Secret takeaways:

-

A repeatable pre-screen utilizing Grok 4 turns raw buzz into structured signals and filters out low-grade tasks.

-

Automating basic summaries, agreement checks and red-flag recognition with Grok 4 accelerate research study.

-

Cross-referencing belief with advancement activity utilizing Grok 4 assists differentiate natural momentum from collaborated buzz.

-

Evaluating previous belief spikes with matching cost relocations assists recognize which signals are worthy of attention in trading.

The main battle for a crypto financier is not an absence of details however an unrelenting deluge of it. News sites, social networks feeds and onchain information streams continuously churn with updates that can be frustrating. XAI’s Grok 4 goals to alter that. It pulls live information directly from X, sets it with real-time analysis and filters signals from sound. For a market that is greatly affected by narrative momentum and neighborhood chatter, this is certainly a significant ability.

This short article offers insights into how Grok 4 can be utilized for research study in crypto trading.

What Grok 4 in fact contributes to coin research study

Grok 4 integrates a real-time feed of X discussions with web DeepSearch and a higher-reasoning “Grok Believe.” That suggests you can appear unexpected narrative spikes on X, ask the design to browse wider web sources for context and demand a reasoned evaluation instead of a one-line summary. XAI’s item notes and current protection validate that DeepSearch and broadened thinking are core selling points.

Why this matters for pre-investment research study:

-

Narrative-driven properties respond to social speed. Grok 4 can flag discuss spikes quick.

-

DeepSearch assists you go from a loud tweet storm to a combined set of main files: white documents, token agreements and news release.

That stated, Grok 4 is an insights tool, not a safeguard. Current occurrences around small amounts and reaction habits suggest you should verify outputs with independent sources. That’s why you ought to preferably deal with Grok 4 as a fast private investigator, not as the last arbiter.

Did you understand? Keeping a post-trade journal assists you find what’s working and what’s not. Log your signals, thinking, fills, slippage and last earnings and loss (PnL) Then utilize Grok 4 to find repeating errors and suggest smarter modifications.

Fast-start, repeatable coin pre-screen utilizing Grok 4

Capturing a coin’s name trending on X or in a Telegram chat isn’t adequate to validate putting capital at danger. Social buzz moves quick, and many spikes fade before cost action captures up, or even worse, they may be the outcome of collaborated shilling. That’s why the next action is to turn raw sound into structured signals you can in fact rank and compare.

A repeatable pre-screen procedure forces discipline: You filter out hype-only tokens, emphasize tasks with proven basics and lower the time lost chasing after every report.

With Grok 4, you can automate the preliminary of filtering– for instance, summing up white documents, identifying tokenomics warnings and inspecting liquidity. By the time you get to manual research study, you are currently down to the 10% of tasks that in fact deserve your attention.

Here’s how you do it:

Action 1: Develop a short watchlist

Select 10-20 tokens you in fact appreciate. Keep it focused by style, such as layer twos, oracles and memecoins.

Action 2: Do a fast belief and speed scan with Grok 4

Ask Grok 4 for the last 24-hour X discusses, tone and whether buzz is natural or suspicious.

Trigger example:

Action 3: Auto-summarize basics

Have Grok 4 condense the white paper, roadmap and tokenomics into absorbable indicate focus on basics that highlight structural danger.

Trigger example:

-

” Sum up the white paper for [TICKER] into 8 bullet points: utilize case, agreement, issuance schedule, vesting, token energy, understood audits, core factors, unsolved concerns.”

Action 4: Agreement and audit quick-check

Ask Grok 4 to return the confirmed agreement address and links to audits. Then cross-check on Etherscan or a pertinent blockchain explorer. If unverifiable, mark as high danger.

Step 5: Onchain verifications

Struck onchain control panels: charges, income, inflows, volume on the top central exchanges (CEXs) and overall worth locked (TVL) if a decentralized financing (DeFi) token. Usage DefiLlama, CoinGecko or particular chain explorers. If onchain activity opposes buzz (low activity, big central wallets controling), it’s a signal to downgrade.

Action 6: Liquidity and order-book peace of mind check

Try to find thin order books and little liquidity swimming pools. Ask Grok 4 to look for reported liquidity swimming pools and automated market maker (AMM) sizes, then confirm with onchain inquiries.

Action 7: Warning list

Token opens in 90 days, concentration >> 40% in leading 5 wallets, no third-party audit, unverifiable group IDs. Any hit moves the ticker to “manual deep-dive.”

Integrate Grok 4 outputs with market and onchain signals

As soon as a coin passes the fast screen, the next action is to go into the information that informs you whether a task has remaining power or is simply another short-term pump.

Action 1: Develop a verification guideline set

Having clear guidelines avoids you from chasing after buzz and forces you to inspect basics, activity and liquidity before acting.

Example guideline set (all should pass):

-

Belief rise on X verified by Grok 4, with a minimum of 3 credible sources connected.

-

Onchain active addresses are up 20% week-over-week.

-

No big, impending opens in tokenomics.

-

Adequate liquidity for the trade size in the onchain AMM or DEX order books.

Action 2: Ask Grok 4 to cross-reference

Cross-referencing with basics and advancement activity strains short-term buzz that isn’t backed by development or openness.

Trigger example:

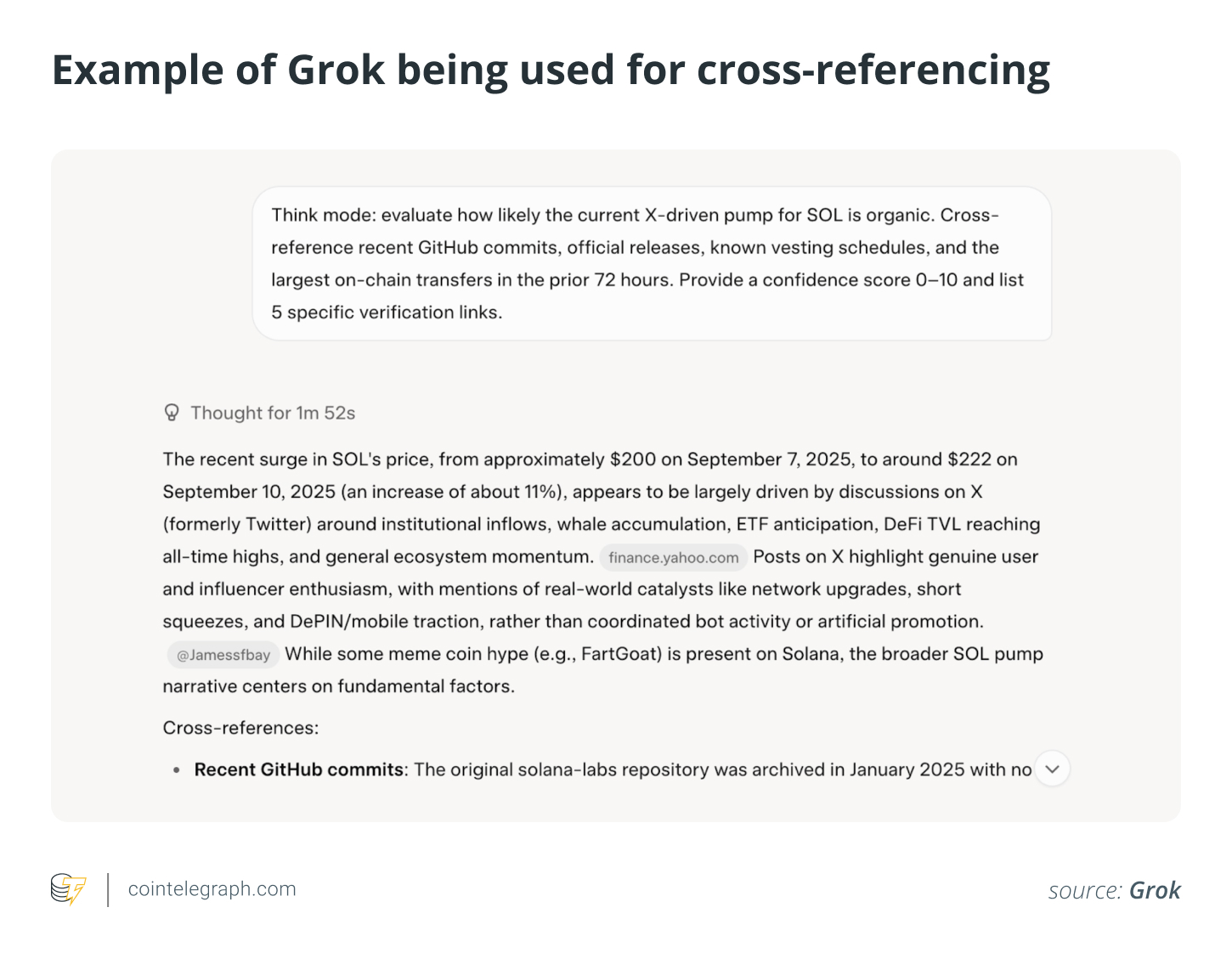

” Assess how most likely the existing X-driven pump for [TICKER] is natural. Cross-reference current GitHub devotes, authorities releases, understood vesting schedules and the biggest onchain transfers in the previous 72 hours. Offer a self-confidence rating 0-10 and list 5 particular confirmation links.”

Action 3: Whale circulation and exchange circulation

Examining whale and exchange activity assists you prepare for sell pressure that belief scans alone can’t catch.

Do not depend on belief alone. Usage onchain analytics to find big transfers to exchanges or deposits from wise agreements connected to token opens. If Grok reports “big inflows to Binance in the last 24 hr,” for instance, it can show increased sell-side danger.

Advanced backtest of Grok 4 for crypto research study

If you wish to move from advertisement hoc trades to a repeatable system, you require to construct structure into how you utilize Grok 4. Start with historical-news response backtests: Usage Grok 4 to pull previous X-sentiment spikes for the token and match them with cost response windows (one hour, 6 hours, 24 hr). Export the sets and run a backtest that replicates slippage and execution expenses; if typical slippage surpasses the anticipated edge, dispose of that signal type.

Next, construct a “signal engine” and a rule-based administrator. This can consist of Grok’s API or webhooks for informs, a layer that uses your verification guidelines and a human-in-the-loop to authorize execution. At a bigger scale, verified signals can feed into a limit-order engine with automatic position sizing utilizing Kelly or repaired risk-per-trade guidelines.

Lastly, impose security and governance. Provided small amounts concerns and dangers of single-source dependence, set a difficult guideline that no Grok-generated signal can straight set off live trades without external confirmation. Numerous independent checks ought to constantly precede capital release.

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.