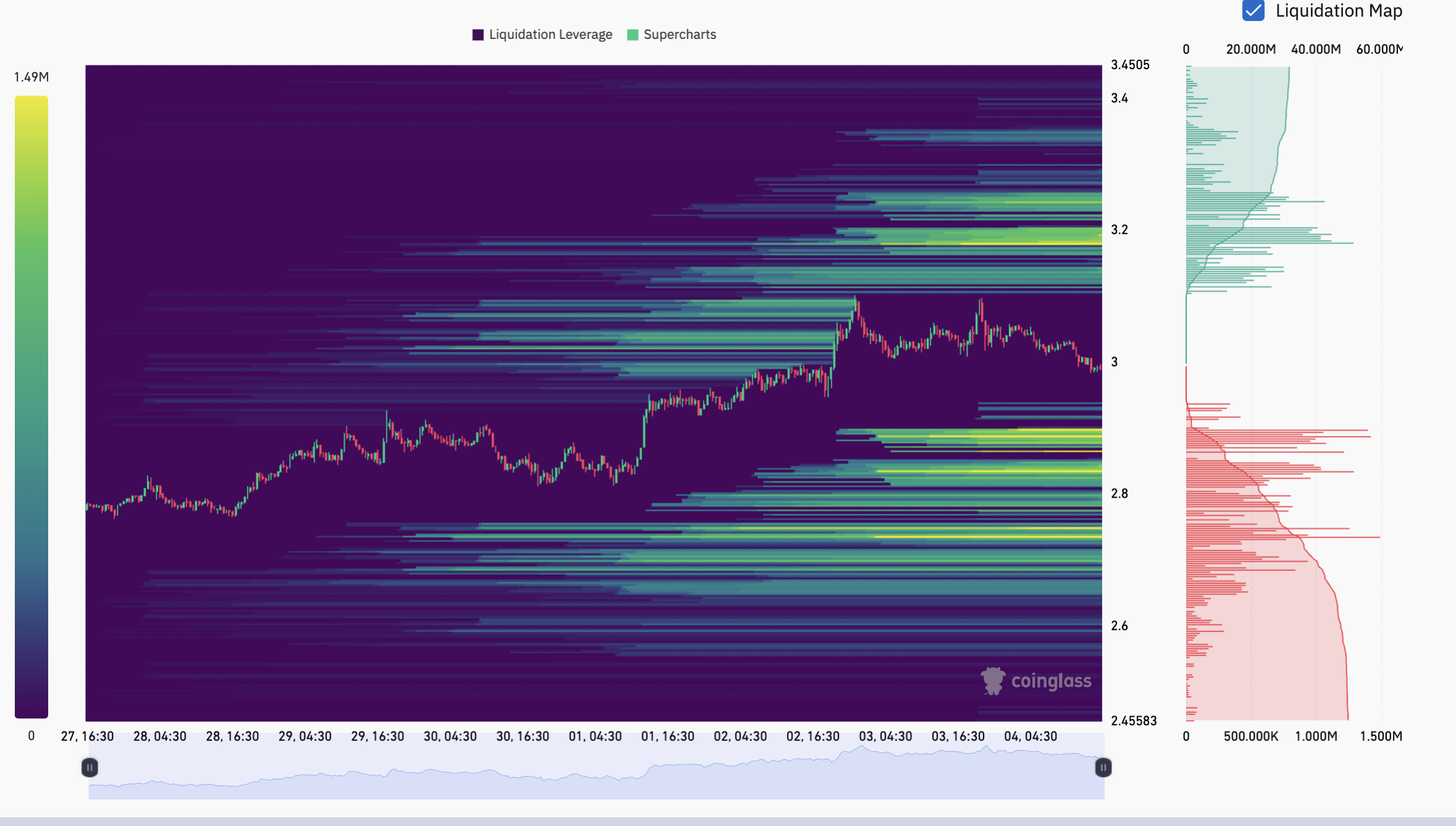

XRP’s $3 level sits right in between 2 heavy liquidity pockets, according to information resource CoinGlass.

On the advantage, there are thick clusters of long liquidation levels in between $3.18 and $3.40.

For example, at $3.18, the cumulative brief take advantage of is roughly $33.81 million, recommending the marketplace might move up to activate stop orders if bulls gain back control.

On the drawback, nevertheless, the heatmap highlights even bigger liquidation swimming pools stacked in between $2.89 and $2.73, of over $500 million.

XRP’s definitive close listed below $3 might activate a waterfall of long liquidations towards $2.89–$ 2.73. Holding above $3, nevertheless, leaves space for a stop-run to $3.20–$ 3.40.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.