Ether (ETH) traded back above $2,000 on Friday, and its gains extended after the United States Customer Cost Index (CPI) print can be found in cooler than anticipated.

The healing put ETH/USD on track for its very first bullish weekly candle light close considering that mid-January, sustaining speculation for a rally towards $2,500.

Secret takeaways:

-

Ether futures’ open interest fell by 80 million ETH in 1 month, and financing rates struck three-year lows, suggesting a weakening bearish pattern.

-

ETH rate has actually developed strong assistance around $2,000, a level that needs to hold to protect the healing.

Ether open interest falls by 80 million ETH

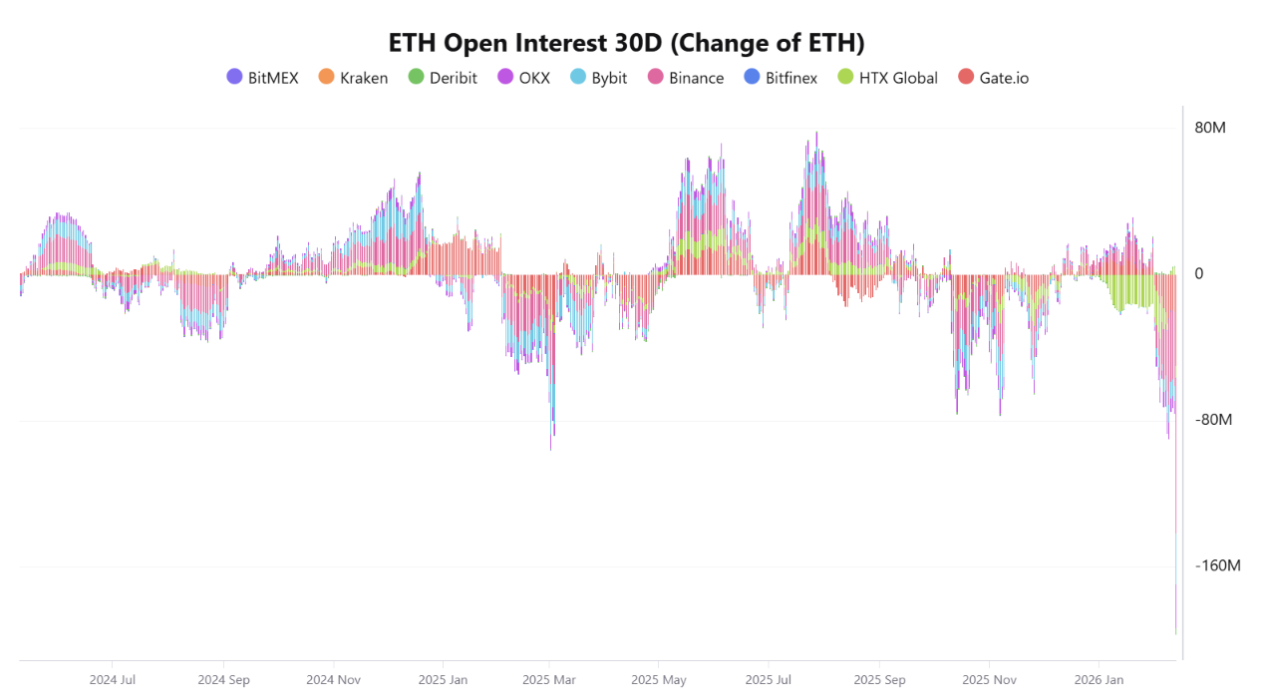

CryptoQuant information reveals Ether futures open interest (OI) throughout all significant exchanges has actually stopped by over 80 million ETH in the previous 1 month.

Binance, the world’s biggest cryptocurrency exchange by trading volume, tape-recorded the biggest decrease of about 40 million ETH (50%) over the last 1 month.

Related: ETH ETF holders in ‘even worse position’ than BTC ETF peers as crypto market tries to find bottom

Ether’s OI on Gate exchange fell by more than 20 million ETH (25%), while Bybit and OKX saw decreases of 8.5 million ETH and 6.8 million ETH, respectively. Cumulatively, the 4 significant platforms saw an overall decrease of about 75 million ETH, while other platforms represented the staying 5 million ETH, validating that the phenomenon is prevalent and not restricted to a single exchange.

This recommends that take advantage of traders are “decreasing their direct exposure instead of opening brand-new positions,” CryptoQuant expert Arab Chain stated in a Quicktake analysis.

This substantial drop in OI amidst dropping costs can be “deemed a clean-up of weaker positions, therefore decreasing the possibility of sharp forced liquidations later,” the expert stated, including:

” This environment might lead the way for a duration of relative stability or the development of a more strong rate base for Ethereum in the future.”

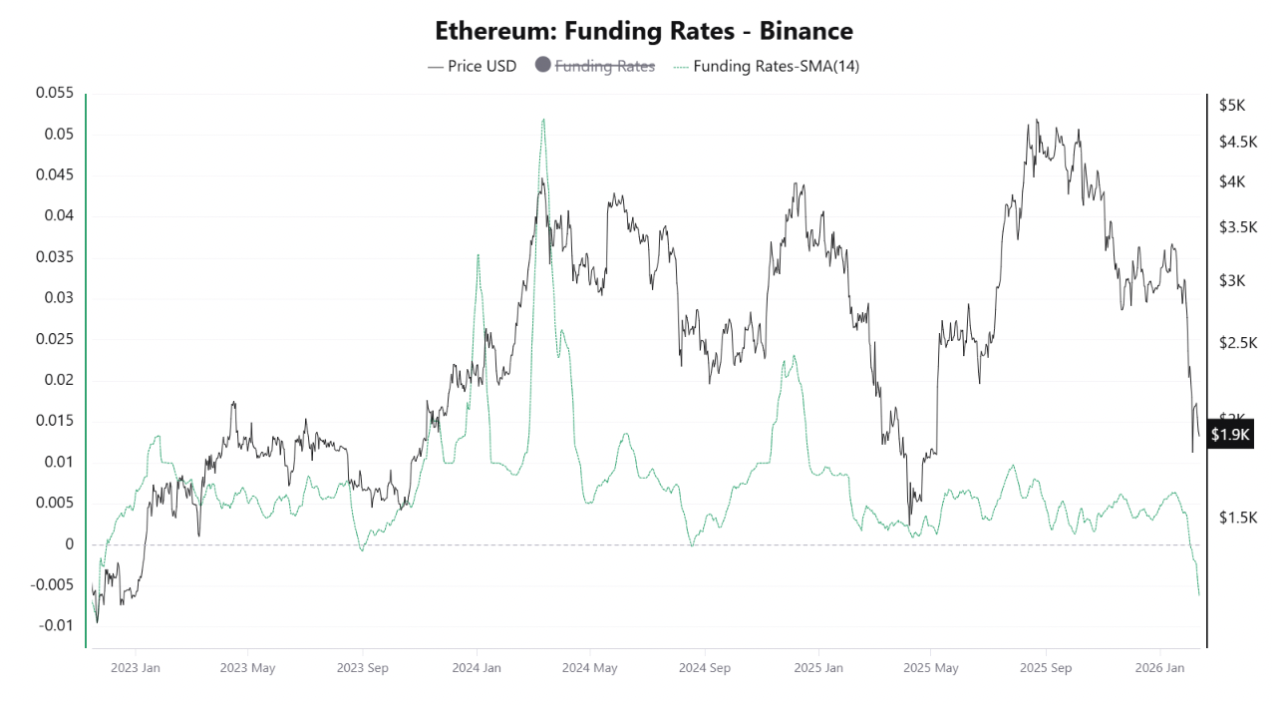

Ether futures financing rates on Binance have actually plunged deep into unfavorable area at -0.006, marking the most affordable worth tape-recorded considering that early December 2022.

” It shows that the bearish belief has actually reached a severe peak not seen in the last 3 years,” CryptoQuant factor CryptoOnchain stated in a Thursday Quicktake analysis.

Historically, severe unfavorable financing rates at significant rate assistance levels typically precede a brief capture.

” When the crowd is this persuaded that costs will fall even more, the marketplace tends to relocate the opposite instructions to liquidate late bears,” the expert stated, including:

” Present information recommends we might be experiencing a timeless capitulation occasion, matching the bottom development of late 2022, possibly setting the phase for a sharp healing.”

As Cointelegraph reported, Ether’s rising network activity and increasing institutional financier inflows are substantial tailwinds for any short-term ETH rate gains.

ETH rate technicals: Bulls need to keep Ether above $2,000

The ETH/USD set broke out of a falling wedge on the four-hour chart, to trade at $2,050 at the time of composing.

The determined target of the falling wedge, computed by including the wedge’s optimum height to the breakout point at $1,950, is $2,150.

Greater than that, the rate might increase to retest the 100-period basic moving average (SMA) at $2,260 and later on towards $2,500.

On the drawback, a crucial location to hold is the $2,000 mental level, accepted by the 50-period SMA, as displayed in the chart below.

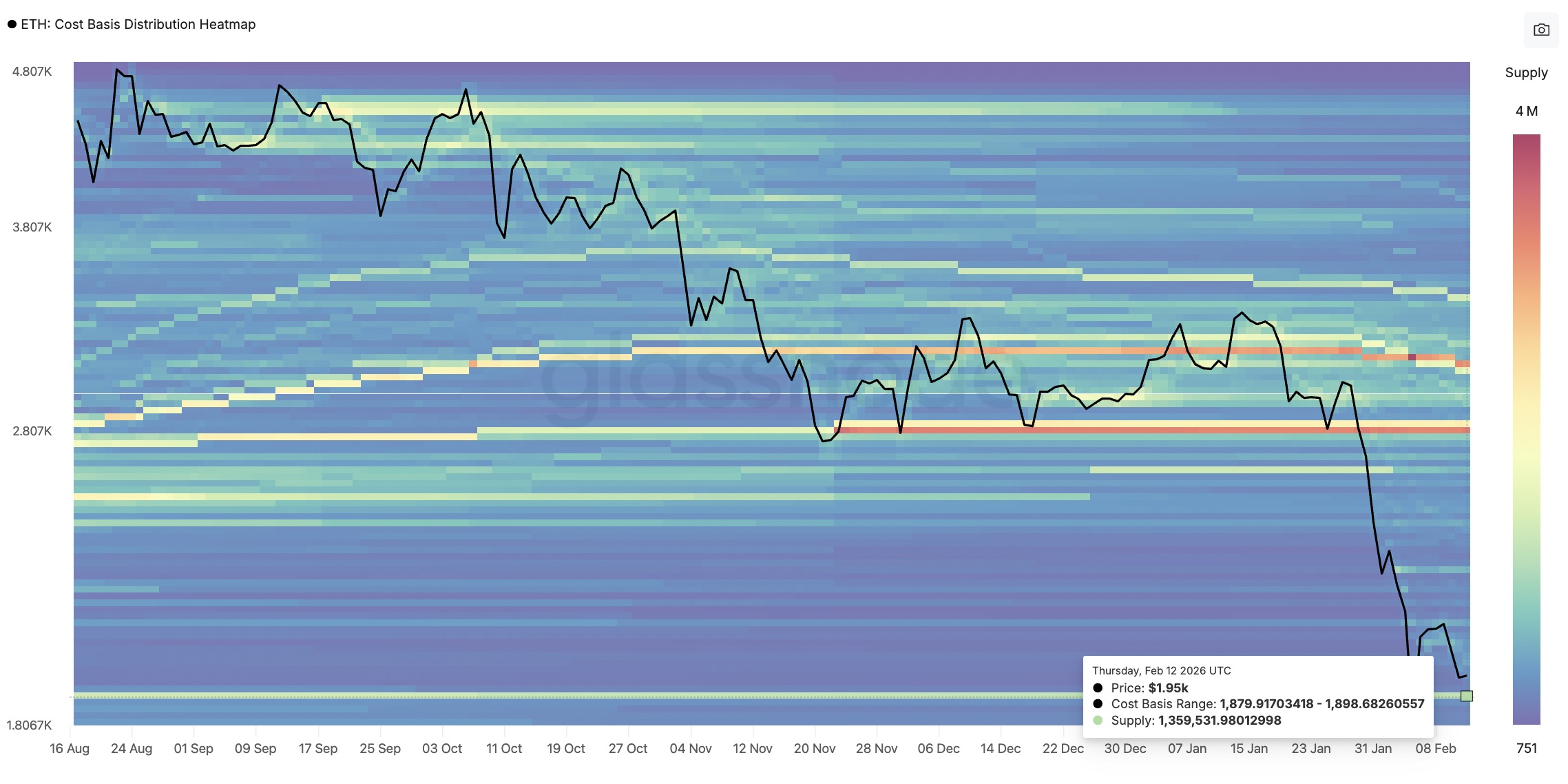

The Glassnode expense basis circulation heatmap exposes a considerable assistance location just recently developed in between $1,880 and $1,900, where financiers obtained around 1.3 million ETH.

As Cointelegraph reported, Ether build-up addresses experienced a rise in everyday inflows as ETH dropped listed below $2,000 recently, signalling strong financier self-confidence in its long-lasting capacity.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding. While we make every effort to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that go through threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this details.