Secret takeaways:

-

Ether’s futures and alternatives information signal neutral‑to‑bearish belief regardless of current rate healing.

-

Institutional ETF outflows and an absence of drivers keep ETH from breaking $3,800.

Ether (ETH) rate has actually acquired 9% from the $3,355 short on Sunday, yet derivatives metrics recommend traders are still not positive the bullish momentum will hold.

The current rate action has actually carefully mirrored the more comprehensive altcoin market capitalization, highlighting the lack of clear chauffeurs for a continual rally above $3,800 in the short-term.

Altcoin market capitalization reached $1.3 trillion on July 28, accompanying Ether’s greatest level in 2025. Subsequently, Ether’s failure to recover the $4,000 mark in late July was most likely the outcome of minimized threat cravings amongst financiers than any particular problem within the Ethereum environment.

Still, that does not suggest financiers have actually ended up being positive about Ether’s rate outlook.

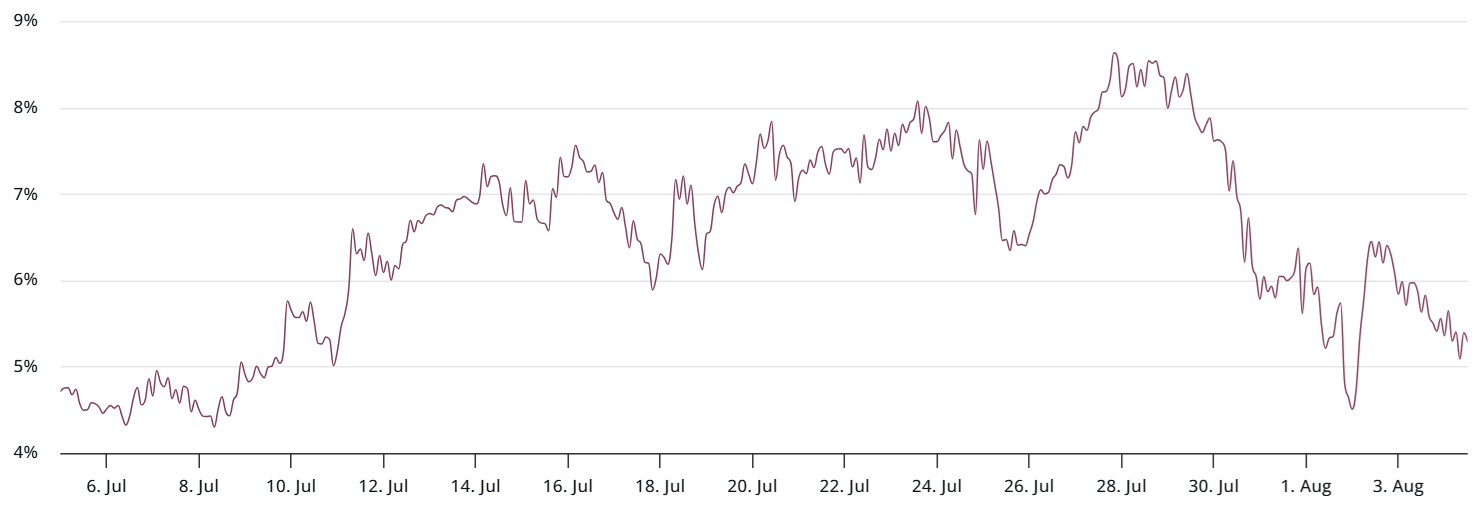

The Ether 3‑month futures premium now stands at 5% at the neutral‑to‑bearish limit. This is especially worrying considered that even the $3,900 ETH rate level, reached a week previously, stopped working to turn the sign bullish.

Ethereum’s TVL decrease injures financier belief

Part of financiers’ dissatisfaction can be connected to the drop in deposits throughout decentralized applications (DApps). The overall worth locked (TVL) on the Ethereum network decreased 9% over the previous 1 month to ETH 23.8 million.

For contrast, BNB Chain’s TVL increased 8% to BNB 6.94 billion in the exact same duration, while deposits on Solana DApps increased 4% to SOL 69.2 million, according to DefiLlama. In USD terms, Ethereum’s base layer continues to control with a 59% share of overall TVL.

Ether financiers’ minimized optimism has actually likewise been shown in ETH alternatives markets, as the 25% delta alter (put‑call) sign reached 6% on Saturday, right at the neutral‑to‑bearish limit.

The alter boosts when need for protective put (sell) alternatives. The existing 3% reading recommends a well balanced threat evaluation, suggesting that bullish belief has actually not returned.

ETH does not have institutional need to break $3,800

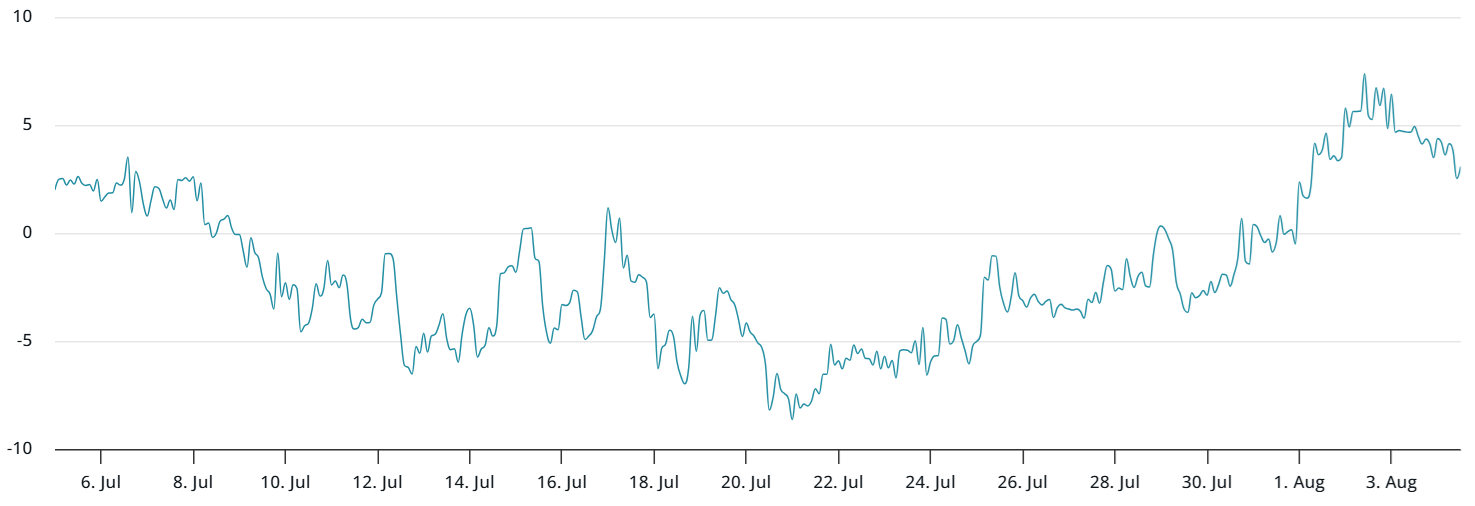

ETH rates on Coinbase and Kraken are presently trading at a small discount rate compared to Binance and Bitfinex, possibly indicating weaker need from institutional desks. This contrasts greatly with the duration in between July 10 and July 23, when rate premiums most likely shown business raising capital to collect ETH reserves.

Related: Crypto funds see $223M outflow, ending 15-week streak as Fed moistens belief

Institutional need for ETH appears to have actually decreased significantly, specifically as Ether area exchange‑traded funds (ETFs) tape-recorded $129 million in net outflows in between Wednesday and Friday. At present, there are no obvious drivers efficient in decoupling Ether from the more comprehensive cryptocurrency market and driving its rate above $3,800.

There is no impending motorist for a cryptocurrency rally, especially as worldwide trade war threats continue and issues grow over the United States task market outlook. Traders are significantly unwilling to provide the federal government the advantage of the doubt, as financial development and inflation information might have been increased by organizations and people stockpiling items ahead of import tariff walkings.

Without restored institutional inflows, ETH will likely continue moving carefully with the total altcoin market.

This short article is for basic info functions and is not planned to be and must not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.