Secret takeaways:

-

Bitcoin threats checking $100,000 after breaking a crucial assistance level of a bear flag.

-

The so-called “expert” whale moved 5,252 BTC ($ 588 million) to exchanges and opened a brand-new $234 million brief.

Bitcoin (BTC) is revealing indications of technical weak point after breaking listed below a crucial short-term assistance level, accompanying big BTC transfers from a so-called “expert” entity to significant exchanges.

Bear flag setup targets BTC costs listed below $100,000

The BTC/USDT 4-hour chart reveals Bitcoin slipping under the lower trendline of a bear flag, an extension pattern that typically indicates additional drawback following a quick debt consolidation.

The predicted target from the pattern breakdown indicate around $98,000, lining up with the mid-June swing low.

BTC likewise trades listed below its 20- (green) and 50-4H (red) rapid moving averages (EMAs), lining up with the $109,000-110,000 resistance location. Failure to recover this location as assistance might even more confirm the bearish setup.

Strange whale bets more on Bitcoin dropping

Bitcoin’s bear flag setup emerges versus the background of restored activity by a well-known whale implicated of controling costs.

It is the exact same entity that stole over $200 million shorting Bitcoin throughout the China tariff crash 2 weeks back. This so-called “expert” whale and “$ 10B Hyperunit Whale” has actually resurfaced with numerous enormous bearish bets.

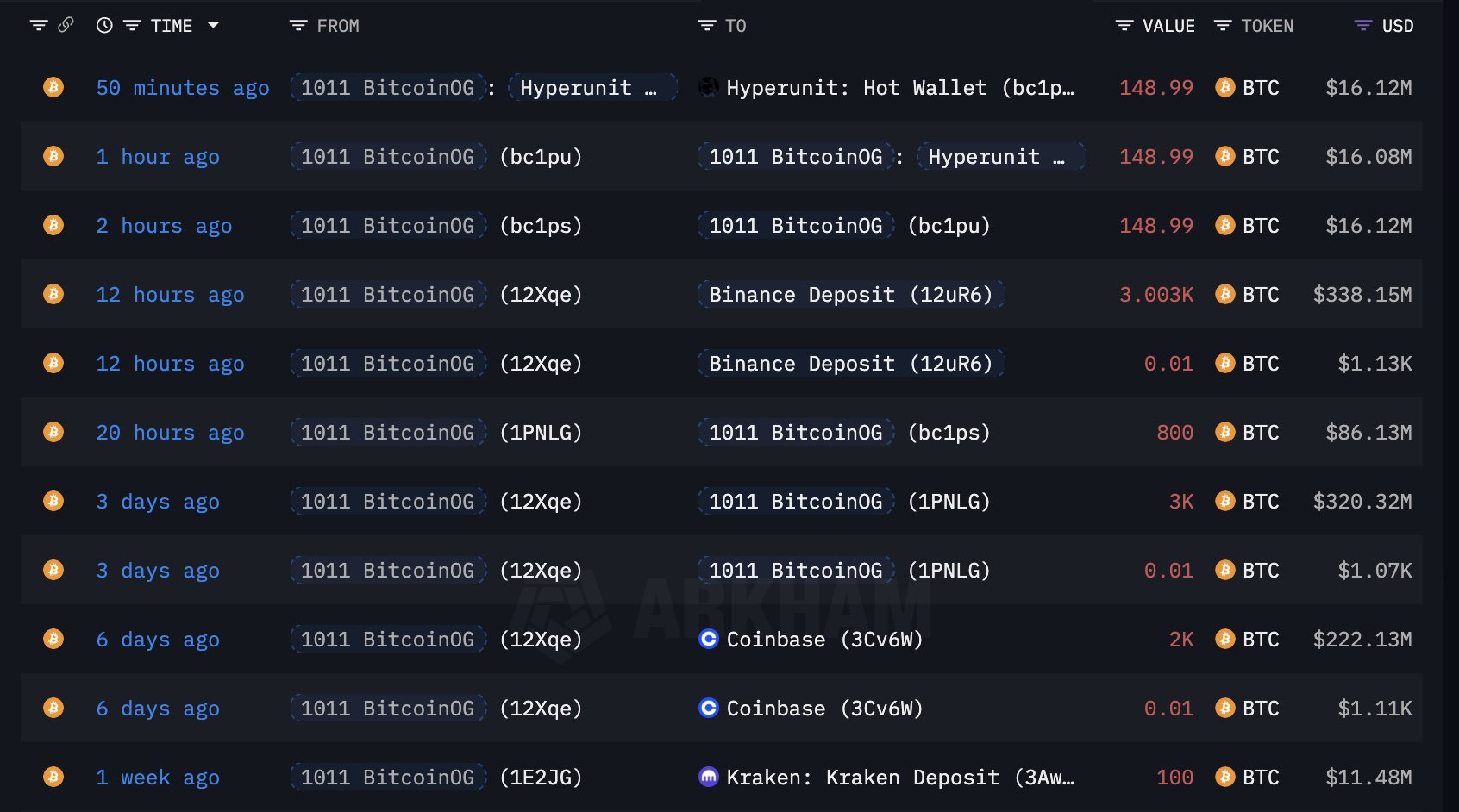

Initially, it has actually moved 5,252 BTC, worth about $588 million, to significant exchanges consisting of Coinbase, Binance, and Kraken, according to Arkham information.

Such big inflows typically show the intent to offer or hedge positions.

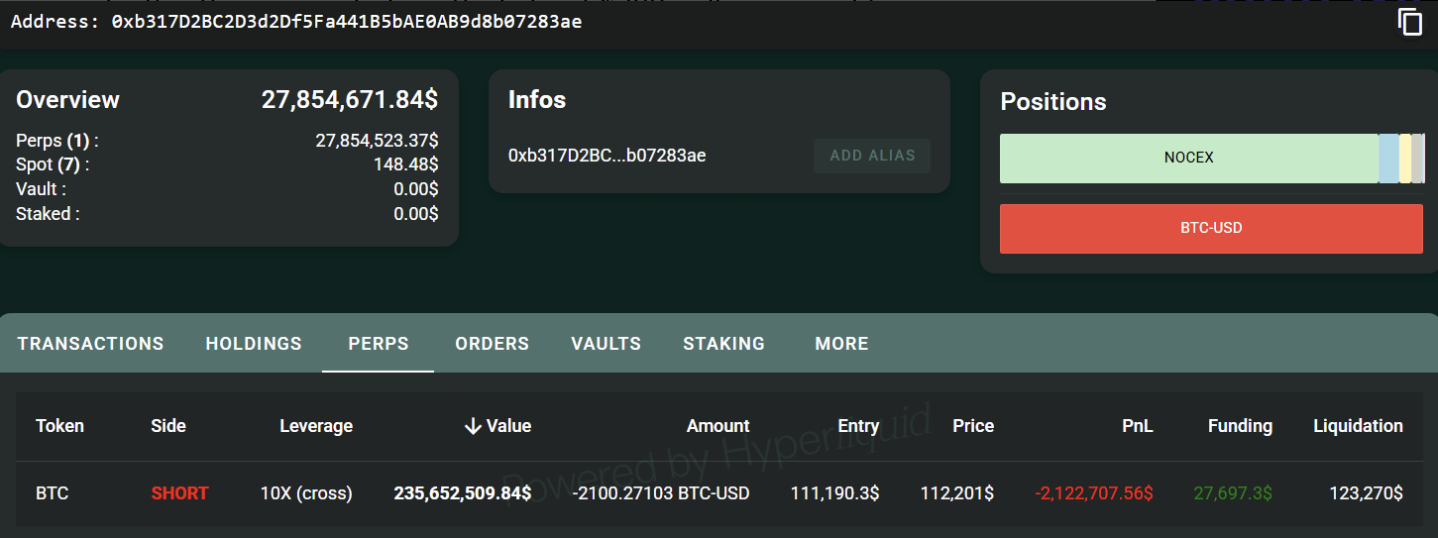

On the other hand, the whale’s brand-new $234 million brief position on Hyperliquid, opened near $111,190 per BTC, is currently resting on about $6.7 million in latent earnings, recommending self-confidence that the sag has even more to go.

Expert CryptoNobler called the whale relocation “pure control,” recommending that it might deliberately dispose his Bitcoin holdings in hopes that the costs drop towards its brief position targets.

The real identity of the whale stays unofficial, however blockchain sleuths have actually connected the wallet to Garrett Jin, previous CEO of the defunct exchange BitForex.

In now-deleted posts, Jin acknowledged the connection after encountering Binance CEO CZ on X, later on declaring the fund comes from customers and not to him personally.

Related: 3 reasons a Bitcoin rally to $125K might be postponed

Crypto expert Quinten François has actually voiced uncertainty over the supposed link in between the Hyperliquid whale and BitForex’s previous CEO, recommending the connection may be “too cool to be reliable” offered the circumstantial nature of the proof.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.